Fra Zerohedge:

Just over eight months since Fed Chair Powell panicked and pivoted as global stocks (and bond yields) tumbled, the flip-flop is completeas The Fed has cut rates (by 25bps) for the first time since Dec 2008 (and cut the IOER to 2.1% from 2.35%).

Additionally, the Fed ends the normalization of the balance sheet two months ahead of schedule.

Fed praises US economy, blames rest of the world for cutting:

“In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 2 to 2-1/4 percent”

But in a bit of a shock, in addition to Esther George, who was widely expected to dissent, Eric Rosengren also joined the hawkish #resistance, wanting to leave rates unchanged. His dissent is what is spooking markets, because as RSM’s Joseph Brusuelas notes, “Ms. George and Mr. Rosengren took one for the team and expressed their dissent on the rate cut, which is surely one of the more controversial in memory. Two dissents is very rare indeed and reflects the not so gentle split on the committee.”

Mission Accomplished Mr. Trump… but if stocks plunge here, expect Trump to slam Powell for not hiking rates 25bps.

From expectations of 100bps of rate-hikes priced-in in Nov 2018, Powell’s massive pivot now markets pricing in 100bps of rate-cuts…

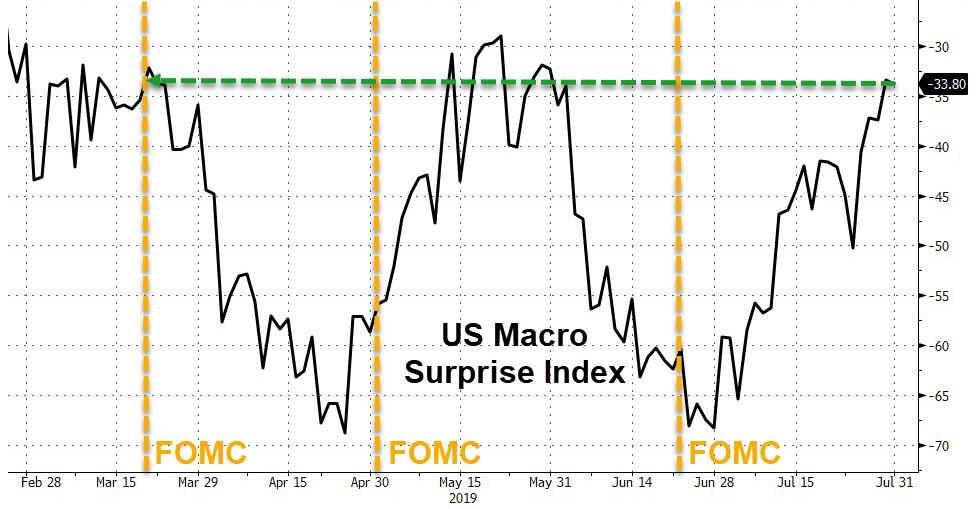

US Macro data has been better than expected since the June FOMC… but cut anyway!

The last time The Fed started a rate-cutting cycle, valuations were dramatically lower…

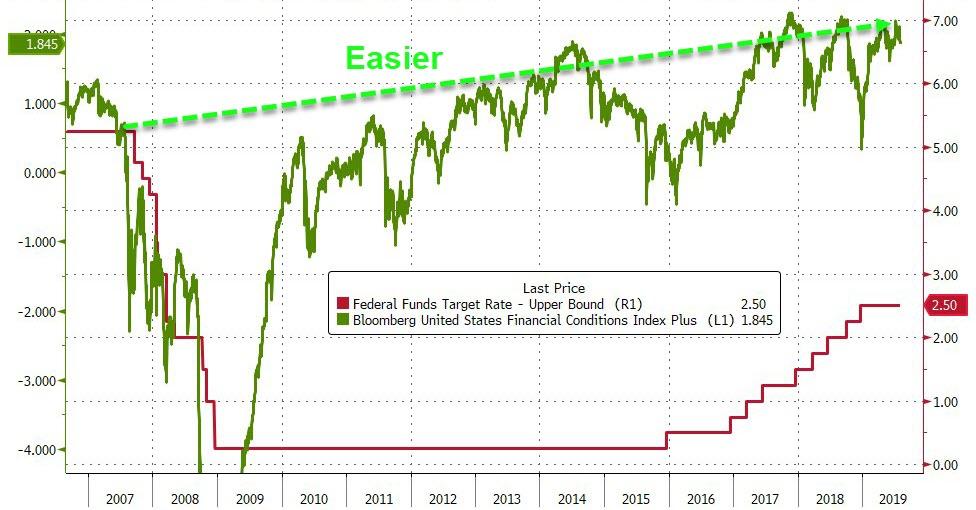

Financial Conditions are even easier now than they were in 2007 when The Fed started to cut rates…

