Nordea venter, at ECB vil pumpe flere penge i økonomien i denne uge, måske ved at hæve opkøbsprogrammet PEPP med 500 milliarder euro til 1250 milliarder euro. Det kan indsnævre spreadet mellem de italienske og tyske obligationer. Desuden vil ECB-chefen Lagarde møde spørgsmål om den nylige dom i den tyske forfatningsdomstol.

ECB Watch – Preview: Another easing package

We expect more easing at this week’s ECB meeting. The PEPP could be raised, possibly as part of another package. Lagarde will also face questions on the consequences of the German Constitutional Court ruling. More easing should support Italian bonds.

- We believe the ECB is ready to ease monetary policy again at next week’s Governing Council meeting: this time by raising the Pandemic Emergency Purchase Programme (PEPP) by 500bn to 1250bn and possibly even signalling that the purchases will not end by December 2020.

- The ECB could be ready to take more measures. We outline the most likely measures that could be part of a policy easing package.

- President Lagarde will acknowledge the European Commission’s proposal for the Next Generation EU support packages and dismiss the German Constitutional Court criticism.

- New staff projections are likely to see even more negative growth and very low inflation ahead.

- Even higher bond purchases should cement the low-yield regime further and compress intra-Euro-area bond spreads.

Policy signals have been clear: more easing is coming

Recently, we have heard several speeches by and interviews with Governing Council members who all support expectations of further easing.

In an 18 May interview, President Lagarde said: “For the systemic shock we are facing today, the PEPP – our programme for purchasing EUR 750 billion of public and private sector securities – seems the most appropriate tool.” Moreover, when asked if the June meeting could bring about an increase in the PEPP: “We have been very clear and we continue to be very clear – we will not hesitate to adjust the size, duration and composition of the PEPP to the extent necessary. We will use all the necessary flexibility within our mandate.”

In the same interview, Ms Lagarde reiterated the estimate that additional debt issuance in the Euro area due to the pandemic could be in the range of 1000-1500bn in 2020 alone, which supports the argument for raising the PEPP envelope.

The account of the 30 April Governing Council meeting – released 22 May – supports the view that more easing is coming and emphasised that pre-emptive action was preferable.

In a 25 May interview, Banque de France Governor Villeroy de Galhau said: “In the current low-inflation environment, our mandate in no way prevents us from innovating, acting, supporting the economy rapidly and powerfully. Indeed, it even creates the conditions for legitimate and efficient action. It is in the name of our mandate that we will very probably need to go even further”.

The German Constitutional Court ruling will not stop the ECB

A big part of the press conference will probably be about the German Constitutional Court ruling, which was sceptical towards the ECB’s Public Sector Purchase Programme (PSPP). President Lagarde is likely to remain brief and “legal” in her response to those questions: 1) The ECB is subject to European law, it is accountable to the European Parliament and it is under the jurisdiction of the Court of Justice of the European Union, and 2) the European Court of Justice ruled in 2018 that the PSPP is legal.

An increase in the PEPP would serve a dual purpose. First, it would be a “show, don’t tell” reply to the questions regarding the limitations that the ECB is facing because of the ruling. Second, it would aim at convincing the markets of the necessary support for peripheral bonds even if the PEPP will be slightly more adhering to the capital key going forward. The ECB will publish its PEPP purchases on a bi-monthly basis starting in June. The first data are expected to be out on 2 June.

Not much room for higher bond yields

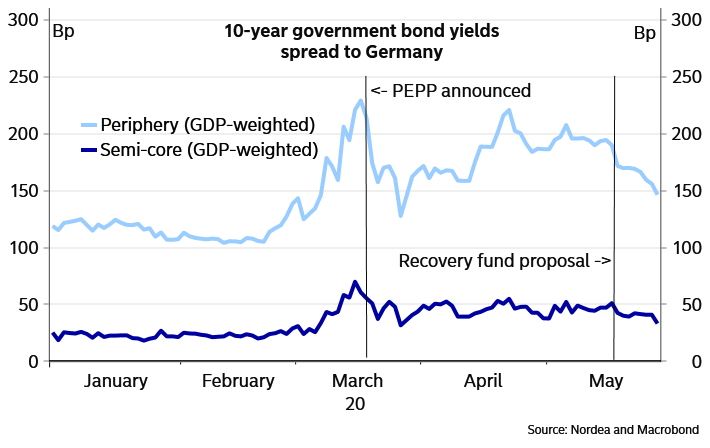

10-year peripheral government bond yields have fallen relative to German yields since the ECB announced the PEPP and again following the Franco-German recovery proposal, but more remains to be done if the aim is to “close spreads” relative to before the coronavirus. Another easing package from the ECB, especially increasing the size of the PEPP, would certainly support a further contraction in spreads.

