Fra Zerohedge:

- On December 23, with the S&P points away from a bear market, Steve Mnuchin called the Plunge Protection Team, i.e. President’s Working Group on capital markets, with one clear message – stop the plunge.

- On December 25, Trump pulled an Obama, and told Americans to buy stocks: “We have companies, the greatest in the world, and they’re doing really well,” the president told reporters at the White House on Christmas Day. “They have record kinds of numbers. So I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.” (Pension funds heard him loud and clear, unleashing the biggest stock buying spree in history the very next day).

- On January 4, just two weeks after Fed Chair Powell hiked rates by 25bps and said the Fed’s balance sheet was on “autopilot”, and tightening would continue, the former Carlyle lawyer, sitting between Bernanke and Yellen capitulated, and for the first time said that the Fed would be patient, effectively ending the Fed’s rate hike posture.

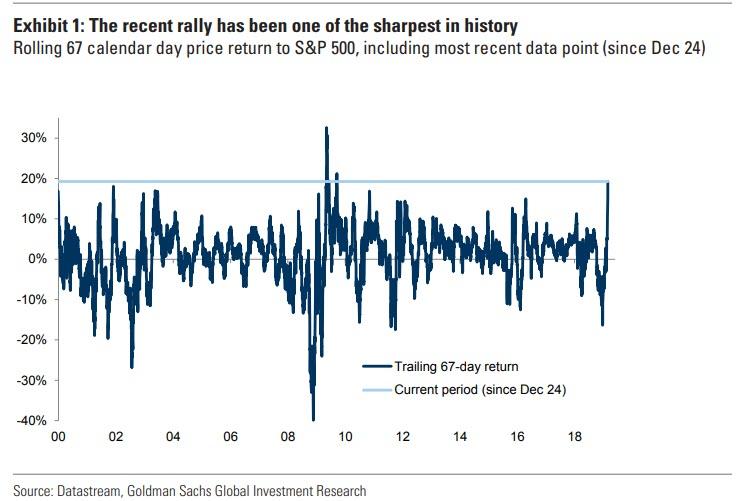

What has transpired since then is nothing short of breathtaking, with the S&P rebounding from the mid-2,300 to 2,800 (and on same days rising above it), in what Goldman dubbed “one of the sharpest rallies in history.” Indeed, as shown below, the rolling 67-day price return of the S&P is the 3rd fastest rally this century, perhaps ever. In other words, there are bear market rallies and then there are bear market rallies, and what we have just experienced was, according to Goldman, “the sharpest rally since the global financial crisis recovery, and sharp valuation re-rating alongside negative earnings revisions”…

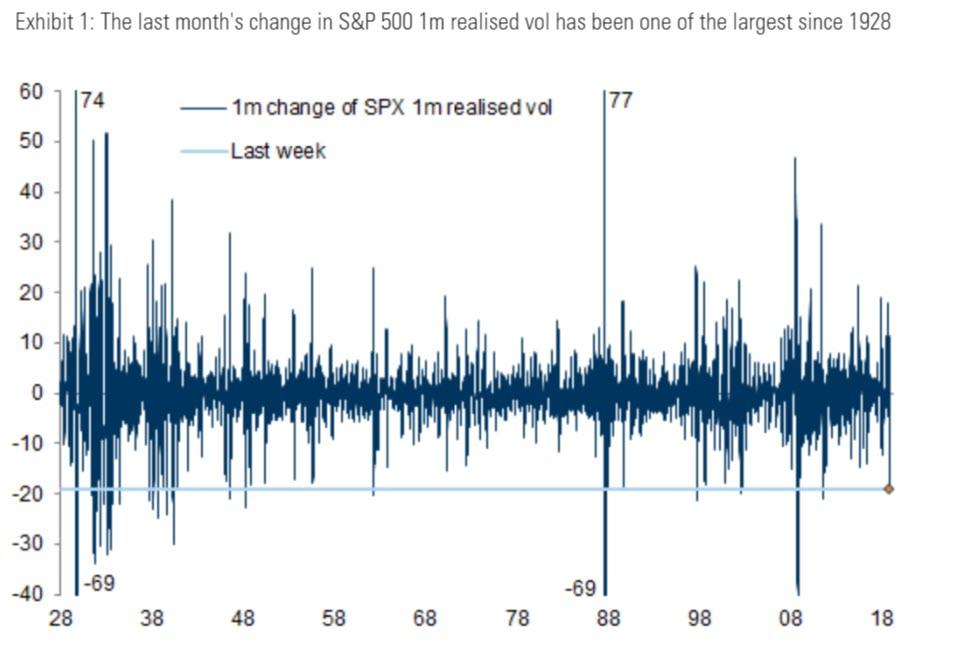

… one which was accompanied by one of the largest declines in realized vol since 1928.

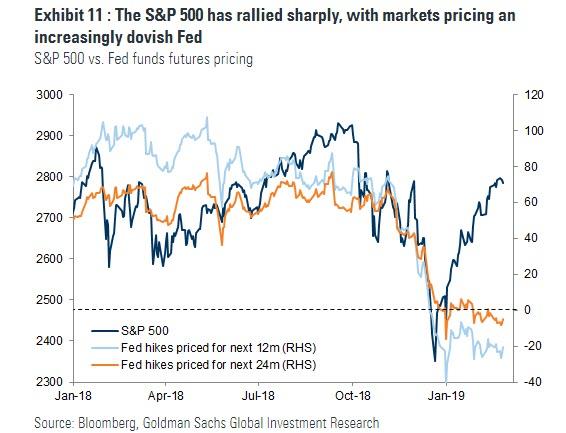

Alas, with the S&P now clearly unable to breach 2,800 and stay comfortably above this “quad resistance” level, the rally appears to be over, and as Goldman wrote over the weekend, “there is now a material disconnect between Fed pricing and the S&P 500… as not only are markets pricing no hikes in the next 12 months, but they are pricing a cut in the next 2 years.”

Updating this gloomy take, overnight Goldman’s Ian Wright doubles down on the bank’s bearishness and notes that “the macro backdrop of growth moving down but inflation moving up is far from consistent with a sustained low vol regime, and vol of vol remains high, and so higher volatility will likely return before too long.”

Therefore, Goldman thinks periodic corrections are more likely than a sustained bear market (as part of a “skinny and flat” range), and US skew has returned, and as a result the world’s most influential FDIC-backed hedge fund think that it is time to start hedging for the coming mean reversion lower