Fra Zerohedge/ Socgen:

SocGen believes that we are facing two possible scenarios in 2020:

- 1) a mild recession in 2020, which is the bank’s central scenario, with two quarters of negative GDP growth in 2Q and 3Q, at a respective -0.7% and -0.8%, with full-year GDP growth at +0.7%; or

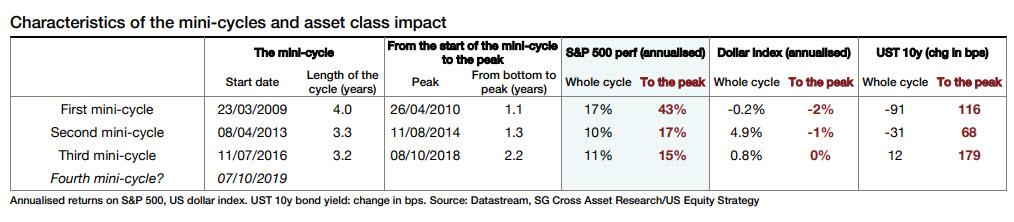

- 2) the start of a fourth mini-cycle. The bank considers here the latter scenario and its potential impact on the S&P 500. Given the characteristics of the previous three mini-cycles – the French bank determines the exact dates by looking at the US Leading Economic Index and the UST 10y bond yield – and finds they last 3.5 years on average. In other words, should there be a fourth mini-cycle thanks to the massive central bank liquidity injection in 2019, the current economic cycle would be extended to 2023-24.

More importantly, SocGen focuses on the period between the start of the mini-cycle and the peak – reached previously in April 2010, August 2014 and October 2018 – which usually last 1.0-1.5 years. The bank then notes that the third mini-cycle was very likely spurred by President Trump’s late-cycle fiscal boost, and highlights the following impacts on US assets from these mini-cycles: higher equity markets, a weaker dollar, and higher Treasury yields.

