Fra Zerohedge:

Today at 4:15pm EDT, DoubleLine founder Jeff Gundlach is holding his latest live webcast open to investors and casual listeners, titled enticingly ‘Highway to Hell’, and which we assume will discuss either Brexit, the US-China trade deal, the long-term US debt picture or how this, latest asset bubble finally ends.

Readers can register and follow it live at this address, or clicking on the image below

As usual, we will grab and highlight the most interesting charts from Gundlach’s presentation as they come in.

* * *

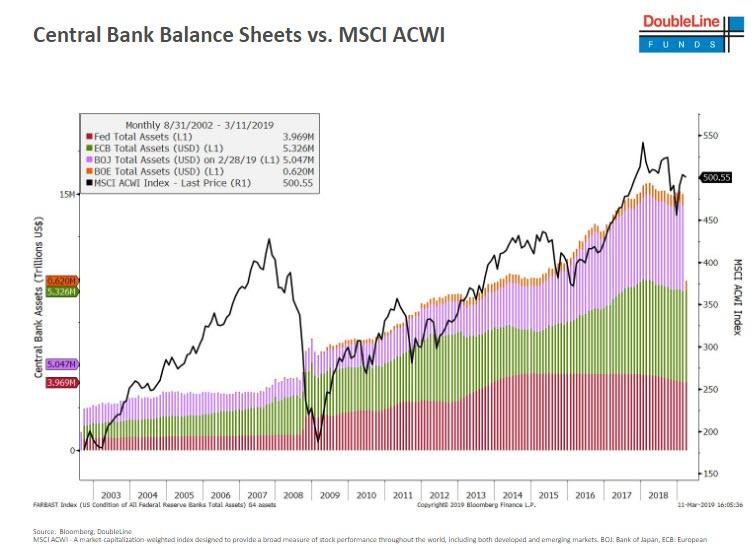

Gundlach, as usual, starts with one of his favorite charts, the one showing the global central bank balance sheet level juxtaposed to the global market, as the background for the Fed’s “180 degree turn” in the stock market’s recent rebound, which is understandable since the “S&P was and is in a bear market.”

If that wasn’t bad enough, Gundlach also said that stocks will take out the December low during the course of 2019 and markets will roll over earlier than they did last year.

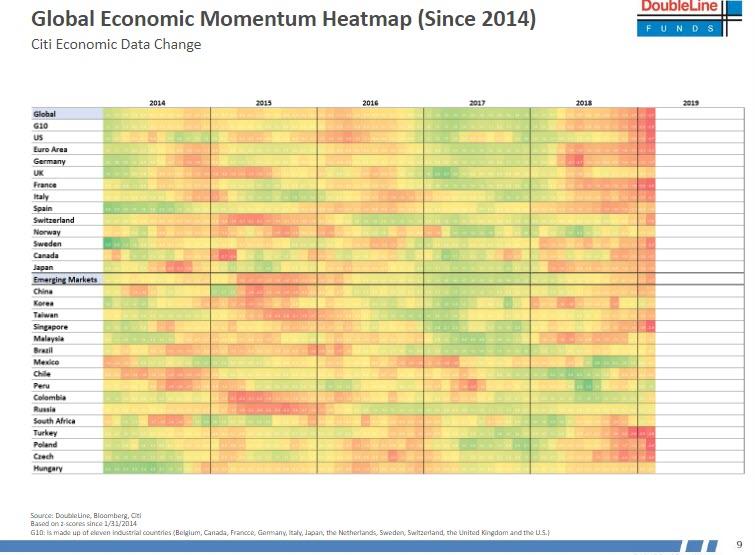

Shifting from the market to the economy, Gundlach shows that global economic momentum is getting worse across the globe…

