Saxo Bank opstiller et par scenarier for den kommende udvikling – at bunden er nået, og at det kan blive endnu værre – som i 1929.

Uddrag fra Saxo Bank:

Summary: We have reached the part of the crisis cycle in which, despite incoming news going from bad to worse we need to look at value, the next policy steps and how the market will find its low. This is extremely dangerous as we are programmed for fight or flight, not to calculate risk versus reward in a pressure cooker.

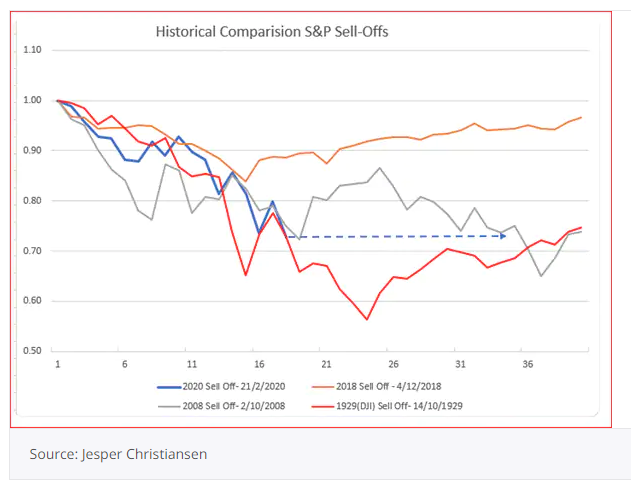

First, let’s start with where we are relative to the other great bear markets of the past:

Comment:

Blue line – present market (2020)

Red line – “worst case” – initial phase of 1929 (Another 15% to follow that path)

Grey line – “medium bad” – the steep fall in late 2008 and into 2009

Macro Conditions:

- A high degree of illiquidity in markets (wide spreads / discontinuous pricing )

- Substantial discount in “financial assets” to tangible assets – Gold physical vs. paper Gold paper is trading at elevated spreads

- A “Dash for cash” where investors are forced by both prices and volatility to reduce exposure to markets, forcing across the board further selling.

- COVID-19 anxiety is now reaching a panic state, which is valid but a bit late both for governments and population

- No one is short the market, few have enough will or cash to buy the market

Scenario 1: Optimism – Why the worst may be over (The low is either in or arrives within another 5% from here)

- Global central banks have gone all in. The US Fed has cut by 150 bps in less than two weeks taking them to zero-bound. Next up is yield curve control (10Y US Yield will not be allowed to trade above 50 bps) – ECB, BOJ, BOE and others all have followed.

- Governments has stepped up commitment to fiscal expansion even spending “shy” Germany has committed whatever it takes to help German companies through their development bank KfW

- The real low in the market classically arrives with a sentiment change, which is a soft value but probably based on markets combined assessment of fair value, discounted future value and not least an attitude change towards “We need to move beyond fear as driver….”

- Sovereign Wealth Funds are not mark-to-market, they could start to add to their massive portfolio when time is due or even better continue to average into positions.

- Significantly weaker dollar. One of the major constraints in terms of liquidity right now is the lack of US dollar funding for non-US entities. A direct weakening of the dollar could mitigate some of that, in the absence of direct dollar selling, further expanding USD swap lines could help.

- Value – Peter Garnry’s model for the MSCI US index is now back to its “average valuation” – This model uses seven valuations metrics as input, but it should be noted that in 2008, the market needed to go to 2.5 standard deviation cheap before it turned.

- Confirmation bias – What is good value? When is the right time? All questions related to trading are based on one’s own bias, but also to the market narrative. The “right strategy” if long cash at this stage would be to deploy the intended capital investment in portions of 25% from this week and over the next four weeks. The first 25% sometime this week, another in one or two weeks…. Averaging avoids trying to time the market.

Scenario 2 – Pessimism: Why this is only the beginning of a much bigger crisis

- Triple Whammy: We have just witnessed a 1-2-3 blow to global demand, global supply and energy, unheard of in my 30 years of market experience. 2020 is guaranteed to be a recession year and we will be into 2021 before anything normalizes

- COVID19 could have a second outbreak similar to the 1918-19 Spanish Flu

- Market is on the brink of being disorderly. We risk seeing a Bank Holiday similar to the Roosevelt Emergency Banking Act of March 1933, in which he closed the market for four days.

- Strong US$ and lack of $ funding “kills” growth, lending and velocity of money. Recession becomes depression.

- Germany was in recession pre-COVID where are they now in “depression light”?

- The Fabric of International Cooperation has broken down. Since Trump took office (and he is just the last President to break it down) Gone in all but practice: WTO, OPEC+, G-7 and G-20. These have all been tools in keeping “order in the financial system” in the past.

- Fear, depression and cash. There is no hiding when the market goes into a tail-spin, fundamentals, value and “assumptions” all die by the sword of illiquidity.

Conclusion

My personal take? Not that it matters, as I have predicted seven of the last three recessions, but the “truth” lies somewhere in between.

- We will handle and deal with COVID19. The government response globally has been appalling and will cost lives, but we will be smarter for it next time and we needed a reminder of our sensitivity to health and health system capacity (which has been proven to be more than inadequate)

- Forget the emotions of the market. Focus on at what price level you want to increase your exposure to stocks, bonds and currency. Close out the noise.

- Have a plan for things to get worse and what to do ahead of time

- Have a plan for things to get better and what to do ahead of time

- Be sensitive to massive extremes in sentiment, both positive and negative

- One interesting thing here is that COVID19 is enabling the business cycle again for the first time since GFC in 2008/09 and that’s the best news in a long time. When this is over there is no hiding. The stronger companies will get stronger, the weaker ones weaker, remember this when you buy “concepts” and “pipedreams” of promises. Buffet has said a lot of nonsense, but his saying: When the tide goes out, you can see who is swimming naked” must be one of the most apt expressions for now and the next six months.

Furthermore for the balance of this week we will focus on “tell signs” for the lows being in and creating “need to follow” baskets of equity, bonds and futures for both hedging and new long plays.

Coming together is a beginning. Keeping together is progress. Working together is success.

― Henry Ford