Fra Zerohedge:

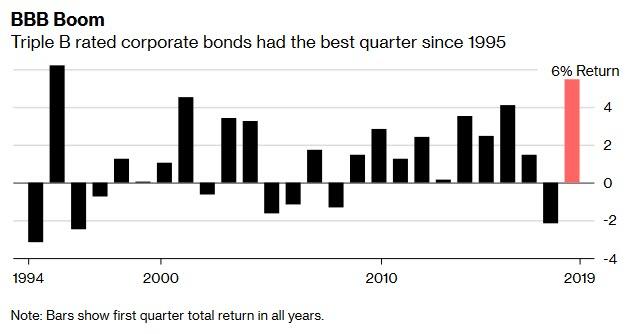

In a quarter in which virtually every asset class posted positive returns, the lowest, BBB-rated investment-grade bonds shruged off well-publicized fears of a “fallen angel” tsunami, i.e., a wave of downgrades to junk, and soared to the best first quarter performance since 1995. According to Bloomberg debt rated BBB returned 5.8% in the first three months, compared to a drop of 2.1% in the first quarter of 2018.

The breathtaking move continued on the first day of April and benefited the riskiest of names as Junk bonds spread tightened by a massive 11bps, the most since January. As Bloomberg’s Sebastian Boyd noted, “the breadth is spectacular. Of 480 movers in the Bloomberg Barclays U.S. High Yield index, 89% are tighter on the day. Every single industry group is tighter, led by pharmaceuticals. On a sector basis, the best performers are communications and health care, but with a move as broad as this isn’t really linked to industry-specific news” and is instead tied to the euphoria that was unleashed by China’s manufacturing PMI which sent global risk assets soaring.

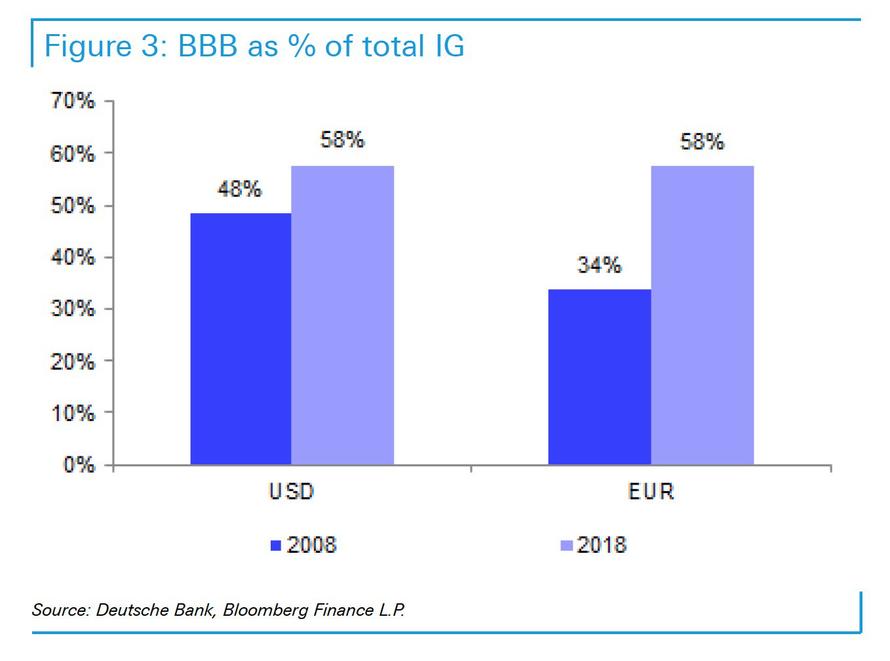

But it’s not junk bonds we are concerned about at least in the context of this post, but rather the BBB IG space: as a reminder, BBB debt now accounts for nearly 60% of the entire $6.4 trillion US investment grade space, with a similar portion for Europe. This is why virtually every fixed income luminary has warned that the next recession may be catalyzed by massive downgrades which would blow up the junk bond space, which at last check was roughly one-third the size of the entire BBB-rated bond universe.

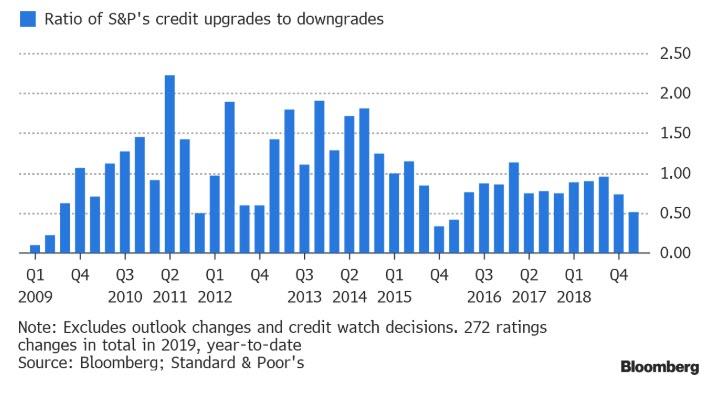

And yet, despite the blistering return of the lowest-rated IG debt, concerns of massive downgrades are starting to be realized: according to the latest S&P data compiled by Bloomberg, the first quarter saw the most credit ratings downgrades for U.S. companies relative to upgrades since the beginning of 2016.

The Q1 downgrade wave was sprearheaded by several prominent names as major companies including utility PG&E, retailer J.C. Penney and entertainment giant Walt Disney all had their ratings cut “in a quarter that saw nearly two downgrades for every upgrade.”

Worse, the ratio dipped for both investment grade and high yield bonds, with downgrades outpacing upgrades for higher quality issuers for only the fourth time in the last twelve quarters.

So is the bond downgrade frenzy merely a delayed reaction to the sharp price drops observed in the fourth quarter and the start of Q1, or are the rating agencies ahead of the curve for once? If so, and if the downgrade cascade accelerates from here and engulfs the BBB space in coming months and quarters, the stellar bond market performance observed in the first quarter may end up being the biggest bull trap since 2007.