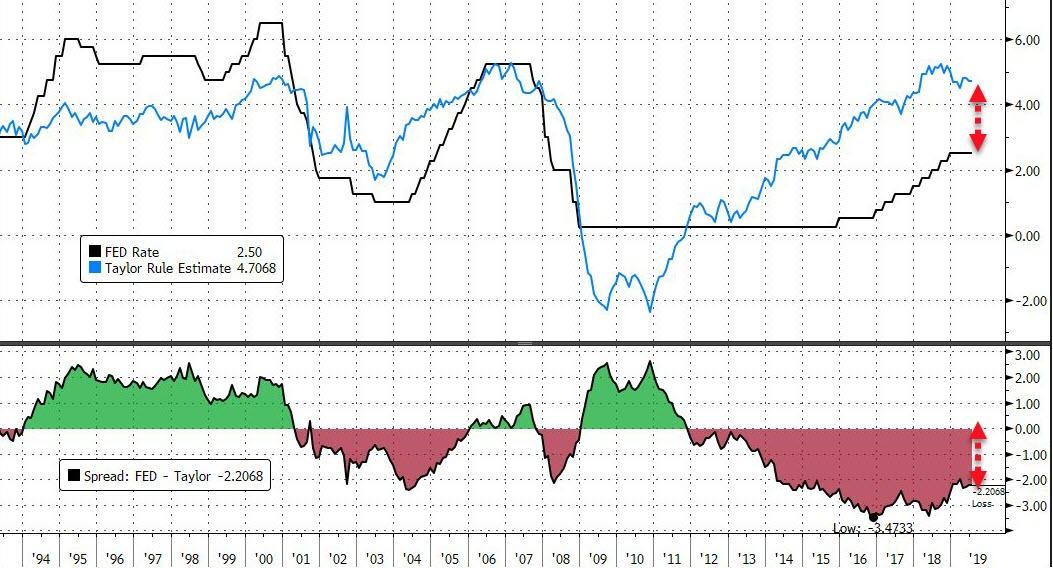

Finally, according to the traditional Taylor Rule model (with Core PCE at 1.6% and Unemployment at 3.7%), The Fed Funds rate should be around 225bps HIGHER…

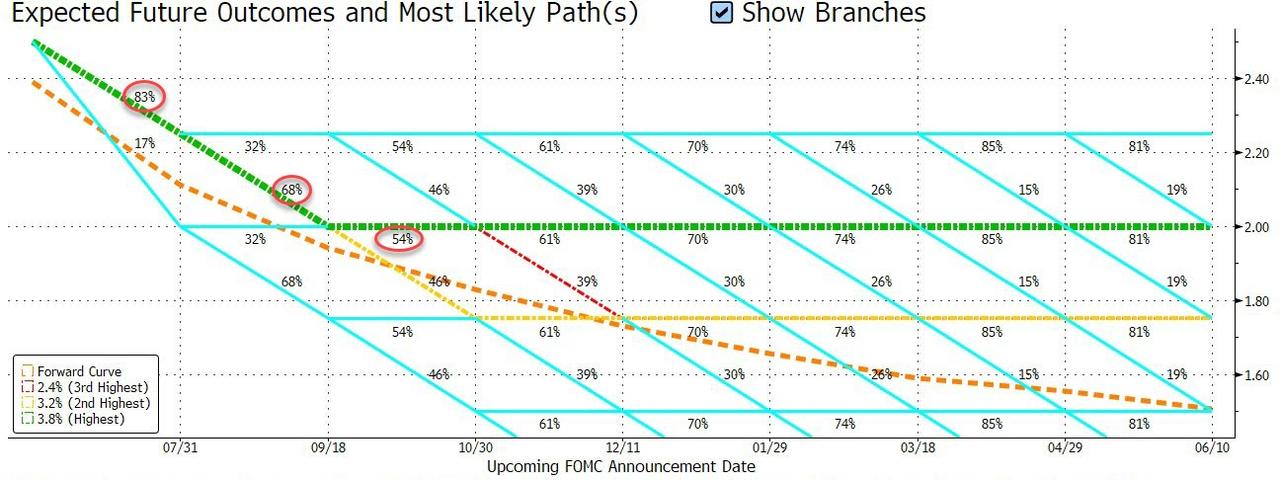

The Fed Funds futures market priced in a 68% chance of another 25bps cut in September… and then done (dramatically less dovish than the rates forward market is priced for)…

… in a somewhat stunning moment of clarity for the business channel, CNBC’s Steve Liesman just ever-so-quietly dropped a hint as to the real reason why The Fed is so keen to cut-cut-cut…

In a brief 45 seconds, Liesman drops the “existential” threat argument for why Powell will do whatever it takes to stay in Trump’s good graces…

“If The Fed gets this wrong, I think that they think if they make a mistake here, The Fed could be gone…”

Liesman expands on his ominous view:

“Think about what happens when a person gets up at a rally and starts railing against The Federal Reserve, and starts to create what could lead to Congressional pressure on The Fed, then you could imagine that their could be support for a different system.”

“I think they think there’s a lot of political downside risk to getting this wrong.”

* * *

Full redline below:

The punchline here? Whereas the Fed seemed to almost praise the US economy, it had no choice but to blame the global economy for the rate cut:

“In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 2 to 2-1/4 percent”

Said otherwise, it’s the world’s fault. And even more otherwise, any time there is economic instability in the world from now on, buy US stocks.

* * *

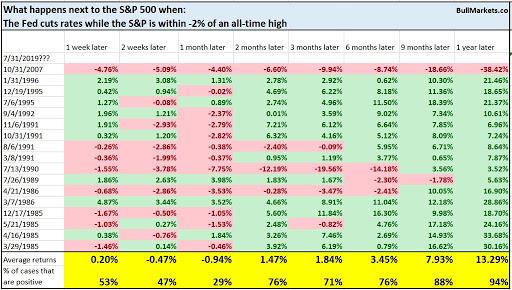

So what happens next?