Fra Zerohedge:

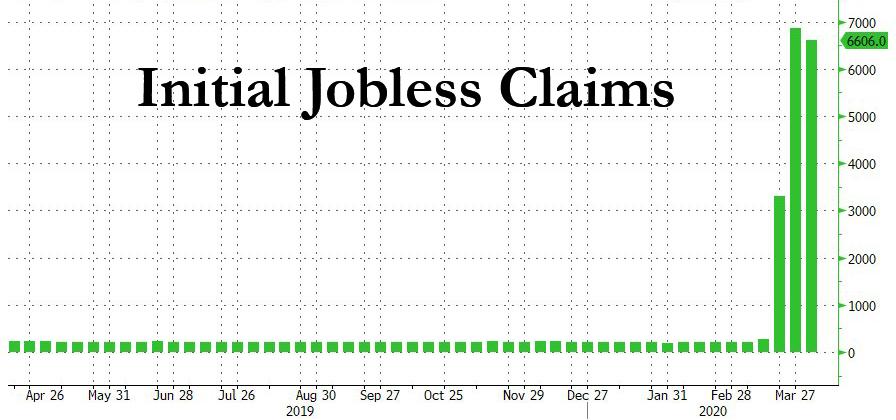

After three consecutive weeks of record breaking initial jobless claims, which cumulatively add up to nearly 17 million lost jobs…

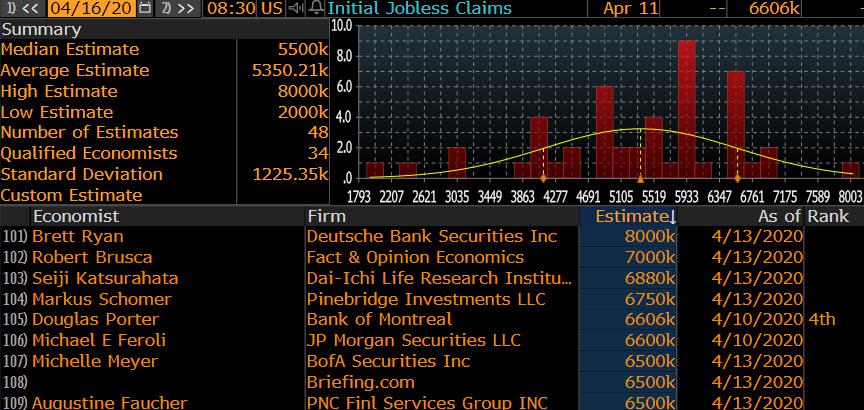

… brace for more of the same, even if with a modest improvement because after last week’s 6.6MM print (which in turn was a small decline from the 6.9MM the previous week), the median consensus forecast expects a 5.5MM report tomorrow at 830am, with some notable outliers such as Deutsche Bank which has gone all the way predicting a record 8MM initial jobless claims with JPM Securities and BofA not far behind, at 6.6MM and 6.0MM, respectively (bizarrely JPMorgan Asset Management is on the other end of the spectrum expecting just 2MM claims to be filed in the current week – how one can bank can have two polar opposite forecasts at the same time is precisely why Jamie Dimon is richer than you).

