Deutsche Bank mener, vi står over for en eksplosion af crypto-valutaer. De vokser næsten lige så dramatisk som brugen af internettet. I 2030 kan der være 200 millioner cryptocurrency-konti. Kina og internetselskaberne – og ikke bankerne – bestemmer udviklingen.

Uddrag fra Deutsche Bank:

Cryptocurrencies have been around for about a decade, but it was not until 2017, when bitcoin’s price surged to nearly $20,000, that they grabbed significant global attention. If we connect the dots between the dematerialisation of payments and the rise of cryptocurrencies, we can envision a near future in which cryptocurrencies gain broad acceptance. This view is supported by trends among young generations who readily accept digital currencies and payments.

Overall, though, relatively few people have bought and sold cryptocurrencies. They are largely seen as a supplementary means of financial transactions.

Today’s adoption rates could, and likely will, change. If the Chinese government, along with Google, Amazon, Facebook, or Apple (the so-called GAFA group), or a Chinese company like Tencent can overcome some of the barriers to cryptocurrencies (discussed later), then cryptocurrencies could become more appealing. This will hasten their adoption and give them the potential to replace cash.

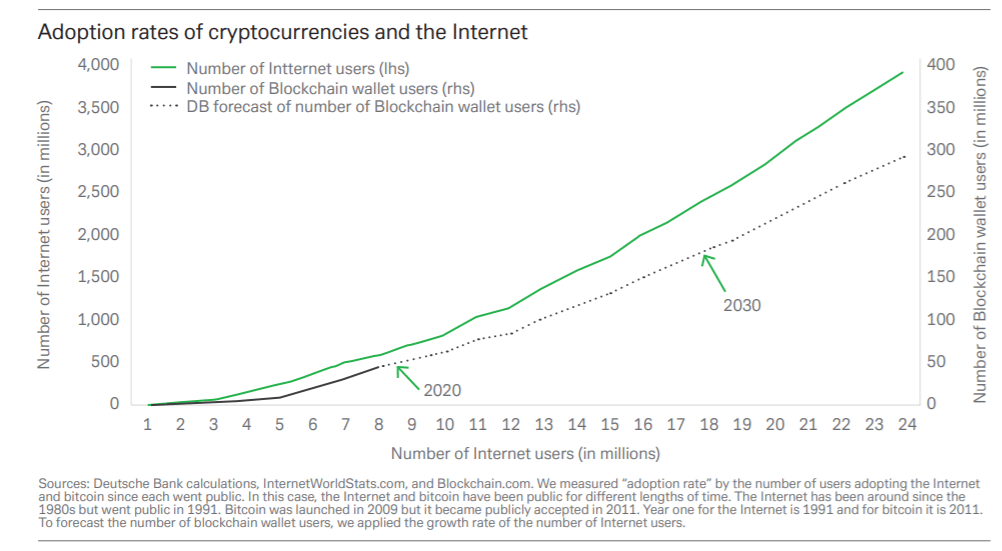

The chart below shows the adoption rate of blockchain wallets as compared to the adoption rate of the Internet. At least for now, the curves are similar after adjusting for scale. If current trends continue, there could be two hundred billion blockchain wallet users by 2030.