Still, the ECB’s actions are unlikely to take away all the volatility from bond spreads. We do not expect the political negotiations around the policy package to be easy, and negative news from Brussels together with weak economic data could easily send Italian spreads higher again.

While increasing hopes of an economic recovery and more credit risk being shifted from the peripheral countries to Germany as part of an eventual recovery fund put some upward pressure on German bonds yields, bigger ECB bond purchases should cement the regime of low bond yields even further. Given the ECB’s reluctance to cut rates further, another expansion of the bond purchases could also flatten the curve as an immediate response.

Peripheral and semi-core spreads to Germany

Additional easing measures

The ECB is likely to take additional measures as part of an easing package. Here are a number of likely measures:

- The ECB could extend the PEPP until the coronavirus crisis is over or at least until the middle or end of 2021, from currently end of 2020.

- The ECB could buy corporate bonds with lower ratings to support the recovery of that market (including the so-called Fallen Angels, or bonds that have lost their investment grade ratings during the corona crisis).

- The ECB could specify the reinvestment policy of the PEPP program, eg with the aim of converging with the capital key only longer out, which would open the door for more deviations from the key in the short term.

- The ECB could sweeten/extend/expand the various forms of longer-term refinancing operations (LTROs) currently in place. Especially the period, for which the lower TLTRO interest rate will apply, could be extended.

- The ECB could further ease its collateral requirements or extend the period or looser collateral requirements further.

- The ECB could hike the tiering multiplier.

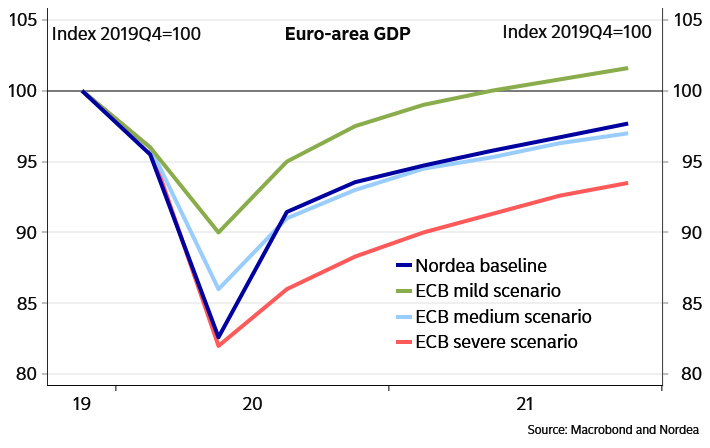

Mild scenario is already out of the window

Long-awaited new staff macroeconomic projections will be released at the meeting next week. We already know the growth forecast for the Euro area for this year from other heavyweights like the IMF (-7.5% y/y) and the European Commission (-7.7% y/y). Much suggests that the ECB growth forecast will land even lower than those for 2020, closer to our forecast of -9% y/y. In April we got a preview of how the ECB is thinking about the outlook in the shape of three possible scenarios.

By now, the ECB seems to have already dismissed the milder scenario of -5% y/y as Lagarde commented this week that: “We’ll have a better sense in a few days as we publish our numbers in early June, but it’s likely we will be in between the medium and severe scenarios,”. This points to a forecast of between -8 and -12% y/y, far down from 0.8% in the March forecast. Of course, the ECB knows as little about the likely development of the virus as the rest of us and the uncertainty surrounding the forecast will be stressed once again.

What we have not even seen scenarios for yet is the inflation forecast. While we expect the disinflationary forces to have the upper hand in the coming months, even years, there are concerns in the Governing Council for upside risks to the inflation outlook, which might be reflected in the forecast. From the account of the April meeting it appeared that some members think “there could be upward pressure on prices from the costs of containment measures and supply disruptions, as well as from a number of structural effects following the pandemic.”.

Still, there is little doubt that there will be a strong downward revision of the ECB inflation forecast as well. The IMF and the European Commission agree on HICP at 0.2% y/y in 2020, so the ECB might match that with some margin as most seem to agree with the vanishing of inflation in the short term. More interesting is the inflation outlook for next year, and where the ECB will pin inflation at the end of their forecast horizon in 2022 (from 1.6% in March).