Fra Zerohedge/ JPM

After JPMorgan clocked in its most profitable year in history in 2019 largely on the back of the Fed’s QE4 which – as we remind readers again – was triggered by JPMorgan itself, which sparked a repo market crisis after yanking money market and repo liquidity forcing the Fed to first launch repos and then T-Bill purchases, the bank is not only convinced that the good times will continue to roll after the most powerful market meltup in history in the past 4 months, but that the current melt down on the back of fears over a global viral pandemic, is overdone and will end soon, presenting its clients with another delightful opportunity to BTFD.

As JPM’s equity strategist Misla Matejka writes in his weekly Equity Strategy notes, “at the global equity level, we remain constructive” and while the JPM analyst acknowledges that “the latest health scare is likely to worsen before getting better, which could lead to more significant near term derisking” he notes that “past outbreaks have tended to drive only limited market falls.”

In summary, Matejka is so confident that the virus sell-off over the coronavirus pandemic, whose full proportions and damage remain largely unknown, says that “health scares, similar to the localised war campaigns, as well as the terrorist incidents, were historically buying opportunities, rather than the reasons for sustained selling.”

To “validate” its optimism, JPMorgan looks at the last two decades, and finds four pandemics which posed a global health risk, noting that “each of these caused a significant number of deaths and impacted economic activity in the affected region.” Matjeka specifically focuses on the 2003 SARS outbreak and confidently concludes that this time will not be different, and in fact will be much better due to “the much faster the pace of response from Chinese authorities.”

The current outbreak in China is reminiscent of the SARS (Severe Acute Respiratory Syndrome) pandemic which started in late 2002 and ended up infecting over 8000 people with 774 recorded fatalities.

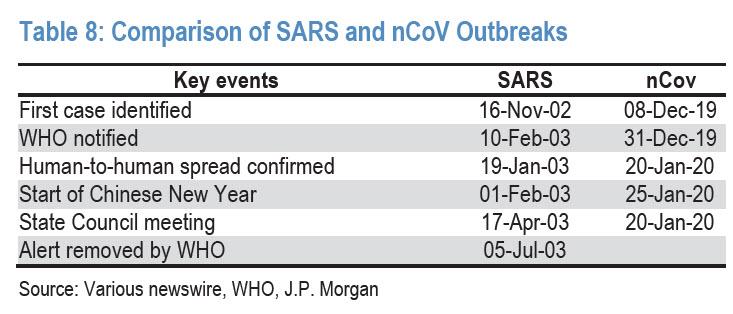

In the case of SARS, the first case was detected in November 2002, WHO was notified on the 10th of February 2003, and the state council stepped up efforts in April, 2003. This time around, WHO was appraised of the situation much faster, and on 20th January President Xi ordered all-out efforts for prevention and control of the coronavirus.

That said, even JPM admits that “on the other hand, an average incubation period of seven days makes it difficult to contain the spreading. We note that some of the reported cases of the current coronavirus outbreak didn’t display any fever, further complicating the efforts to control the outbreak.”

Going back to the implications of SARS on the economy, JPM’s Chinese economists note that the tourism sector was hit particularly hard. Inbound tourism dropped 27% from 1Q to 2Q of 2003 and there was a significant drop in domestic tourism revenue. There was also a sharp drop in retail sales, in highway transportation, and the air fright decelerated notably. In contrast, sectors such as exports, IP, construction activity and fixed asset investment were largely unaffected by this pandemic.

Overall though, Matejka notes that “while a number of economic activity indicators showed a significant swing down, and then up during the 1H ’13, the growth the growth delivery for the whole year has not materially changed.”

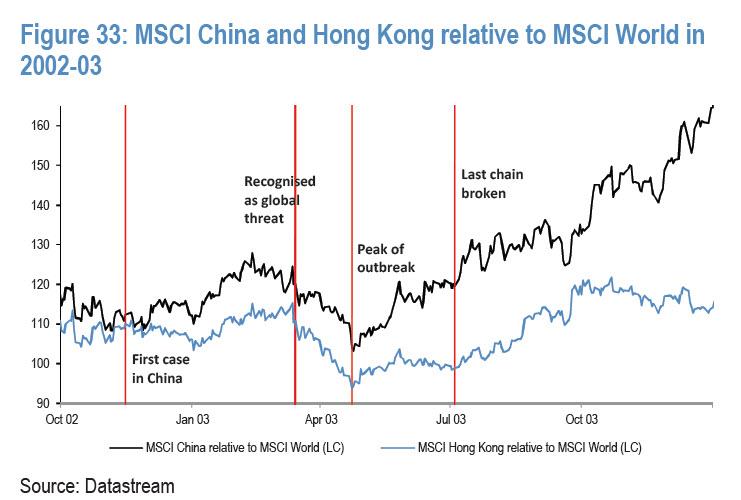

The impact on equity markets was significant, as Hong Kong equities lost almost a fifth of their market capitalization over the course of a few months during this epidemic. Chinese markets also severely underperformed during this period, down 15% relative.

As the uncertainty eased in late April – early May 2003, these markets started to recover. MSCI China and Hong Kong in particular reversed all of their losses over the following few months, and went on to make further significant gains.

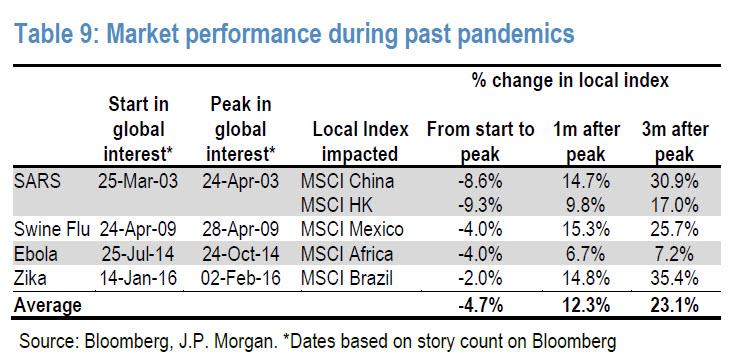

Why is JPM so optimistic? Simply said, because if prior cases had a happy ending, no pun intended, then JPM sees no reason why this time should be different, and “the more equities fell initially, the more they subsequently rebounded. These episodes did not lead to a prolonged period of selling, and were the buying opportunity within weeks.”

And that’s how a global viral pandemic became just another reason to buy the dip.