Guldet står ved en korsvej. Falder det igen, eller bevæger det sig op på niveauet efter finanskrisen? Trods en vis afdæmpning af den politiske og økonomiske usikkerhed i verden, så tror Merrill, at der fortsat kan blive så megen uro, at guldet muligvis bryder gennem den hidtidige modstandskraft. Guldet er en “safe haven.”

Uddrag fra Merrill:

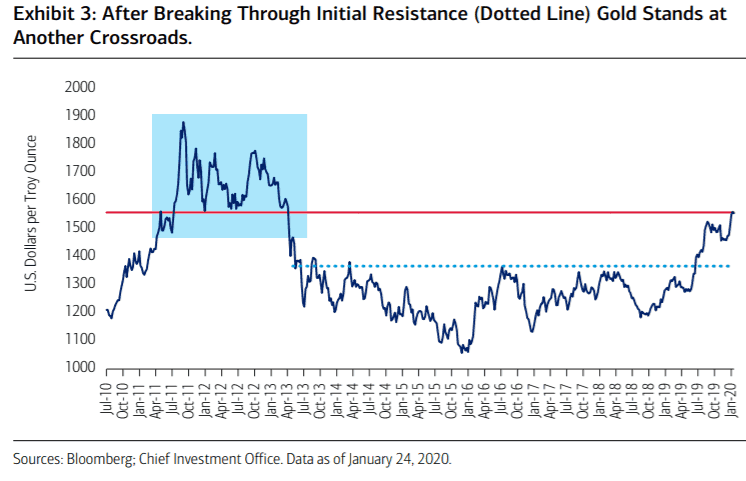

Over the past three weeks, gold’s price has straddled $1,560 per troy ounce, a notable

technical battle zone. Marking a crossroads, this price area acted as resistance in May

2011, before the metal’s final surge to its all-time high at around $1,900. It then acted

as support until April 2013, when its violation triggered a fall of more than 30% (see

shaded box in Exhibit 3).

Today, the yellow metal’s struggle to clear this price band to the upside coincides with

a bullish trifecta of developments. A U.S.-China “Phase I” trade deal has been signed.

Decisive progress for the U.S.-Mexico-Canada trade accord has been made. The election

of Prime Minister Boris Johnson in the United Kingdom has removed the concern of a

near-term hard Brexit. Together these events have helped reduce uncertainty. Meanwhile,

subdued inflation has afforded global central banks the leeway to stimulate. Recent new

all-time highs in the MSCI All Country World Index indicate expectations for green shoots

for global economic growth to germinate, in line with the Chief Investment Office’s

(CIO’s) base case.

These stats underscore our view of the

precious metal as a portfolio diversifier, a quality we favor, particularly in light of

impressive performance in both equity and fixed income returns last year. Despite

greater optimism and stretched valuations in certain equity markets, we remain

cognizant of the risks that may upset the apple cart. Growing discords over Huawei,

Taiwan, the South China Sea, Hong Kong and North Korea may wobble the U.S.-China

trade truce. Tensions in the Middle East remain elevated. In the U.S., we expect electionrelated uncertainty to pick up, while a trade spat with the European Union (EU) can’t be

ruled out. Even wildcards, such as a prolonged bout of the recent Coronavirus in China,

could trigger a return of uncertainty, dampening animal spirits, weighing on the global

recovery, and benefitting relative safe havens such as gold.

Notwithstanding extraordinary policy support in an adverse scenario, central banks are

still contending with low inflation. Reviews of existing policy frameworks at the Fed and

the European Central Bank may augur more unconventional measures to spur it. In the

U.S., consider this alongside large U.S. fiscal and trade deficits. Gold may prove its worth

as a store of value in this case.