Mens corona-virussen har en afsmittende virkning – i Europa især på Tyskland på grund af et fald i eksporten – så kommer der atter fremgang i europæisk økonomi, når epidemien er overstået, mener Saxo Bank. Tyskland kommer langsomt “ud af skoven.”

Uddrag fra Saxo Bank:

In the rest of the world, the early 2020 rebound, which has been fueled by higher credit inflow in China and lower geopolitical risk, could be overshadowed by the final economic cost of the coronavirus. In our view, the negative economic impact should be short-lived and will constitute an opportunity for further fiscal and monetary stimulus.

While we firmly believe that the ECB will remain on hold throughout most of the year, we think that the international outlook could push the Fed to open the door to a rate cut in March.

In the Eurozone, we expect that the coronavirus will have a deeper impact on Germany than on any other countries. Export growth to China, which was back for the first time in 2019 in positive territory in December at 2% YoY, is doomed to slow down again in Q1 this year. However, the overall picture is still improving and fundamentals of the economy remain solid. Export growth to Turkey and the United Kingdom, two key trade partners, is up on a yearly basis and the service sector, which contributes to 70% of the total GDP, is rebounding. January Flash Service PMI was out at a 5-month high of 51.1 vs prior 50.2. Consumption along with public investment should also keep stimulating the economy this year. Slowly but surely the German economy is getting out of the woods.

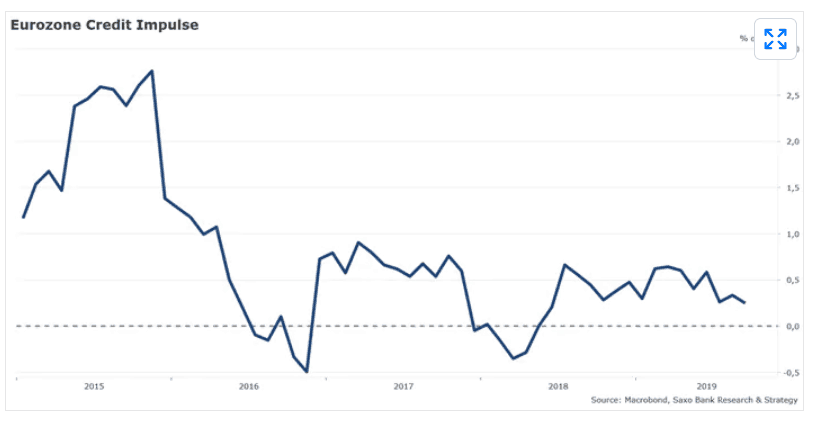

The same positive view applies to the eurozone outlook for 2020. We have recently updated our leading indicator for the euro area, credit impulse, which tracks the flow of new credit from the private sector as percentage of GDP. Credit impulse is considered as the second derivative of credit growth. Our indicator is standing at 0.2% of GDP on a quarterly basis. It means that the inflow of new credit, thought at low level, is still flooding into the economy.

Monetary conditions are also slowly improving. Once the external shock related to the coronavirus will be behind us, we expect a steady and uneventful improvement in GDP growth for the rest of the year.