Fra Zerohedge:

Two months ago we concluded our analysis of the July Jolts by reminding readers that “JOLTS is 2 months delayed, so we wouldn’t be surprised if the next few months JOLTs is where the real ugliness lies.” That’s precisely what happened.

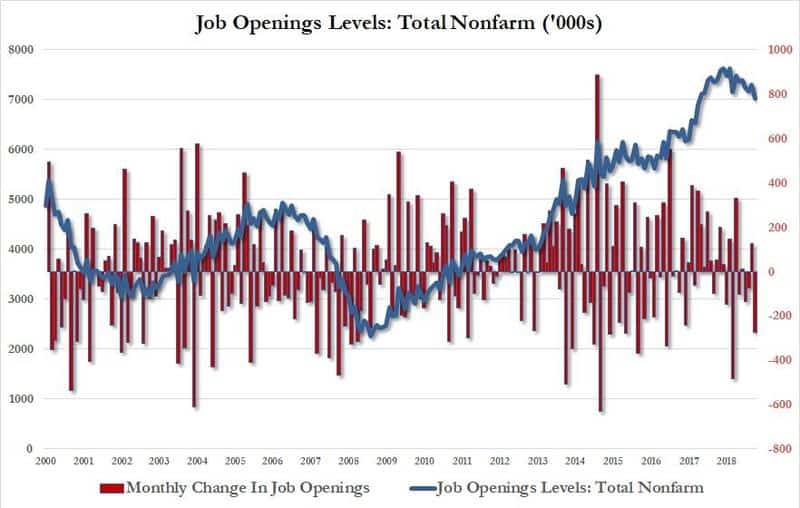

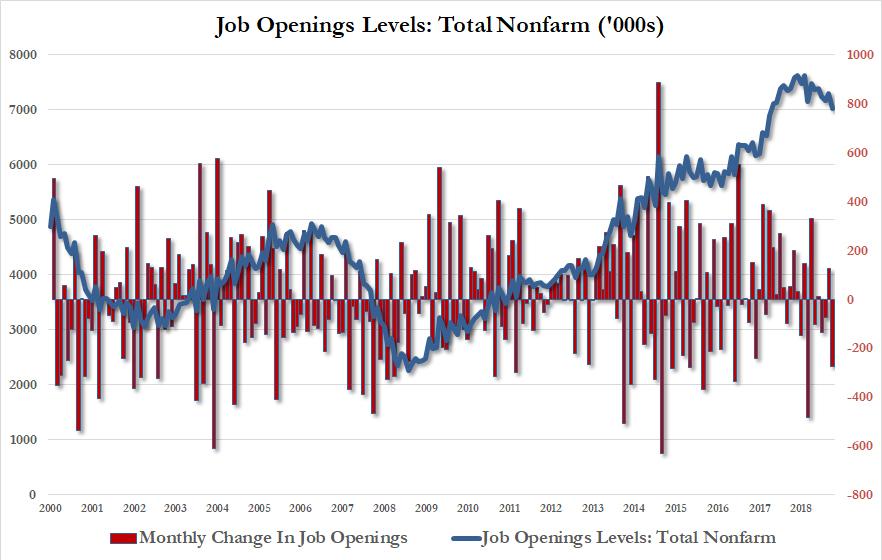

Just in case the last few declining payrolls reports weren’t sufficient to indicate that the US labor market is cooling rapidly, the latest JOLTS released today by the BLS confirmed that US workers are going through a decidedly rough patch, as the total number of job openings tumbled, and after last month’s 7.051 million total was revised sharply higher to 7.301 million, it tumbled again, sliding by 277K to 7.024 million, below the 7.063 million expected, and the lowest number in 17 months, since March 2018.