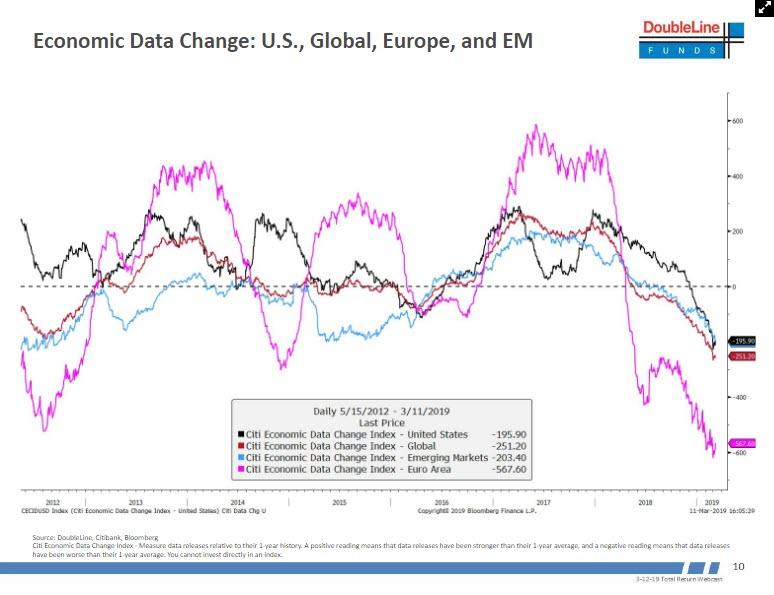

… as also confirmed by the next chart, showing the real-time dropoff in economic data.

Gundlach then highlights the sudden collapse in global trade, which would suggest the world is in a global recession.

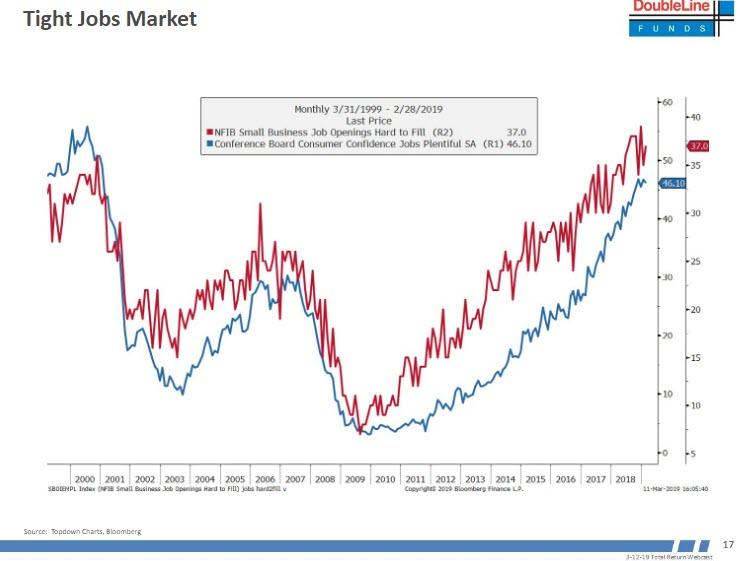

And yet at the same time, US economic data, at least in the labor market, has never been stronger as Gundlach shows:

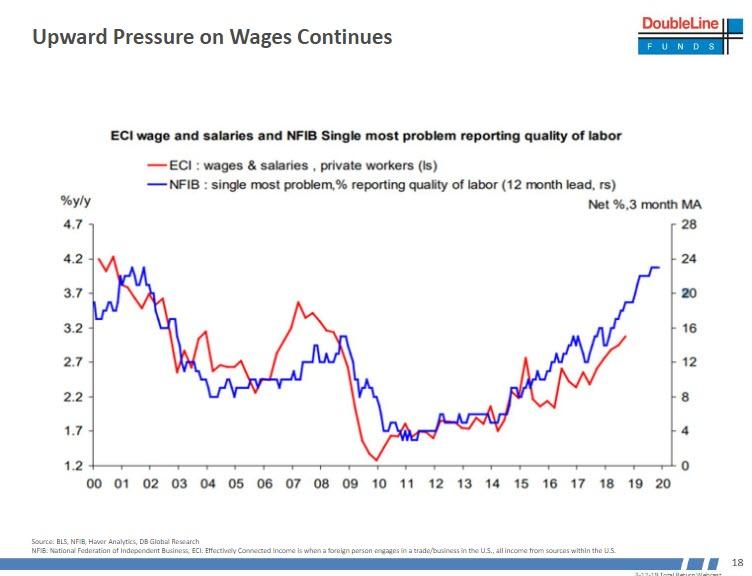

Which in turn means that inflation will keep rising, which, if Morgan Stanley is correct, will force the Fed to turn hawkish again, and hike once more in December and another three times in 2020.

