uddrag fra Zerohedge

Today’s Nvidia’s results after the close offer the grand finale to a surprisingly strong earnings season for Big Tech. But with expectations sky high, and virtually everyone already in the name, Catalyst Funds warns that Nvidia will need to top profit and sales estimates by at least 15% to avoid a selloff.

AI bellwether Nvidia, which memorably dubbed “the world’s most important stock” by Goldman during the last earnings season, is due to report its latest results after market close. Its results, which Bloomberg’s John Authers says have an unhealthy hold over the market, are projected to show a 243% gain in revenue, according to Wall Street estimates, but as Bloomberg notes, a 90% year-to-date share rally means it could struggle to match sky-high expectations.

First, looking at consensus estimates, here is what Wall Street expects the company to report with options pricing in an 8% swing in the stock after hours:

- Revenue estimate $24.69 billion

- Data center revenue estimate $21.13 billion

- Gaming revenue estimate $2.62 billion

- Professional Visualization revenue estimate $479.1 million

- Automotive revenue estimate $292.4 million

- Adjusted gross margin estimate 77%

- R&D expenses estimate $2.73 billion

- Adjusted operating expenses estimate $2.51 billion

- Adjusted operating income estimate $16.46 billion

- Adjusted Operating Margin 66.8%

- Adjusted EPS estimate $5.65

- Free cash flow estimate $12.29 billion

Ahead of the earnings, Goldman’ trading desk – which would characterize positioning in NVDA as an extremely crowded 9 out of 10 – highlights a few key talking points:

- While investors largely expect a beat/raise print, expectations do appear to be for a continued moderation in “beat sizes” (as has been the trend) measured against consensus revs of ~$24.5bn in the April quarter

- Most of the tactical ‘debate’ is less about April/July upside and more about 2H linearity as Nvidia transitions to a new GPU architecture (e.g. hand-off from Hopper -> Blackwell products) as well as a debate when/if investors will start to discuss CY26 visibility / growth (I know, I know)

- Some debate on how all the products fit together and what demand patterns will be (e.g. esp re the GB200 NVL72, which connects 36 Grace CPUs and 72 Blackwell GPUs in a liquid-cooled, rack-scale design)

- What the ‘sovereign’ TAM / demand picture looks like? (still feels like a big unknown);

- The trajectory of Gross Margins (from last call, NVDA noted: “for the remainder of the year, we expect gross margins to return to the mid-70s percent range”).

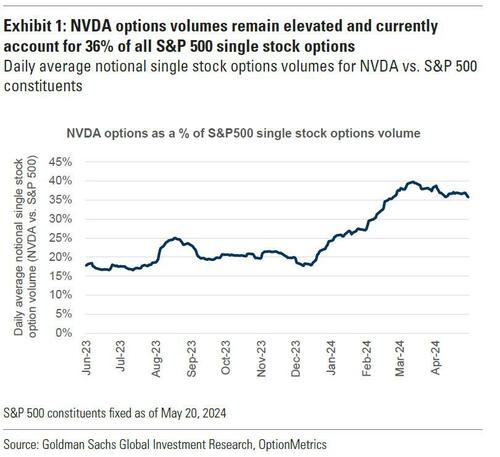

Looking at the broader market reaction, Goldman’s John Marshall writes that “index options are missing the potential for market-wide volatility on Nvidia’s (NVDA) earnings report today after the close. SPX 2-day straddles capturing the move following NVDA earnings only cost 0.76% while the SPX has moved an average of +/-1.2% on the 1-day of the past 4 NVDA earnings reports. NVDA options suggest investors expect this earnings report to be unusually important; NVDA options imply a +/-11.9% earnings-day move vs. its 4-quarter historical earnings-day move of +/-10.8%. The importance of this earnings report is easy to see given NVDA options volume has been 36% of all single stock options volumes over the past three months. Historically, we find SPX options market have underestimated the volatility on NVDA earnings; options priced a 0.7% move but realized a +/- 1.2% move on average over the last 4 quarters” (link to full report for pro subscribers).

* * *

Turning away from Goldman and toward JPMorgan, we read the following preview from Sales Specialist Josh Meyers:

- SENTIMENT: We were good buyers closer to 800, but there’s been less appetite here recently. Sentiment is quite positive into earnings, with our bars well-above consensus and a sense that management has left some in the tank to surprise positively. This suggests that it may take a big upside surprise (earnings or clearer forward guidance) to get the stock moving any higher, and the bullishness is tempered by a concern that the setup is similar to last year… where the stock traded sideways for 8 months despite continued earnings beats. My one concern is a setup that feels a little similar to ANET, another expensive, well-loved AI-themed name where expectations of a surprise were low into earnings.