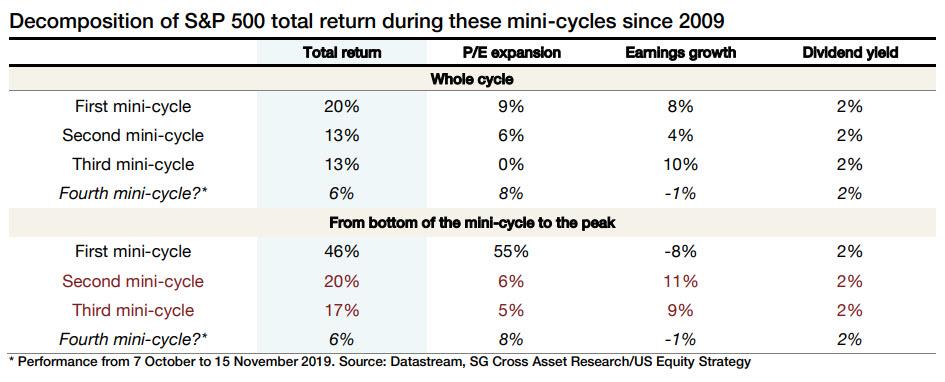

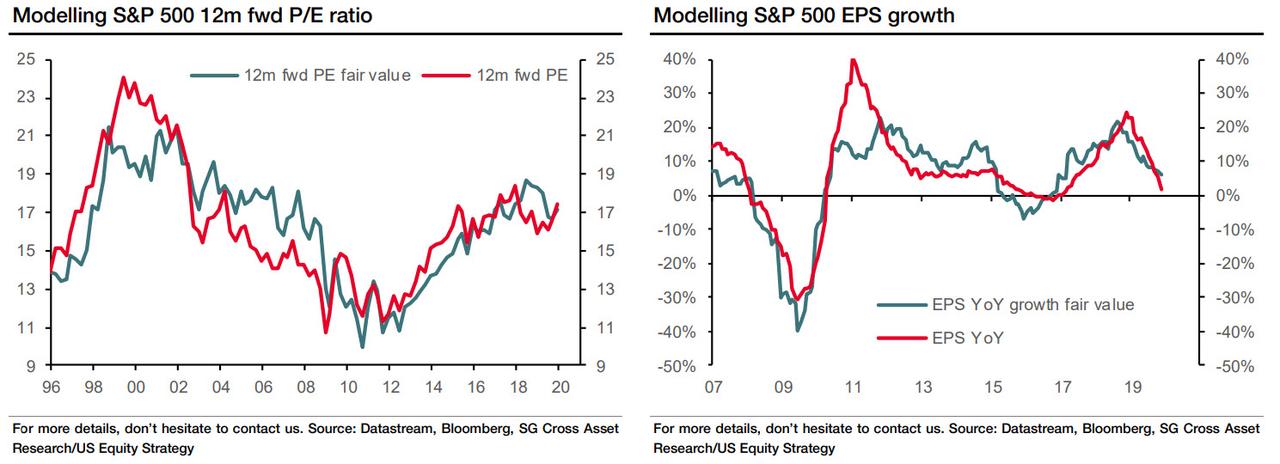

Next, SocGen focuses on the drivers of the S&P 500’s total return during the second and third minicycles since 2009, paying attention to the period from the bottom to the peak. P/E expansion was not exuberant, in tandem with strong earnings growth. Looking at the recent market moves, the S&P 500 is already up 6% since 7 October 2019, the start date of the fourth mini-cycle based on the US Leading Economic Index, thanks entirely to the abovementioned P/E expansion.

It would also put the recent S&P meltup in its proper context, because from a price perspective, SocGen believes that “the lessons of previous mini-cycles could support a melt-up in the S&P 500 to 3,400.” However, for that to be sustainable, the French bank believes there will be a need for earnings to grow next year, as the divergence between fundamentals (E) on the one hand, and market anticipations and low interest rates (P/E) on the other, cannot be that wide. For now, that appears unlikely.

Still, even though SocGen expects that early 2020 will see another economic recession, it concedes that another mini-cycle “is not outside the realm of possibility,” as US consumer confidence and retail sales remain healthy for now, and given the possibility that a trade deal between US and China could put a floor under the current “manufacturing recession.”

Unless of course, China decides to open a trapdoor in the floor should it decide that it no longer wants to deal with President Trump, and crushes hope of a trade deal in 2020, in which case the likelihood of a full-blown recession soars.

But even then the story does not end, because in a worst case scenario, one has to consider that the Fed still can cut rates another 6 times before its hits 0%. What then? Well, the central bank will likely be compelled to first buy even more assets, potentially including ETFS and single stocks, while it will likely also cut rates to negative.

The bottom line is simple: as Saxo Bank earlier noted, “so much liquidity has been injected in the stock market over the past years, it is now almost impossible to withdraw it.” It also means that the Fed can no longer afford even a modest drop in the market (as we saw in Q4 2018) because as Saxo Said, “as it would lead to contagion effect to the real economy” and would cultminate with a full-blown economic depression, one with catastrophic consequences for the status quo, and the Fed itself.

It’s also why virtually every bank, analyst and strategist now has no choice but to be bullish for 2020 and onward: central banks are henceforth perpetually trapped into injecting liquidity at even the slightest sign of trouble, as the alternative – after 10 years of constantly bailing out the market – is unthinkable. The alternative? A recession, or a bear market, would likely be the trigger event that ends the fiat system as we know it, one intermediated by central banks.

Which is why BTFD – if you can find one – and pray that central banks keep it all under control without i) sparking hyperinflation or ii) resulting in too much social conflict and unrest over the wealth inequality they create, as such an outcome would promptly result in a substantial amount of guillotines appearing on town squares, and even more promptly ending any hopes for a fourth, or any for that matter, mini bull cycle.