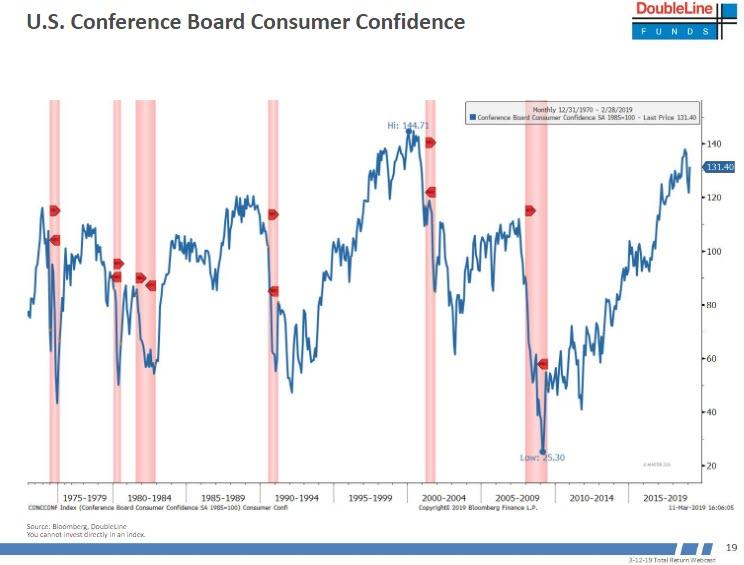

Perhaps as a result of this favorable outlook on wages, consumer confidence remains strong..

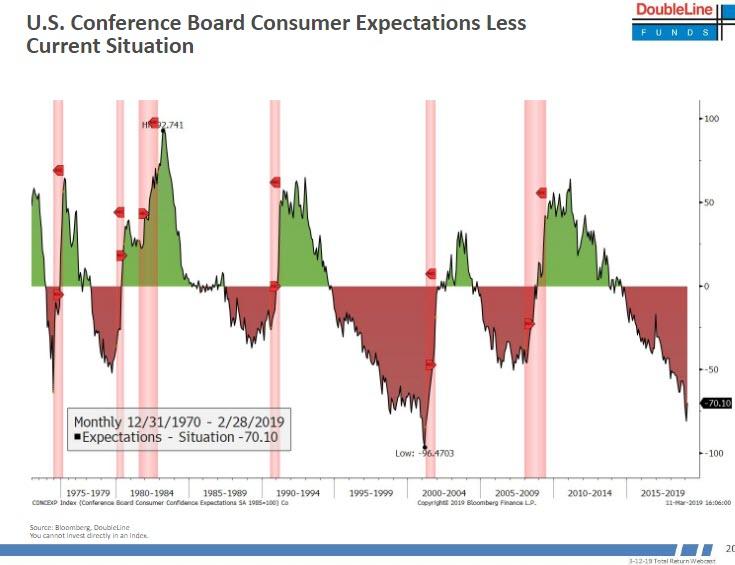

… although one place where Gundlach sees a recessionary red flag, is the gadping difference between consumer expectations less the current situation; the catalyst for the DoubleLine founder: if the current situation start dropping that would be a big recessionary indicator.

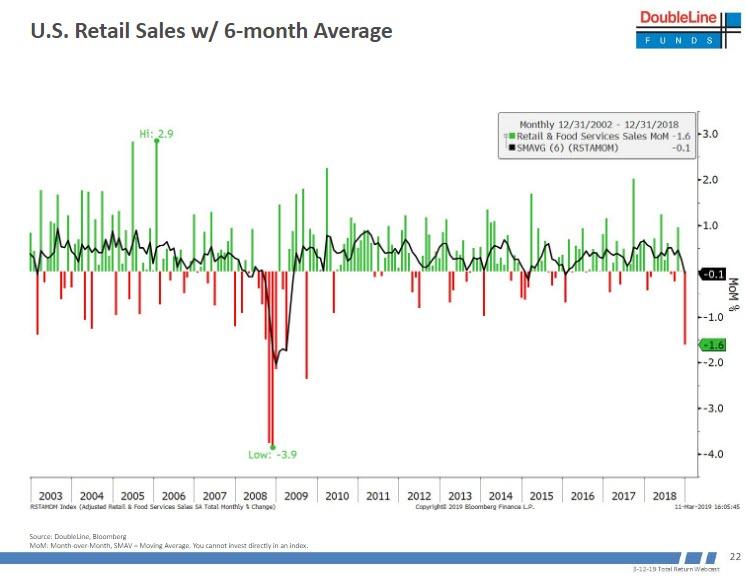

Of course, another big red flag is the collapse in December retail sales, and despite the sharp rebound in the January print as we saw yesterday, Gundlach highlights the sharp drop in the 6 month average and highlights it as another potential recessionary risk factor.

