De seneste optællinger i USA viser, at Joe Biden har udsigt til en kneben valgsejr, men der er dog ikke udsigt til en “blue wave”, dvs. at Demokraterne ikke får flertallet i begge Kongressens kamre. Det gør det sværere at få en ny massiv stimuli-pakke. Aktiemarkedet er afventende, men da en kneben Biden-sejr ikke kan føre til skattestigninger, kan det styrke aktiemarkedet.

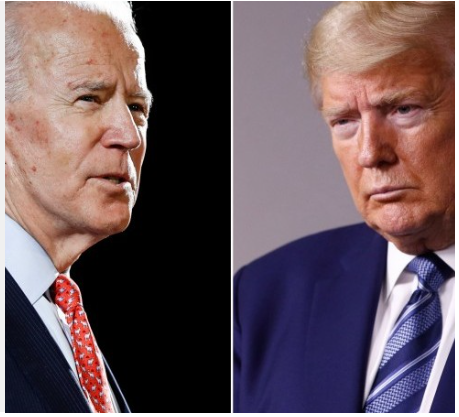

US Elections: Biden has the edge, but no Blue Wave

The election is far closer than polls had suggested. Joe Biden looks a narrow favourite to win the Presidency, but there was no “Blue Wave”.

Animosity and the threat of legal challenges argues against a swift fiscal support package which, with the growing threat of Covid, will be a concern for markets as activity becomes increasingly constrained

Election outcome casts doubt on stimulus

It was certainly ‘risk-on’ heading into election night on anticipation of a relatively ‘clean’ outcome that could not only lead to a substantial fiscal stimulus in 2021, but also open the door to talks on another near-term support package.

Those hopes have been dashed, for the next few days at least. The results so far seemingly show Joe Biden has a very slight edge, but it certainly isn’t going to be a convincing knockout victory accompanied by a Blue Wave. It looks as though there will be a smaller Democrat majority in the House and the chances of Democrats regaining the Senate appear slim at this point.

Unsurprisingly, risk sentiment has been somewhat mixed with the Treasury yield curve flattening at lower levels and the dollar outperforming on the prospect of a less reflationary fiscal environment.

However, equities are less downbeat, presumably on the prospect that either a Trump Presidency or a more constrained Biden would diminish the likelihood of significantly higher taxes and more regulation.