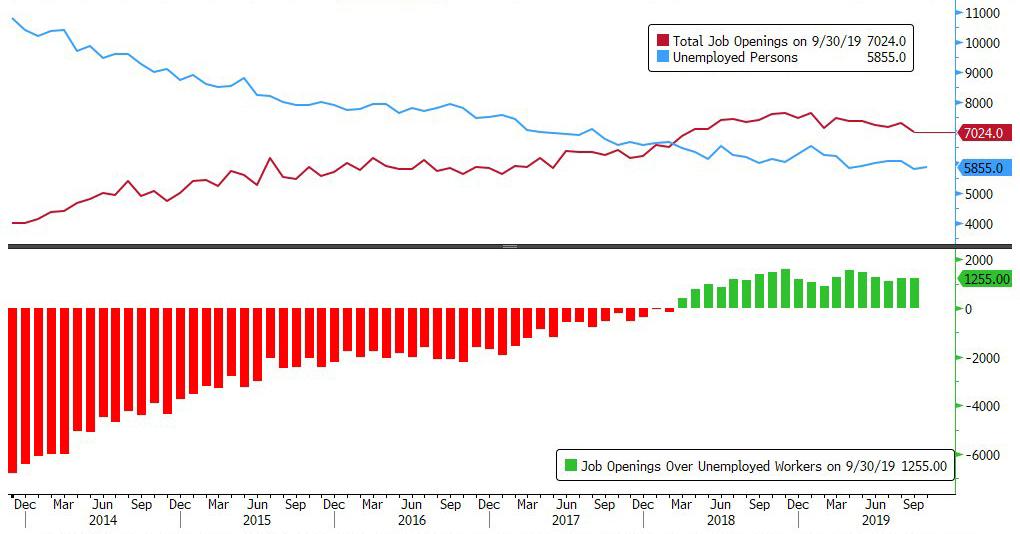

Yet even with the slowdown in job openings, there was still more than 1 million more job opening than unemployed workers; in fact there have now been more US job openings than unemployed workers for a record 19 consecutive months.

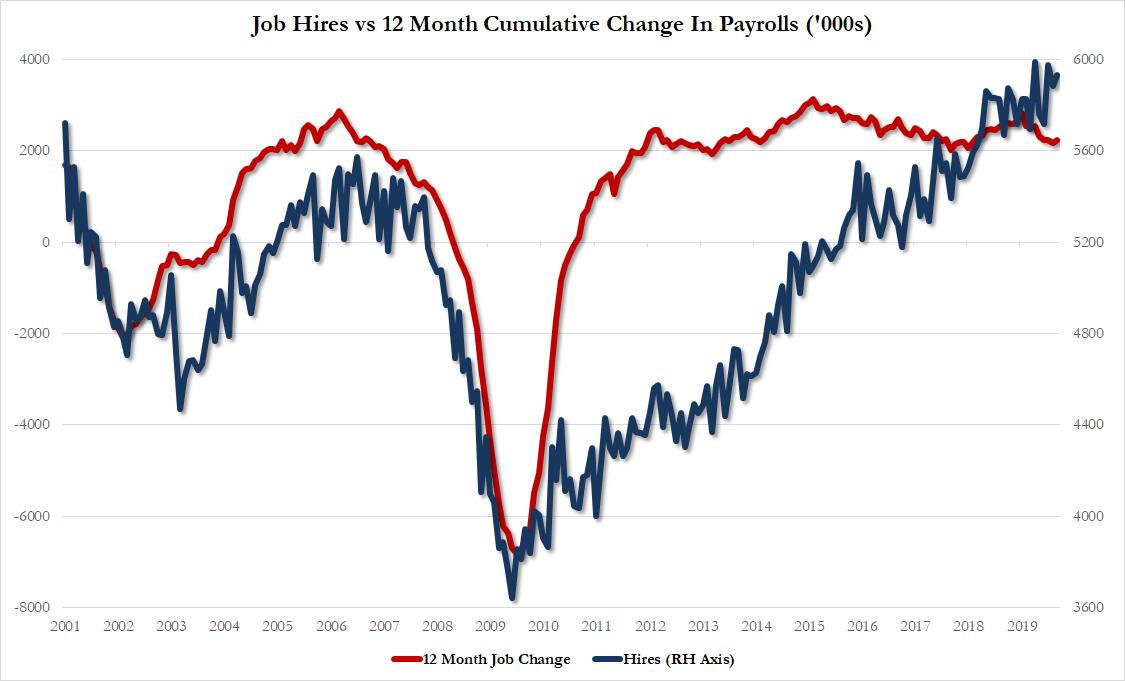

Unlike last month, though, when there was a modest decline in the rate of hires, in September the number of hires rebounded by 50K to 5.934 million, which still was modestly above where the payrolls implied number suggests:

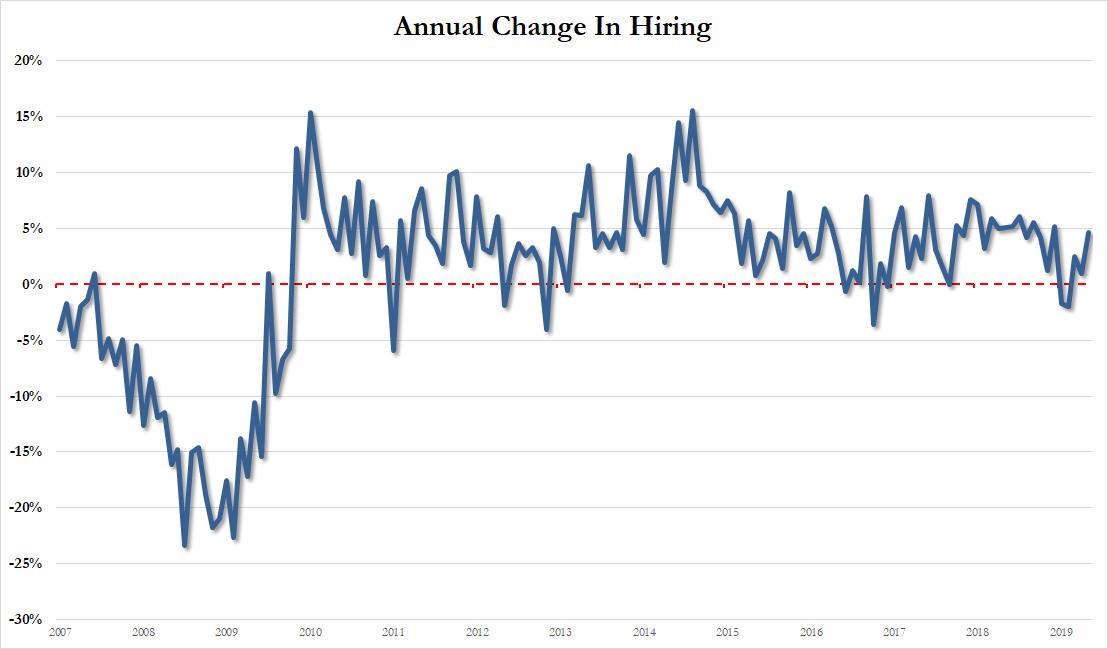

The rebound in hiring, and the upward prior revision, meant that from an annual contraction, hiring once again levitated into expansion, rising by 4.7% in September, up from from a revised +1.0% increase in August.

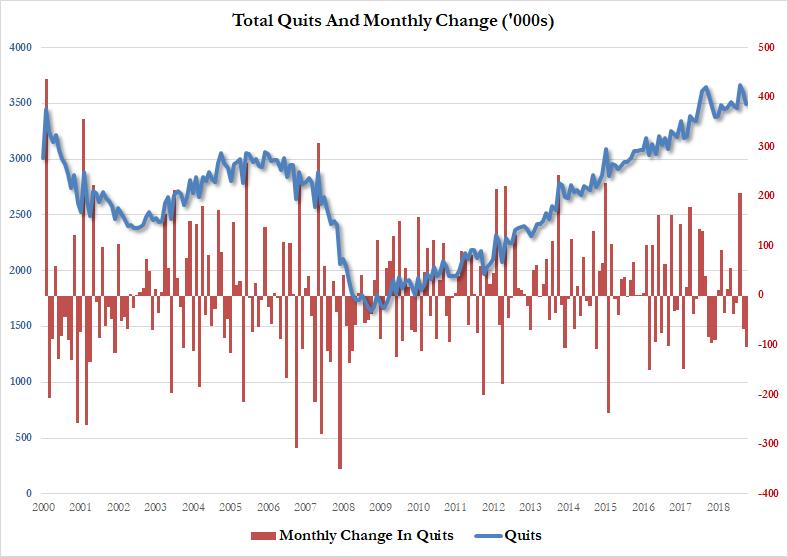

Finally, in the latest indication of the slowing labor market, we saw the so-called “take this job and shove it” indicator – the total level of “quits” which shows worker confidence that they can leave their current job and find a better paying job elsewhere – drop for the second month in a row, and in September the number of quits slid by 103K to 3.498MM from 3.601MM, the biggest monthly drop since January 2018.