Nordea mener, at valget i USA kan føre til et regimeskifte, der kan gavne dansk økonomi og det globale samarbejde og dermed verdenshandelen. Trump skal ikke undervurderes, men Nordea finder det mest sandsynligt, at Biden bliver præsident, og at Kongressens to kamre bliver demokratiske. Dermed kan Biden lancere en genopretningsplan på 2000 milliarder dollar, som i høj grad vil være grøn og digital, og det vil gavne danske virksomheder.

Chief Economist’s Corner: The old men and the election

Much suggests that a regime shift is imminent in American politics. That could benefit the Danish economy and international cooperation. But you should never underestimate Donald Trump.

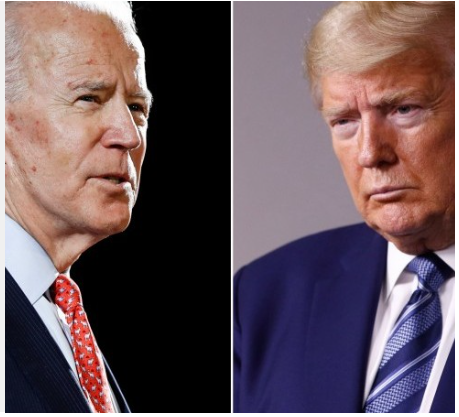

It probably hasn’t escaped anybody’s attention that only a few weeks remain before the US presidential election is decided between the two rather old candidates, 77-year-old Joe Biden and 74-year-old Donald Trump.

According to the opinion polls, the senior candidate Joe Biden is a clear favourite to move into the White House, but Donald Trump should not be entirely written off.

Firstly, because the incumbent president is a formidable opponent to be up against – perhaps not least now when he can boast about having personally defeated the “Chinese virus”.

Secondly, because the election is not decided by winning the most votes nationwide but by winning the right states. That’s why the Trump campaign needs to put everything into winning all the important swing states, including Pennsylvania, Arizona, Florida and Ohio, to turn a looming defeat into victory. But the problem is that the Democrats have a fairly solid lead there too. It will require a giant effort by the presumably still coronavirus-weakened President Trump to conduct a successful campaign in so many places in such a short time.

That’s why I think we’re about to see a change of presidency. Moreover, in addition to his already well-known personality traits, the decisive factor in the hour of reckoning will not least be his failure to handle the pandemic.

The human and economic costs of the coronavirus crisis have been massive. The US has so far had almost 8 million registered COVID-19 cases, of which more than 220,000 have been fatal. In Q2 the economy contracted almost 9%, while unemployment surged dramatically from 3.5% in February to 14.7% in April. And although things may be looking up, the pre-COVID 19 level is still a long way off.

Even if a Democratic president assumes office, an actual regime shifts depends just as much on the outcome of the concurrent election to the two chambers of Congress, the House of Representatives and the Senate.

The Republicans currently hold a majority in the Senate where 35 of the 100 seats are up for election, while the Democrats command a solid majority in the House of Representatives where all 435 seats are up for election. If Congress remains divided, the president’s hands will be more or less tied, whereas a majority in both chambers will almost certainly mean full control. And right now the polls actually show that the Democrats stand to make a clean sweep.

If so, we can look forward to a period when the US will again focus on equality, welfare, the climate and international cooperation. And although the harsh rhetoric towards China will continue, there is hope that the destructive trade war between the two superpowers can be brought to an end.

In my opinion, that is probably the most optimal scenario imaginable from a Danish viewpoint. The US is one of Denmark’s most important partners by all parameters. And as a small, open economy we have benefited from the significant advances in technology and trade that became possible through the US-led liberal world order.

At the same time it’s worth noting that Joe Biden aims to launch a USD 2trn investment programme to restore the economy. The programme is to future-proof the US society through a green and digital transition of the economy. This could potentially greatly benefit Danish companies, as these are areas where Denmark has built up comparative advantages over the years and enjoys wide international recognition.

I’m not too worried about how financial markets will react to a change of presidency, although the Democrats’ manifest implies higher taxes – something that is normally not received well in the stock markets. But experience shows that slightly longer term investors focus more on the long-term economic development, which Biden’s policy actually supports. Also, let’s not forget that monetary policy, which is the key factor behind the recent long upturn of the stock markets, will remain ultra-loose for many years to come.

We’re in many ways facing a landmark election. The only thing we can be sure of is that the next president of Gods own country will be an old white man. But I would not hazard to guess what that will lead to now in the age of identity politics.