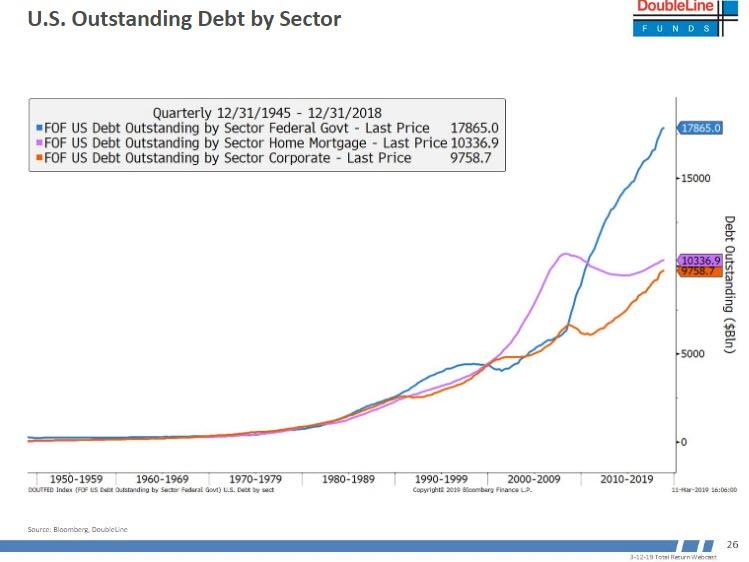

Going back to one of his favorite topics, the relentless growth of US debt, Gundlach shows the following chart of debt by sector. Needless to say, it is troubling, and as Gundlach said, .

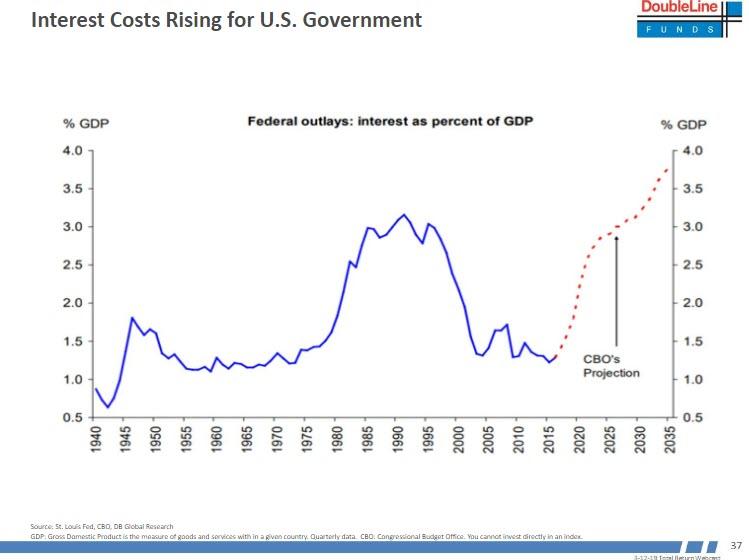

And tied to that, the following new warning on the US interest expense: “The US interest expense is projected by the CBO to explode higher starting yesterday”

Gundlach then went on a rant against MMT, calling it a “crackpot” theory, which is based on a “completely fallacious argument”, and adds that “People who have PhDs in economics actually are buying the complete nonsense of MMT which is used to justify a massive socialist program.”

Gundlach also discusses the US trade deficit, which recently soared, saying that “the trade deficit is not shrinking but expanding,” and the goods deficit is at “an all-time record”, which according to Gundlach may hurt Trump’s re-election chances.

Having predicted president Trump early, when everyone else was still mocking him, Gundlach admits that he is “not really sure what’s going to happen,” when it comes to the next election. “If you ran on promising a lesser trade deficit” and elimination of national debt, and both have “exploded” higher, Gundlach thinks it’s hard to say that you’re winning.

And speaking of the next president, Gundlach suggests that if the economy falls into recession and Trump gets thrown out, we might get the chance to see how MMT, i.e. helicopter money, really works with the next, socialist, president.

Perhaps this is also why to Gundlach “the next big move for the dollar is lower.”

Looking ahead, Gundlach also touches on the future of monetary policy, and once again highlights the discrepancy between the bond market, which expects half a rate cut, and the Fed’s dot plot which expects three hikes in 2019-2020.

What happens? To Gundlach, “Fed expectations are likely to show capitulation to the Fed this time…the bond market is having none of the Fed’s two dots that they revealed in December.” He then adds that the Fed “will absolutely drop the 2019 dot,” suggesting it may be dropped to 1/2 a hike.