Fra Zerohedge:

After US Manufacturing’s PMI bucked the global slowdown trend, rebounding in January, US Services data was also expected to likewise stabilize against weakness worldwide, but it didn’t.

Markit’s US Services PMI printed 54.2, down from 54.4 – the lowest since September – weighed down by the joint-weakest rise in new business since Oct 2017, the rate of new order growth matches December’s recent lows, and activity expansion is the softest in four months.

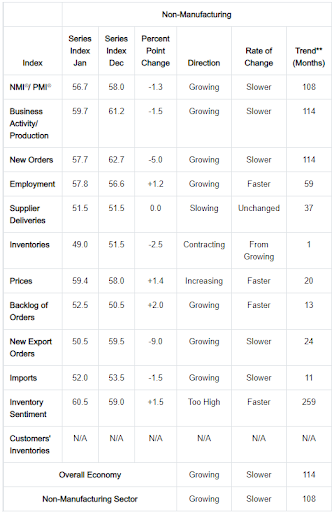

ISM’s Non-Manufacturing Index disappointed, dropping to 56.7 (57.1 exp) from an upwardly revised 58.0 as new orders dropped sharply in January. ISM Services has not been lower since Dec 2017

So manufacturing upticked in January and services slumped according to both surveys.

The downshift in services expansion is in sync with forecasts for economic growth to moderate this year as the tax-cut boost fades and the trade war weighs on business plans.

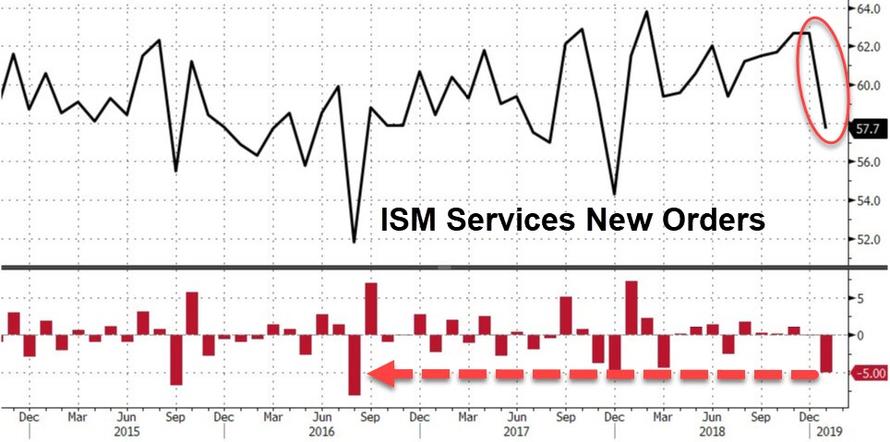

The index of non-manufacturing business activity declined to 59.7from 61.2 the prior month, and the gauge of new orders fell to 57.7from 62.7, the steepest drop since August 2016.

And New Export Orders crashed by the 3rd biggest amount since Lehman…

Commenting on the PMI data, Chris Williamson, Chief Business Economist at IHS Markit said:

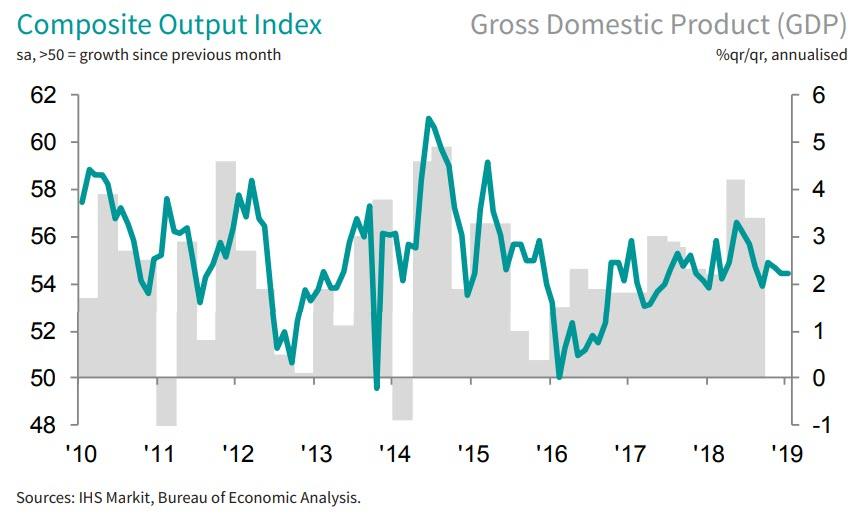

“The robust economic growth signalled by the US PMI surveys at the start of the year sits in stark contrast to the near-stalling of growth seen in Europe, China and Japan. At current levels, the surveys are consistent with annualised GDP growth of around 2.5% at the start of the year.

“Jobs growth remained buoyant as business optimism perked up to its highest since October. Backlogs of work are meanwhile building up, in part because firms struggled to meet demand, which has in turn allowed sellers to continue to push prices higher.

“However, although still robust, the rates of economic growth, job creation and inflation signalled by the PMI surveys have cooled since peaks seen last year. This possibly reflects some impact from the government shutdown, though scant evidence of such was seen in the anecdotal evidence from the surveys, but also reflects an easing of demand growth, notably from abroad. Foreign sales of goods and services barely rose in January, contrasting with signs of faster growth of domestic orders. “

Just remember, it’s never a decoupling, it’s always just a lag.

We give the last word to the ISM services survey respondents to clarify exactly what is going on…

“Business has slowed well below expectations as our customers deal with the effects of economic situations exacerbated by the government shutdown.”

“The government shutdown is not affecting our business at this time.”

So there you have it – goldilocks?