Nordea mener, at den hastigt voksende lockdownbølge i Europa kan dæmpe investorernes risikovillighed, ligsom den usikkerhed, der måles i et Surprise Index kan blive dæmpet.

Lockdowners on Parade

The political lockdowners are back on parade, why risk appetite could suffer short-term. The USD may post a short-term comeback due to eg. relative virus developments. A Biden victory, on the other hand, seems mostly priced in.

The start of the influenza season (October) has coincided with a surge in virus case counts. This was quite predictable. And where case counts surge, lockdowns follow.

That said, it’s probably best to keep the analysis overly simplistic since that is what our politicians are doing, and it’s mostly their decisions which matter. Even with months of alleged intensive administerial virus response planning, the strategy seems to be almost the exact the same as in the spring. Case count up = restrictions up.

One could have hoped for much more effective and targeted track, trace and test strategies being in place by the time of the second wave in Europe, but those hopes have vanished like a fart in the wind during the early Autumn.

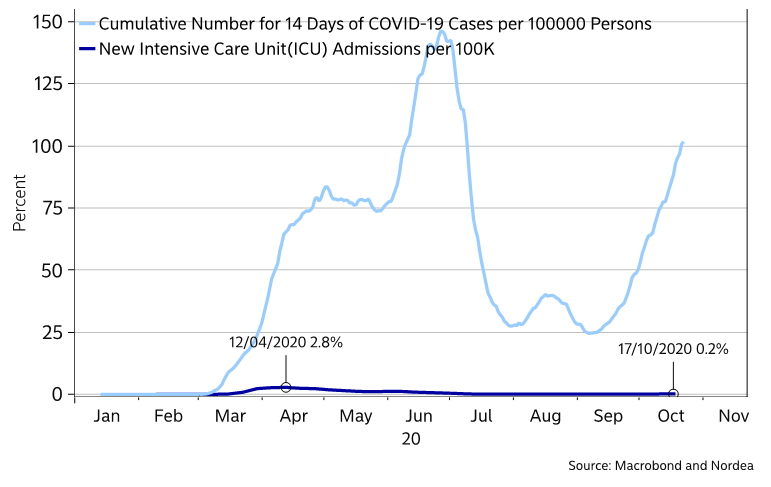

Chart 1. Sweden: case count surging, ICU admissions not

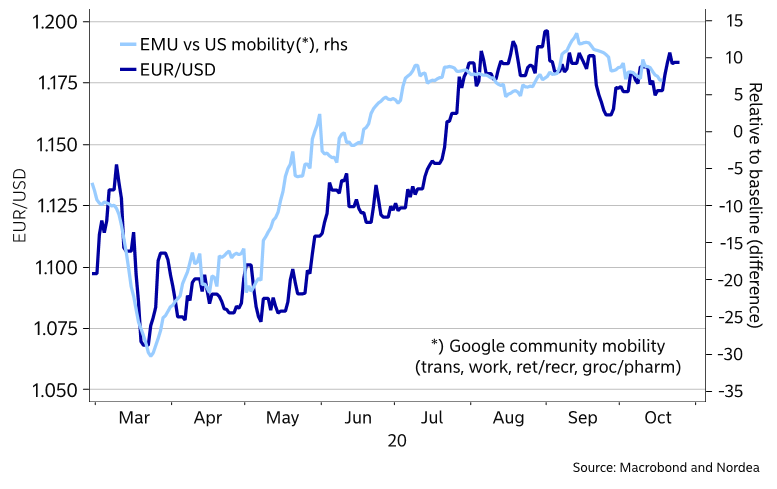

Insofar lockdowns and virus worries impact social mobility, this depresses economic activity. In turn this widens already large output gaps which could force central banks to go even more crazy. With a larger and larger share of Europe entering lockdowns, how will Apple’s or Google’s mobility data look in a couple of weeks? On its own it should look EUR-negative, though we do still have that pesky election to contend with, as well as a negative fiscal impulse in the US.

Chart 2. EUR/USD vs relative social mobility

As for the psychological toll from lockdowns and other restrictions, they probably risk being even more adverse late in the year than earlier in the year. Being kept away from your friends and relatives may be more acceptable when there’s still a lovely country-side to enjoy – which will gradually not be the case over the next several months (at least not in our Nordic climes).

In the UK’s “very high risk” areas, pubs cannot open unless they ”operate as if they were a restaurant”, and serve ”substantial” meals. And alcohol can only be served as part of those meals. This almost make us ponder the scope for social unrest.

