Fra Zerohedge:

It’s been an ugly night for global economic surveys. September manufacturing PMIs from South Korea, Indonesia, South Africa, Italy, and the UK all printed below 50.0, confirming ongoing global weakness, and Sweden was a disaster.

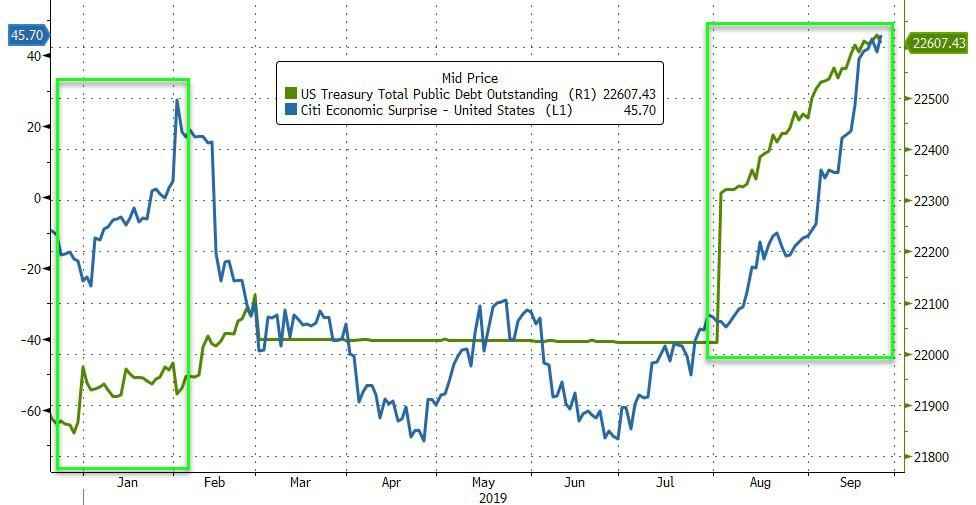

Only Canada and Brazil managed upside surprises as all eyes are firmly focused on US manufacturing surveys – hoping they will track the massive surge in US economic surprise data.

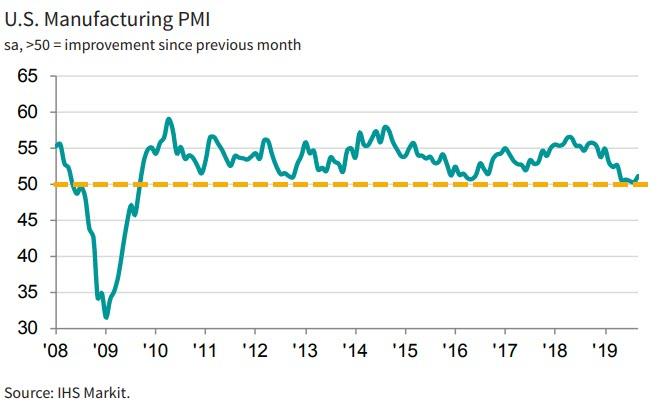

- Markit Manufacturing PMI 51.1 (51.0 exp), up from 50.3 in August

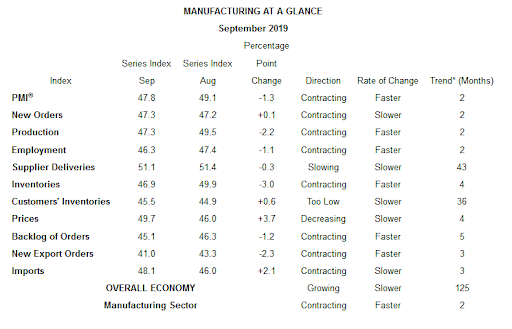

- ISM Manufacturing 47.8 (50.0 exp), down from 49.1 in August

This is the weakest ISM since June 2009, with New Orders weakest since March 2009.

