Dollaren er alt for stærk, og hvis ikke den amerikanske centralbank kan svække den, er der behov for en ny Plaza-aftale, dvs. en international aftale.

Uddrag fra Nordea:

FX weekly: USD needs to weaken or else it is time for a new Plaza accord

The USD is too strong to everyone’s taste, but who can stop it from appreciating? The Fed has done a lot, but has it done enough? So far it doesn’t look like it is adequate, and a new Plaza Accord 2.0 could come in to play, if the USD gains more.

If you want to receive a copy of FX weekly directly in your inbox, you can sign up via this link.

The great pseudo-nationalization of everything is underway; that seems kind of inevitable by now. Whether the public sector succeeds in bailing out everything is another matter. Without any demand, it will prove to be a costly operation. We continue to think that it makes sense to bailout as much as possible given that this is a politically decided recession / close-down. The long-term effects of very broad bailouts though need to be considered as it could become politically tempting to interfere in right about everything in private business. “We gave you the bailout, so now we are also allowed to decide for you”.

We are also very interested in the long-term behavioral effects of the current Corona curfews. Will commercial real estate be emptied now that many corporations have found that at lot of work is done very smoothly from home? Who dares to open the border for tourists first? And will tourism become much more local in 2021-2022 than what we saw in e.g. 2019? Covid-19 will probably change economic agents’ behavior for good or at least for years. We would in general prefer to be long sectors that are well designed to cope with generally more isolationist behavior from the population and more isolationism in policy designs around the globe. And then we should probably get accustomed to more “stateism” across many sectors after the widespread and costly bailout packages.

Who will Fund the USD double deficit if the USD remains this strong?

With the massive issuance upcoming in the US, either the Fed will have to buy almost everything or else the USD needs to weaken to attract foreign purchases of US Treasuries again. Essentially no one wants a strong USD currently, but that doesn’t necessarily mean that it will weaken. A stronger dollar generally tightens financial conditions outside of the US, which is kind of counterintuitive since that weaker currencies outside of US in principle should lead to a competitive advantage. Some mentionable reasons why a strong USD is bad news for growth are that i) EM countries have borrowed in USD, ii) firms who have borrowed in dollars see debt burdens grow in local currency and iii) the financial sector also empirically becomes less keen to lend out when the USD is strong. The last thing the world needs right now is an even stronger USD; in such case we wouldn’t rule out a new Plaza accord like attempt to weaken the USD in a coordinated way. Everyone’s in the same boat now (Global: Once we are out of this mess, the USD could be hammered)

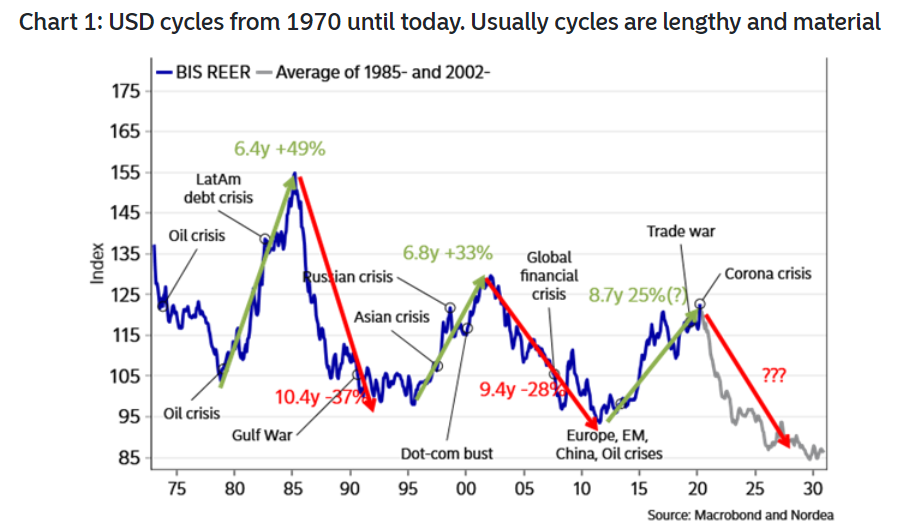

Chart 1: USD cycles from 1970 until today. Usually cycles are lengthy and material

Libor-OIS tightening could make dollar selling even cheaper

Fed rate cuts and tighter basis swaps has translated to a further cheapening of the cost of selling USD and on a 12-month basis it hasn’t been this cheap to buy EURUSD since 2015 (~1.2%). Why is the cost still so high with ZIRP from the Fed? Libor-OIS has exploded wider recently from 0.1% to 1.38%, but the spread has started to fade a little in recent days again. If that continues, which it probably should in the wake of Fed’s crazy money printing, then this would make it even cheaper to sell USD. If the Libor-OIS spread “normalizes” we could get closer to zero cost for selling USD. And who knows whether the Fed could be tempted to join the NIRP club? St Louis Fed suddenly started openly discussing it. The NIRP cat is out of the bag now. The sliding USD hedge costs could be a game-changer for the USD outlook, once we are getting closer to the end of the Corona-curfews.

Chart 2: USD hedge costs are falling off a cliff. Now LIBOR/OIS is the only thing that is “costly..”

The Fed is hence indirectly trying to kill the USD momentum with the Oprahnomics of USD liquidity, but they need global trade to corroborate. Due to low commodity prices and a clear setback in global trade, fewer USDs change hands globally. This is a marked a drop in the velocity of USD liquidity due to less trade, which is one of the reasons why all these liquidity facilities from the Fed were needed.

Once economies re-open around the globe, USD liquidity will start to increase both via global trade and via all the facilities from the Fed (they will be closed with a time-lag). This is ultimately a story that could bring the USD materially lower (10-15% scope in our view), but to really turn USD bearish already now, we would need a pick-up in global trade first, which is still not around the corner due to the lock-downs. Right now, this story is probably optimally traded via a short USD/JPY (or CHF/JPY) position with a target of 103.50 as this position would also perform, should equities sell off again (Week Ahead: A perfect bear market rally may have concluded)

Chart 3: Less global trade, stronger USD

It could be argued that (almost) all major central banks are printing the bottom out of their own currencies currently, why the Fed would need to “out-print” the rest of the pack to really weaken the USD. The total fiscal policy response from the US is likely to be bigger as a percent of % US GDP, than e.g. the comparable response from Spanish, Italian and French authorities, which will allow the Fed to print at a higher pace of GDP than ECB. On the other hand, it could be argued that investors are not convinced that e.g. Italy and Spain will at all be able cope with the economic consequences of prolonged curfew scenarios. At least the EUR didn’t take it well, when Spain prolonged the lock-down until 26th of April. Corona bonds would in our view be a massive EUR/USD buy signal.

We think the USD will be markedly weaker 9-12 months from now, but we aren’t overly convinced of selling USD versus EUR right now as curfews are likely to be tightened rather than eased in major economies in the next few weeks still.