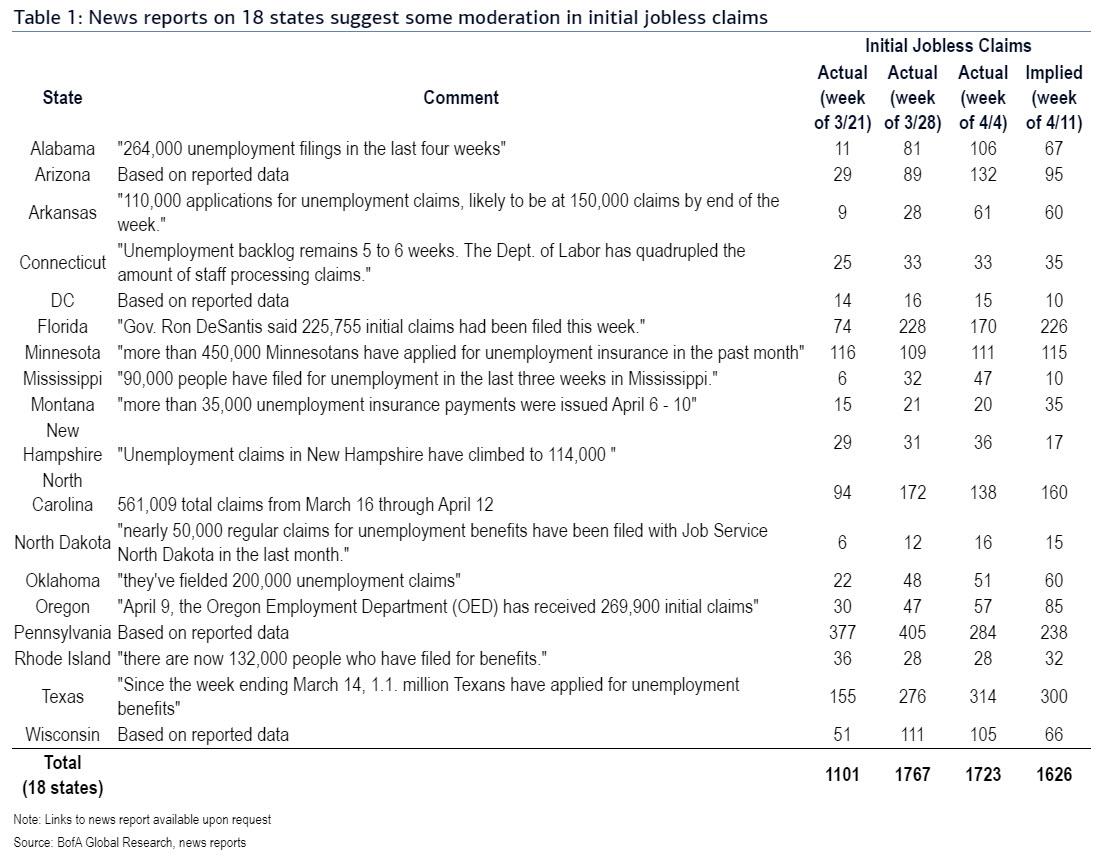

Ignoring JPMorgan, we focus on Bank of America’s forecast, which once again runs through local news sources to get an early feel for how jobless claims are likely to evolve in the next report covering the week ending April 11, released tomorrow.

This week BofA was able to estimate implied figures for 18 states, versus 16 in last week’s analysis. That said, these 18 states were generally smaller, which adds to forecast uncertainty. For these 18 states, BofA calculated a total of 1.6MM NSA, which would be a 5.6% decline from the prior week’s level of 1.7MM.

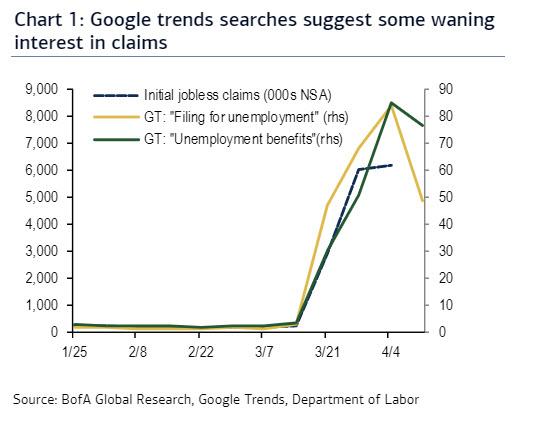

Applying a similar % decline to total NSA claims in the US and applying this week’s seasonal factor, seasonally adjusted claims would end up in the range of 6.1-6.2MM. The latest Google Trends data also suggest that interest in filing claims waned somewhat.

The takeaway is that jobless claims are likely to see some moderation but remain near record levels. As such, the bank revised downs our latest forecast to 6.0mn from a preliminary forecast of 6.5mn.

What does this mean for unemployment?

As mentioned above, over the past three reports there has already been nearly 17MM initial jobless claims, and if the latest forecast is correct then that will rise above 23MM. Does this mean unemployment will increase by 23MM? It’s important to note that anyone can file an initial jobless claim even if they are not eligible, which can lead to an inflated number.

As such, continuing claims-people who are actually receiving unemployment benefits-has historically tracked much closer with changes in the unemployed. The former generally undershot the latter during the last two recessions, but could track more closely this time around given the expanded eligibility of self-employed and gig workers, who are normally captured by the household survey, for unemployment benefits.

So what do the claims data suggest for the April BLS jobs report? We need to monitor claims activity between the March survey period of the week ending March 14 and the April survey period of the week ending April 18.

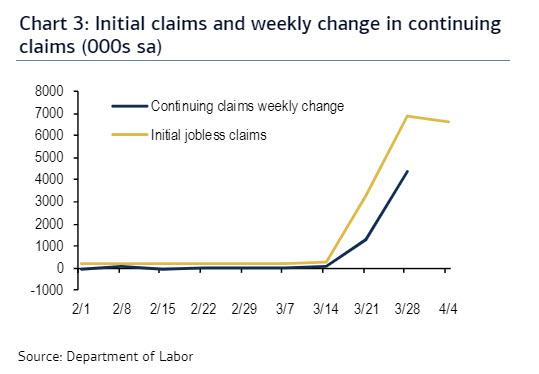

The focus is on continuing claims, which lags initial jobless claims by one week. So far, we only know what has happened in the first two weeks (the second half of March)-continuing claims rose to 7.5mn from 1.8mn two weeks prior, reflecting an increase of 5.7mn. Considering 9.9mn initial jobless claims over that period, that would suggest a high 58% approval rate.

So if we assume a 60% approval rate and initial jobless claims averaging around 6mn over the next three weeks, that would imply an additional increase of 10.8MM in continuing claims, or 16.5MM in total over the five week survey period.

This means that if there was a one-for-one change in the level of unemployed, the unemployment rate would reach 14.5% in April from 4.4% in March, all else equal. In other words, get ready for a new record… while stocks most likely soar on their way back to all time highs.