Fra Zerohedge:

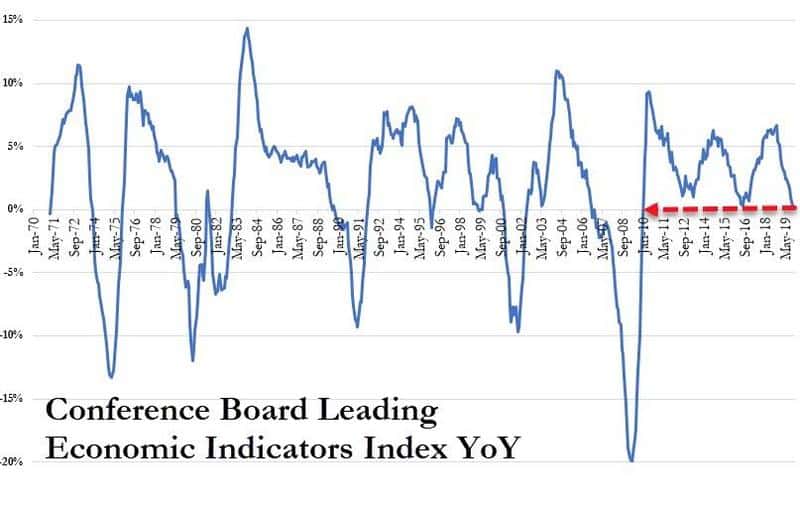

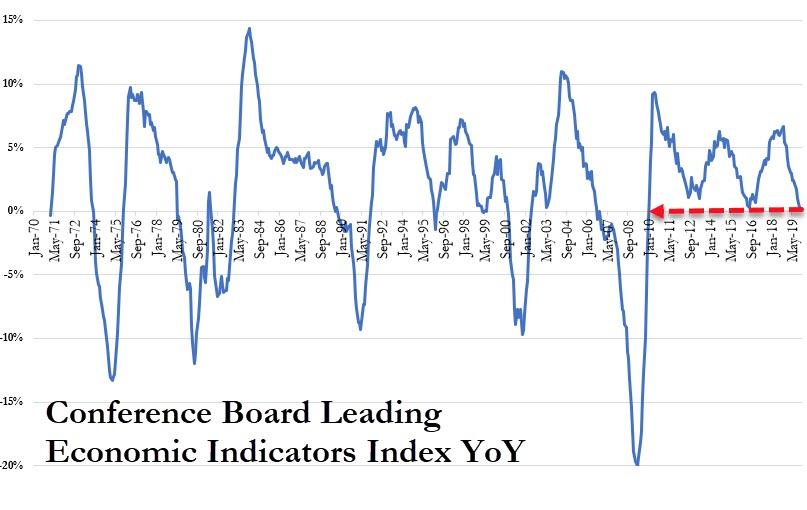

A worse-than-expected 0.3% MoM drop in the Conference Board leading economic index, ending the year with 5 down months in the last six.

- The biggest positive contributor to the leading index was stock prices at 0.09

- The biggest negative contributor was jobless claims at -0.23

The LEI is clearly not recovering…

And on a year-over-year basis, the LEI is up just 0.1% – its weakest YoY move since Nov 2009…

“Probably nothing”

Fra Conference Board:

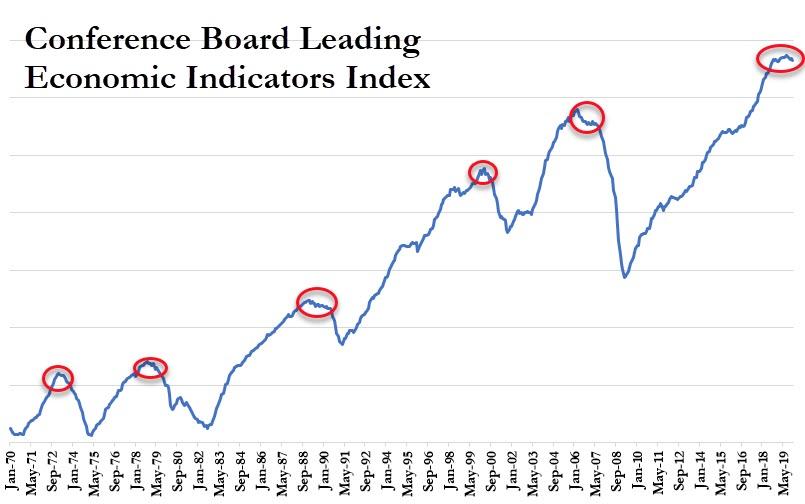

The Conference Board Leading Economic Index® (LEI)for theU.S. declined 0.3 percent in December to 111.2 (2016 = 100), following a 0.1 percent increase in November, and a 0.2 percent decline in October.

“The US LEI declined slightly in December, driven by large negative contributions from rising unemployment insurance claims and a drop in housing permits,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. “The LEI has now declined in four out of the last five months. Its six-month growth rate turned slightly more negative in the final quarter of 2019, with the manufacturing indicators pointing to continued weakness in the sector. However, financial conditions and consumers’ outlook for the economy remain positive, which should support growth of about 2 percent through early 2020.”

The Conference Board Coincident Economic Index® (CEI) for the U.S. increased 0.1 percent in December to 107.2 (2016 = 100), following a 0.3 percent increase in November, and a 0.1 percent decline in October.

The Conference Board Lagging Economic Index® (LAG) for the U.S. declined 0.1 percent in December to 108.8 (2016 = 100), following a 0.4 percent increase in November, and a 0.2 percent increase in October.

About The Conference Board Leading Economic Index® (LEI) for the U.S.

The composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of several individual leading, coincident, or lagging indicators. They are constructed to summarize and reveal common turning point patterns in economic data in a clearer and more convincing manner than any individual component – primarily because they smooth out some of the volatility of individual components.