Fra Zerohedge:

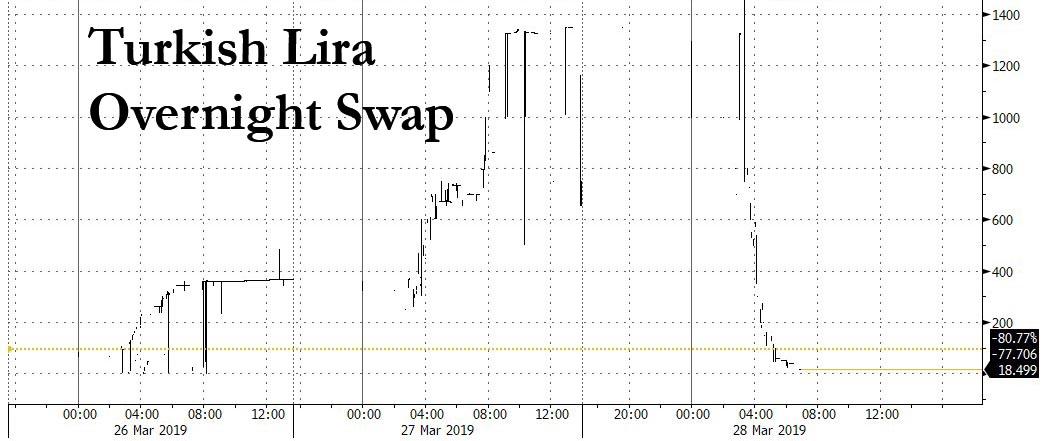

The Turkish lira resumed its plunge on Thursday following a sharp rebound on Tuesday when Turkish authorities unleashed an unprecedented assault on lira shorts, helping push the TRY briefly higher ahead of regional elections, after a disappointing reading on the central bank’s net FX reserves stoked fears that the country was even closer to a full-blown currency crisis than investors had feared, while local accounts continued to accumulate foreign currency after overnight swaps on the Turkish Lira collapsed to just 40% from a historic high around 1,338% on Tuesday.

After nearly a week of chaos that one trader described as unprecedented in his two decades in the market (“I’ve never seen a move like this in the 21 years I’ve been watching the market“), it appears President Erdogan has relented, and following a vocal outcry from the international community which was effectively trapped in lira positions, both long and short, after overnight swaps hit rates well above 1,000%, on Tuesday the swap plunged as low as 18.5%, in line with recent historical prints, and an indication that after doing everything in its power to squeeze shorts (and longs) the central bank appears to have capitulated.

As we reported previously, bankers and analysts at large international banks reported that Turkish lenders appeared unable or unwilling to provide lira in exchange for currency this week, in an attempt to prevent short selling. While Turkey’s banking association (TBB) on Wednesday night denied claims that the country’s lenders had been limiting or halting sales of lira to foreign banks, one London-based analyst told the FT on Tuesday that Turkish banks told him they had been ordered “not to lend even a single lira to foreign counterparties” That squeeze sent the cost of borrowing lira soaring for foreign banks and hedge funds, although as shown above, it has since tumbled.

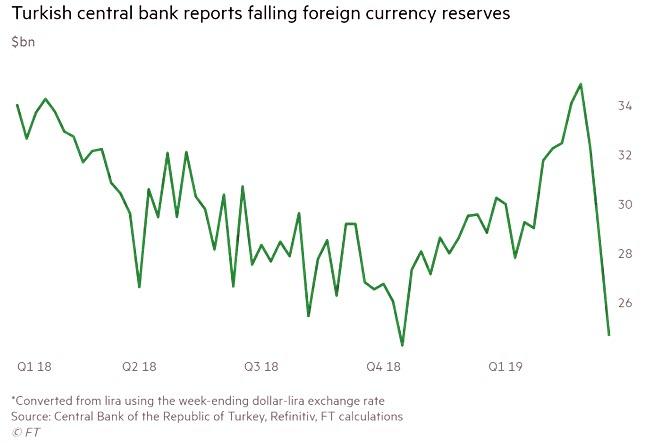

Meanwhile, the underlying pressures facing Turkey accelerated, and on Thursday data showed another dizzying drop in Turkey’s foreign exchange reserves brought the total decline for the first three weeks of March to 45.1 billion lira, or about $10 billion.

According to FT calculations, Turkey has now burnt through at least a third of its foreign reserves this month in an effort to stem a plunge in the lira ahead of local elections at the weekend, putting the country on path to a full-blown currency and funding crisis. According to the central bank, reserves now stood at about $24.7 billion, down from $28.5 billion a week earlier, a 13% drop in one week.

The latest currency sell-off added to deepening turmoil on Turkish financial markets, which have been in flux for almost a week in a deja vu of last summer’s crisis that sent the lira tumbling to record lows, with lasting effects on the economy.

In a push to reassure the market, Central bank governor Murat Cetinkaya told the state-run Anadolu news agency that net foreign-currency reserves had risen in the final week of the month, rising by $2.4 billion during the past week, although this could have been due to a simple accounting trick:

on Thursday, the Turkish central bank raised the limit on Turkish lenders’ FX-lira swaps with the monetary policy authority. The limit was raised to 30% of so-called FX Markets Transaction Limits determined by the CBRT for commercial lenders from 20%. The increase to the swaps limits comes after the central bank raised the maximum amount to 20% from 10% on Monday and was made in an attempt to increase its FX reserves, at least optically.

What is even more concerning than the collapse in reserves, however, is that even locals now appear to have lost faith in a currency which the government is forced to defend at any cost – literally – and on Thursday the Lira fell 5% to 5.5914 per dollar amid a sell-off that’s roiling the nation’s markets, as the very same measures designed to deter short-sellers from selling the currency before municipal elections on Sunday achieved the opposite outcome and spooked investors, both foreign and domestic.

