Nationalbanken i Schweiz kæmper en hård valutakamp, som den ifølge Saxo Bank meget let kan tabe, hvis ikke corona-krisen snart løses. CHF har mistet 6 pct. i værdi over for euroen det seneste år.

Uddrag fra Saxo Bank:

Summary: The Swiss National Bank (SNB) is engaged in battle it seems less and less likely to win.

The Swiss National Bank (SNB) is engaged in battle it seems less and less likely to win. Since the beginning of the year, the CHF has lost almost 1.8% versus the EUR and more than 6% over a year. This past Monday, the CHF reached its highest level since July 2015 against the euro as Cov-19 fears spread in financial markets and risk aversion skyrocketed. Judging by hedge funds positioning, the CHF is considered good as gold for many investors in order to curtail the risk linked to coronavirus.

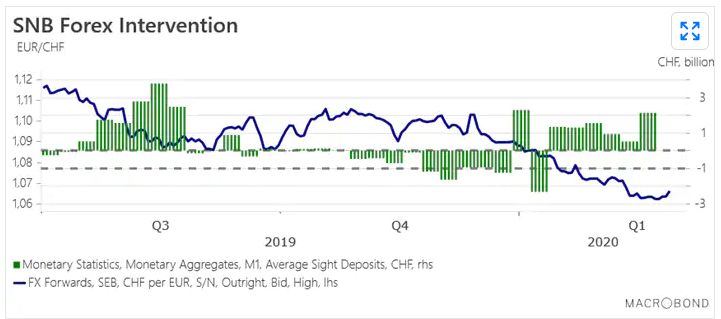

While the SNB has intensified its forex interventions in the market since mid-January, with total sight deposits reaching CHF592.3bn from CHF590.1bn last week, it is getting more and more obvious that it has only been able to limit the appreciation of the CHF and not to stop it. Contrary to what has happened in summer 2019, the situation facing the SNB is much more complicated. Fears are not related to trade war and limited damages to the economy, as it was the case, but to uncertainty resulting from an exogenous factor with global economic implications. What is even more worrying for investors is that, at this stage, no one is able to price to economic and financial cost related to the coronavirus outbreak.

Considering uncertainty will prevail at least for a few more weeks, it is likely that the Swiss franc will continue to rise, pushing the SNB to come more significantly into the market. We believe that the central bank will do all its best to defend the psychological threshold at 1.05 on the EURCHF cross, but a breakdown, that would open the door to further decline, is perfectly conceivable if the coronavirus is not handled fast.