Source: Bloomberg

This is the second straight reading below 50, the line separating expansion and contraction, extending the drop from a 14-year high just over a year earlier.

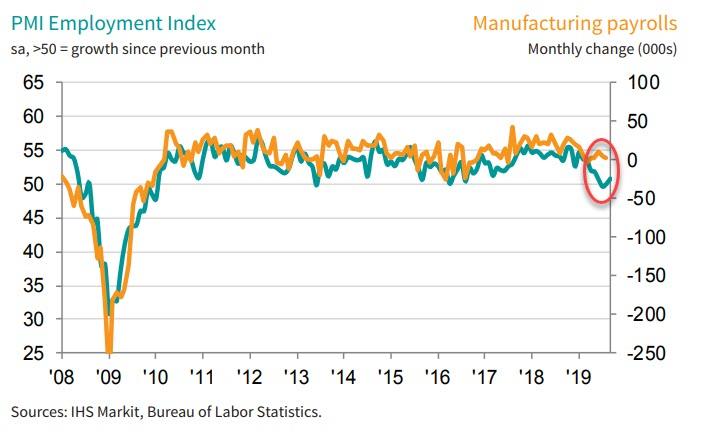

The pullback in the employment gauge, to 46.3 from 47.4, comes amid economist projections that the main monthly Labor Department report Friday will show limited manufacturing payroll growth. Economists forecast a 3,000gain in factory employment for a second month.

The measure of export orders, a proxy for overseas demand, fell to 41, the lowest level since March 2009, while the imports index remained in contraction.

“Global trade remains the most significant issue, as demonstrated by the contraction in new export orders that began in July 2019. Overall, sentiment this month remains cautious regarding near-term growth,” says ISM’s Timothy Fiore.

Of the 18 manufacturing industries, three reported growth in September:

- Miscellaneous Manufacturing;

- Food, Beverage & Tobacco Products;

- and Chemical Products.

The 15 industries reporting contraction in September — in the following order — are:

- Apparel, Leather & Allied Products;

- Printing & Related Support Activities;

- Wood Products;

- Electrical Equipment, Appliances & Components;

- Textile Mills;

- Paper Products;

- Fabricated Metal Products;

- Plastics & Rubber Products;

- Petroleum & Coal Products;

- Primary Metals;

- Transportation Equipment;

- Nonmetallic Mineral Products;

- Machinery;

- Furniture & Related Products;

- and Computer & Electronic Products.

Chris Williamson, Chief Business Economist at IHS Markit said:

“News of the PMI hitting a five-month high brings a sigh of relief, but manufacturing is not out of the woods yet. The September improvement fails to prevent US goods producers from having endured their worst quarter for a decade. Given these PMI numbers, the manufacturing recession appears to have extended into its third quarter.

“The current situation contrasts markedly with earlier in the year, when companies were struggling to keep up with demand. Now, spare capacity appears to be developing, which is causing firms to curb their hiring compared to earlier in 2019 and become more cautious about costs and spending.“

As good as it gets?

However, as we detailed here, this is the reason for the rebound in US Macro – and why its all over now. Given the rapid surge in borrowing recently, 2019’s seasonality is even more dramatic on the spending side (and thus the unprecedented spike in economic surprises)

Source: Bloomberg

All of which begs the question: is the only reason why the economy tends to pick up momentum dramatically as the summer ends just a function of a surge in government spending permeating the broader economy as agencies scramble to spend all the money they have before the end of the September 30 Fiscal Year End (just so they get allocated the same or greater budget in the coming fiscal year), which subsequently plunges or is outright halted as the case may be right now?

As Williamson notes:

“It’s also far from clear that the trend will improve in the fourth quarter. Inflows of new work remain worryingly subdued, to the extent that current production growth is having to be supported by firms increasingly eating into order book backlogs. Business sentiment about the year ahead is also stuck at gloomy levels.“

Hardly sounding an optimistic tone about this bounce going anywhere.