According to a trader quoted by Bloomberg, Turkish investors bought an estimated $3.5 billion worth so far this week as locals have bought at least $1 billion a day. As a result, the latest central bank data reveals that Turkish investors now hold a record $176 billion worth of hard currency after buying around $25 billion since early September.

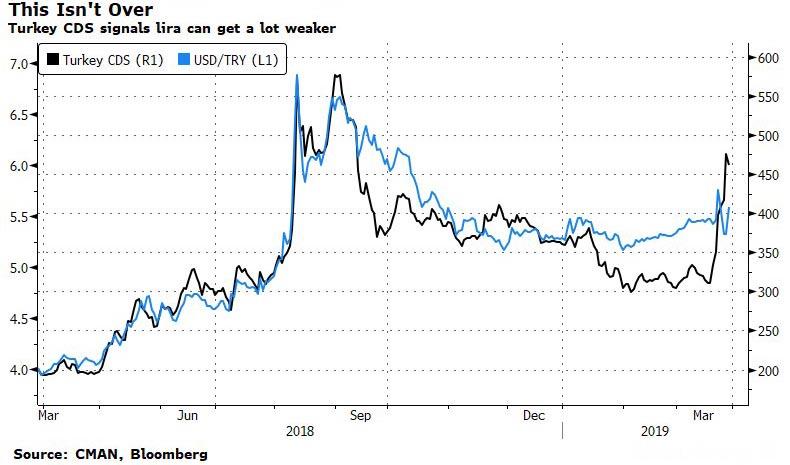

Meanwhile, as Erdogan has focused on the currency, other market indicators are screaming full-blown crisis and on Thursday, Turkey’s five-year credit default swaps widened for an eighth day to 462, the highest since September, while the yield on the nation’s benchmark 10-year lira bond jumped 91bps to over 19%.

As Bloomberg notes, the cost of protection on Turkish sovereign notes has jumped above that for Iraq, Greece, Angola and Pakistan. Governments with costlier CDS include Ukraine, Argentina and Lebanon… for now. The turnaround in market perceptions for Turkey was especially striking because its CDS had been calmly declining even as the economy sank into recession. It wasn’t until recent fears about the plunge in reserves, that the CDS rout accelerated. If only assumes the historical correlation holds, the Turkish Lira will soon tumble to about 6.00 vs the dollar.

So with Turkey now once again in a full-blown financial crisis and this time with the added kicker of its reserves dwindling to dangerous levels yesterday’s quasi capital controls notwithstanding, traders’ attention turns to what happens next week after the local elections are out of the way.

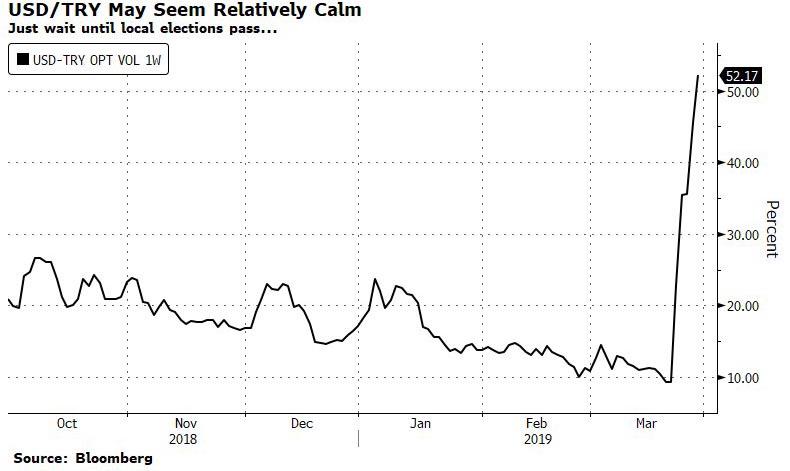

For some idea of how much the Turkish lira may weaken next week, Bloomberg’s Mark Cudmore says to check out the 1 week USD/TRY implied volatility, which has exploded above 48% from 9.4% a week ago:

The expectation in the market is that offshore lira liquidity will be relaxed after the weekend elections, resulting in FX swap rates collapsing and enabling trapped lira longs to exit their positions. In fact, it appears that this has already happened, and the selling in the lira has resumed.

Finally, confirming that Erdogan has already lost the war with “evil speculators”, on Thursday the Turkish executive president made it clear that he sees nothing wrong with his economy, and instead the fluctuations in the exchange rate are due to “operations by the U.S. and the West to corner Turkey” (perhaps headed by JPMorgan):

- ERDOGAN SAYS LIRA FLUCTUATIONS ABOUT OPERATION TO CORNER TURKEY

- ERDOGAN: THE REAL PROBLEM IS INTEREST RATES, I’M AN ECONOMIST

Adding to the comedy, the president said that a “cornering operation targeting foreign exchange and interest rates were foiled”, ignoring to add that as a result of this operation, the last trace of confidence investors may have had in his increasingly banana republic may have now evaporated.

And while Erdogan also said that speculators should be tamed, the greatest worry for lira bulls should be that Erdogan is once again also targeting high interest rates as the source of the country’s woes, saying that “they”, i.e. the central bank, “have to cut interest rates or the inflation problem will carry on.”

Of course, whatever Erdogan wants, Erdogan gets so as soon as the local elections are over, expect a coordinated attack by the Turkish executive branch on the central bank of the country which is now mired in a deep recession where prices are soaring, urging for much lower rates, which in turn will soon send the lira plunging to new all time lows.