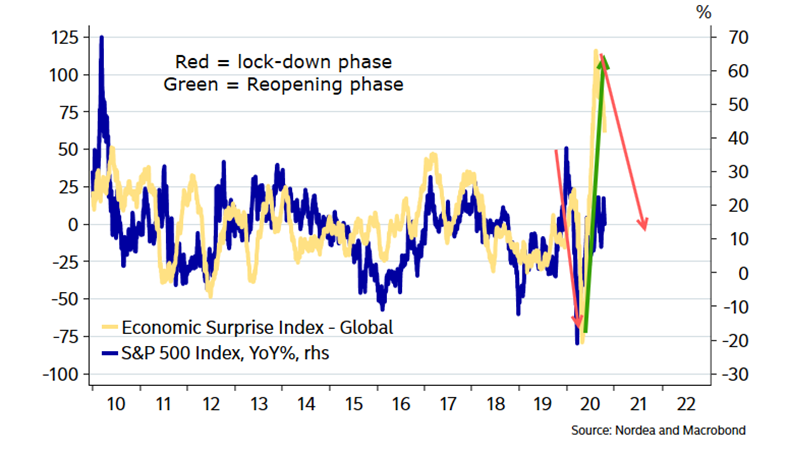

Another interesting pattern to note, now that Lockdown politicians are on parade again, is that the Global Surprise Index tends to drop during a lock-down phase and vice versa during a reopening phase.

When lockdowns are implemented, the answers in economic surveys tend to uniformly go down, which is apparently a process that is hard to assess correctly as an economist. When everything could slowly reopen during the early summer, most respondents saw progress compared to the month prior – this diffusion index disease is not properly accounted for in consensus key figures. In other words, expect economic surprises to go negative due to new lockdowns. This could be a Q4 issue for risk appetite.

The “good thing” is that a lockdown wave increases the possibility of another wave of monetary mayhem, which means that downside risks are clearly sugar-coated by the Corona-put from central banks.

Chart 4. Entering a lockdown phase means weaker Global surprise indices

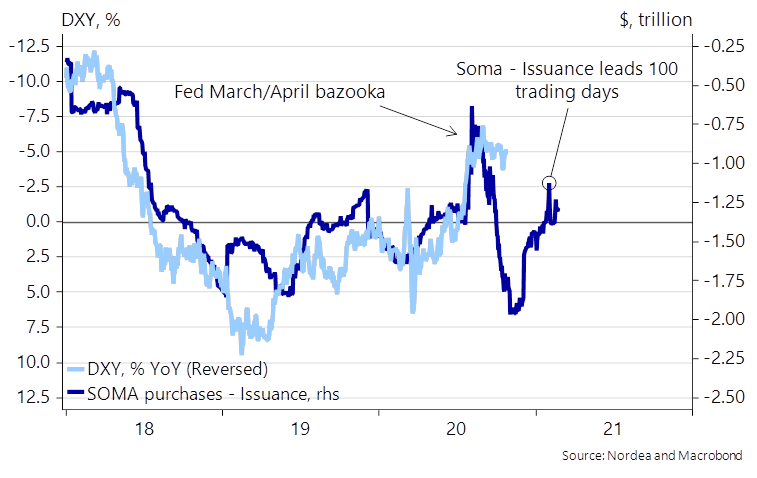

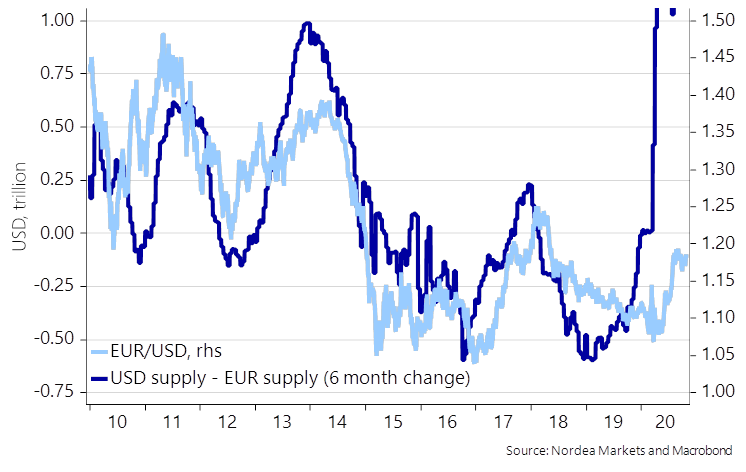

The USD liquidity impulse is currently not as benign as one should think. Since Mnuchin and the US Treasury prefunded a huge fiscal deal that is likely not going to materialize on this side of the election, the USD liquidity impulse has taken a beating due to Treasury prefunding / cash hoarding ahead of the fiscal deal.

The USD usually regains its footing after a while when the USD liquidity impulse tightens, alongside weaker risk appetite and flatter yield curves. This could be the case over the next 1-2 months before a (much) better 2021 with continued wide scaled QE alongside a fiscal deal that will allow the US Treasury cash account to drop in size.

The USD liquidity impulse is currently not as easy as you may think

Loyal readers of this publication will know how liquidity focused we have been in recent years. USD liquidity runs most of the world of finance, while relative central bank balance sheets (relative liquidity) matter for FX pairs. It took the ECB research team 10 years to notice something that the rest of us had known for ages – namely that relative balance sheet developments between Fed and ECB matters for EUR/USD.

Next step is for the ECB to acknowledge that the Fed balance sheet is more important for EUR/USD than the ECB balance sheet, but that is probably too much to ask for, since it would be equal to admitting that the ECB policy is no longer potent. We will probably have to wait (at least) another decade for such an official epiphany.

Chart 6. Relative balance sheets matter for EUR/USD