Aktiemarkederne reagerede op og ned ved de første meldinger om det amerikanske valgresultat, men der gik ikke lang tid, før high-tech aktierne steg ved udsigten til, at Trump måske kunne blive genvalgt.

Stocks sweat out election nailbiter, safe-haven bonds get bid

* Asian stock markets: https://tmsnrt.rs/2zpUAr4

* S&P futures whipsawed as U.S. vote proves too close to call

* Final result might not be know for a day or more

* Tech stocks gain on talk a Trump win would favour sector

* Dollar rallies, 10-yr Treasury yields down sharply

* Gold retreats, oil clings to gains

* Graphic: 2020 asset performance http://tmsnrt.rs/2yaDPgn

* Graphic: World FX rates in 2020 http://tmsnrt.rs/2egbfVh

Share markets were whipsawed and bonds well bid on Wednesday as results from the U.S. presidential election proved far closer than polls had predicted, potentially leaving the outcome in doubt for days to come.

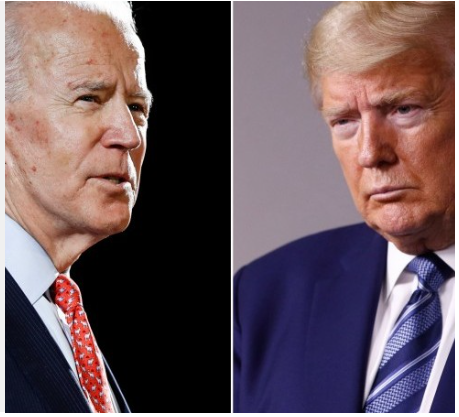

Democratic contender Joe Biden took to the air to declare he was still optimistic about winning and called for all votes to be counted, no matter how long it took.

President Donald Trump responded on twitter by claiming “they” were trying to steal the election and announced he would make a statement of his own later.

Investors had initially wagered that a possible Democratic sweep by Biden could ease political risk while promising a huge boost to fiscal stimulus.

But the mood quickly changed as Trump snatched Florida and ran much closer in other major battleground states than polls had predicted.

U.S. equity futures went on a wild ride, rising then falling, only to climb again as the voting seemed to favour Trump.

Dealers said investors could be thinking a status quo result would at least lessen political uncertainty and remove the risk a Biden administration would roll back corporate tax cuts.

The technology sector seemed encouraged, with NASDAQ futures rising 2.2%, while E-Mini futures for the S&P 500 edged 0.7% higher. EUROSTOXX 50 futures were up a slim 0.1% and FTSE futures gained 0.3%.

Andrew Brenner, head of international fixed income at NatAlliance Securities, said the move in techs looked like it was a play on the Senate potentially staying Republican.

Brenner said that under a Biden win tech stocks were seen faring worse, partly due to Democrats going after the sector in hearings and also that a potential rise in capital gains tax would hit tech stocks harder.

Japan’s Nikkei was ahead by 1.9%, while MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.1%.

Chinese blue chips rose 0.6%, with markets uncertain how Sino-U.S. relations would develop from here.

Some investors were now hedging against the risk of a contested election or at least a drawn-out process as mail-in ballots were counted.

“It’s a wait-and-see,” said Matt Sherwood, head of investment strategy at Perpetual in Sydney.

“I think the odds of a clean (Democrat) sweep are diminishing, almost by the minute. That reduces the possibility, or the likelihood at least of a large stimulus program being agreed to in the first days of a Biden administration.”

That saw 10-year Treasury yields fall all the way back to 0.81%, having been at a five-month top of 0.93%.

The U.S. dollar had a roller coaster session, reversing early losses to be last up 0.8% on a basket of currencies at 93.902. The euro fell back hard to $1.1654 and away from a top of $1.1768.

The chance of a Trump victory saw the dollar jump 2% on the Mexican peso on the assumption U.S. trade policies would continued to favour tariffs.

Going the other way, the dollar eased 0.9% on the Russian rouble.