by Danielle DiMartino Booth, op-ed via Bloomberg.com,

The remarkable rebound in the U.S. stock market from the lows in late December has resulted in gains that the analysts at Goldman Sachs rightly point out already constitute banner returns for an entire calendar year.

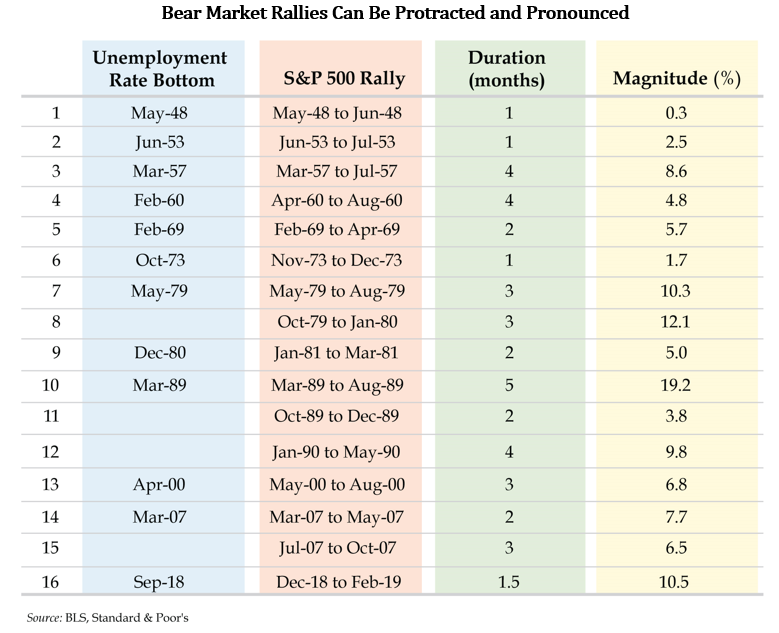

History is replete with examples of major recoveries following big sell-offs, many of which turn out to be head fakes otherwise known as bear market rallies. At the end of the trading day, it’s still fundamentals that should drive investing decisions.

According to historic payroll data and the National Bureau of Economic Research, every time the three-month average unemployment rate exceeded its six-month average at cycle peaks over the past 50 years — like it did in January — the U.S. economy has experienced a recession. In a 2016 speech to the International Monetary Fund, then Federal Reserve Bank of New York President — and current Bloomberg Opinion contributor — William Dudley corroborated the historic pattern citing research first conducted earlier in his career at Goldman Sachs:

“History shows it is very difficult to push the unemployment rate back up just a little bit in order to contain inflation pressures. Looking at the post-war period, whenever the unemployment rate has increased by more than 0.3 to 0.4 percentage points, the economy has always ended up in a full-blown recession with the unemployment rate rising by at least 1.9 percentage points. This is an outcome to avoid, especially given that in an economic downturn the last to be hired are often the first to be fired.”

To Dudley’s point, the odds that layoffs will continue rising are high. As per January data from Challenger, Gray & Christmas, layoffs have risen over the prior year for six straight months. Economists would characterize that as an established trend. Retail and more recently, energy, have been some of the weakest sectors. Media is another sore spot.

Backing out to the broader economy, one of the fastest growing reasons for increased layoffs last year was mergers and acquisitions. There’s likely to be no letup in 2019 after last year’s record M&A activity, which is just one of the more creative avenues companies have pursued to reduce costs in recent years. The looming earnings recession will compel firms to be more direct in their approach, as in outright headcount reduction to protect profit margins.

Auto dealers are struggling to shoulder the weight of the most crowded lots in almost two years. As a result, auto production contracted in January, promising to pressure Midwest manufacturing, a stand out area of the economy in recent months as other regions faltered. As is the case with the earnings sudden stop, motor vehicle and parts swung from 8.4 percent year-on-year growth in December to a 0.7 percent contraction in January, according to Industrial production data from the Fed.

Although autos were a sweet spot in the delayed December retail sales release, that strength appears to be wavering as cumulative tax refunds disappoint. In the first 18 days of the tax season through Feb. 21, cumulative refunds totaled $36.3 billion, down $61.7 billion, or 63 percent, from the same period last year. This portends poorly for the seasonal surge in auto buying and consumer spending tied to households’ propensity to spend the majority of their tax refund proceeds. If anything, Fed data show households are hunkering down, with checking and savings account balances rising dramatically, moves generally associated with spending pullbacks.

It is the combination of an earnings recession and an economic slowdown that derail parallels with the 2015-16 stock swoon and rebound. As breathtaking as the rally off the Christmas Eve lows has been, it is not at all unusual to see protracted and magnificent surges punctuate bear markets. In the five months through August 1989, the S&P 500 rallied 19.2 percent before backsliding.

What makes the current run historically remarkable is the magnitude of the 10.5 percent rally in such a short time span, which belies the bottoming of the unemployment rate in the face of accelerating layoffs.

It was a bit curious to read in his recent Bloomberg Opinion commentary that Dudley thought it was “hard to see how the normalization of the Fed’s balance sheet tightened financial conditions in a way that would have weighed significantly on stock prices.” The current bear market rally was, after all, catalyzed by Chairman Jerome Powell’s assurances that quantitative tightening might be suspended soon, a stance since corroborated by both hawkish and dovish Fed officials.

Skeptical investors have been badly bruised if they were emboldened to fight both the Fed and the C-Suite at the same time. There is one force, however, that trumps both of these faith-based investing approaches and that is economic fundamentals. This may be a bear market rally for the ages, but that shouldn’t imply investors should do anything other than rent it. Owning it promises to end in tears.