- POSITIONING SCORE (1 = max short/UW, 10 = max long/OW): 8

- BUYSIDE BARS:

- F1Q25 Rev $25.62,

- DC Rev $22.2b,

- EPS $5.92;

- F2Q25 Rev guide $28b.

- DEBATES FOR THE CALL:

- (i) Buyside is already well ahead of the guide and consensus, so how does stock react if we don’t get a more material beat;

- (ii) Concerns about an air pocket/slowdown ahead of Blackwell launch, and lack of visibility on what the Blackwell launch looks like; and

- (iii) People starting to ask about ’25 & ’26 rev (where our survey is 6.3% & 13.7% ahead of F25 & F26 consensus rev).

- IMPLIED 1-DAY MOVE: 7.9%

* * *

We conclude by taking a look at what the UBS trading desk writes ahead of NVDA earnings, and find that the bank’s trader Ryan Cobb notes that flows have been slightly better for sale over the past week or so “as investors prudently take small profits in Nvidia and the rest of the AI trade (Super Micro Computer, Marvell Technology, Broadcom, Dell, Arista Networks) while rotating into other pockets of Semis (Analog). The desk was net buyer in late April/early May, then flipped seller into the print. The makeup of our recent sell flow is mostly Long Only trimming – though no massive de-risking.”

Elsewhere, UBS trader Jephine Wong writes that the options implied move for Nvidia stock is 8.5%, which is in line with the average move seen over the past eight quarters. What is more shocking is the impact Nvidia is expected to have at the index level: The S&P could move as much as 70bp in either direction on Thursday. For reference, the implied move for last week’s CPI report was 83bp while the breakeven for Friday, May 17, was around 45bp — making Nvidia’s earnings a pseudo macro event for financial markets.

UBS analyst Tim Arcuri recently raised his estimates to a Street high, and he believes they will post fiscal first quarter revenue as high as $26 bn, versus the Street’s $24.6 bn and potentially guide $27 bn-$28 bn versus the Street’s $26.53 bn, which should be enough to keep the stock higher.

That said, although expectations are creeping up (as they always do before results), with limited pushback on analyst Tim Arcuri’s Street-high estimates, UBS Tech Spec Sales Robert Ruple thinks a beat/raise at or slightly above Tim’s numbers should be enough for Nvidia to hold in. However, with the stock rallying more than 10% over the last month, he cautions that upside will probably be more limited on a tactical basis. His conversations with investors suggest the July-Quarter bogey is $28 bn, but Rob thinks there is some low-balling and the “real” bogey is probably closer to $29 bn. Regardless, whether Nvidia makes the bogey or not, he doesn’t sense most fundamental investors are backing away from Nvidia, especially ahead of the Blackwell launch in Q4. Beyond Wednesday’s earnings, there should be incremental color from CEO Jensen Huang’s keynote at Computex in early June.

The biggest debate for investors continues to be whether there will be a transitionary “air pocket” between October and January ahead of the mid-December initial shipments of Blackwell. Tim isn’t sure this gets fully addressed on the earnings call later on Wednesday, but he believes concerns of a Hopper slowdown are overblown, considering his channel checks show Hopper is sold out through the end of the year. Also, Tim’s work suggests that once Blackwell starts to ship there will be very strong GB200 demand and as reminder he recently took his EPS forecast to a Street high of $41 for 2025.

While UBS agrees with Goldman that “positioning remains heavily long (9 on 1-10 scale) as the name is the favorite in TMT”, the bank notes that positioning continues to slowly come down from the previous two prints with investors prudently take small profits as the stock has traded sideways since early March. The stock is still up 91% year to date. Shares are up 19% over the last month as my conversations with investors continue to skew more bullish and increase expectations on back of the positive sellside notes (as they do every quarter). Asia is typically most bullish/aggressive on the buyside bogeys, followed by US/Europe slightly below.

Technicals: The 50-day moving average is at $886, which is a little less than down 7% from current levels, and UBS thinks both the $900 and $886 levels serve as support for the stock; the bank has heard anecdotes from investors that “they would likely defend the stock below $900.”