De amerikanske storbanker beskæftiger sig i disse dage meget med growth-aktier contra value-aktier, og der er én fælles vurdering: Value-aktier vil få større fremgang end growth-aktier. Merrill konstaterer, at det store skifte kom med nyhederne om corona-vacciner. Da roterede markedet massivt fra vækst til value – fra Nasdaq til small cap. Merrill venter, at den store kløft mellem growth og value under coronakrisen vil udlignes i løbet af det nye år.

Vaccine Sparks Massive Rotation

The tech sector was up about 10% by Friday, November 6, more than the other sectors, which also rose, just not as much. That left the Growth sector vulnerable on Monday, November 9, when the vaccine announcement came.

It also sparked a massive rally and totally shifted the internal market dynamics, causing a rotation away from the secular Growth stocks to more cyclical value areas of the market like Energy, Financials, Materials and Industrial stocks.

This time, the prospects for much stronger growth as pandemic fears fade in 2021 caused long-term Treasury yields to reverse all of their election-week declines and poke out to new highs.

The higher rates were one reason Growth stocks suffered relatively on the vaccine news.

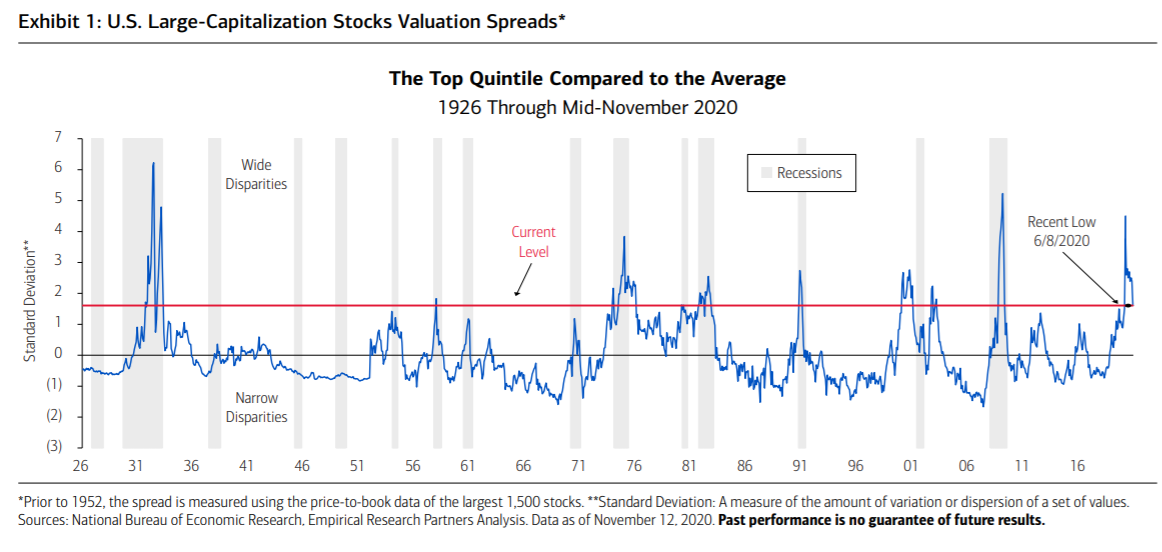

In addition, valuation differentials remain big, with Growth stocks’ relative valuations still almost two standard deviations (SDs) above historical norms, according to estimates by Empirical Research Partners (ERP).

As usually happens over the business cycle, Growth stocks valuation premiums reached a peak back in March during the big market selloff and period of maximum economic pessimism. This was the biggest valuation gap since the 1999 tech bubble, according to ERP.

In our view, the big valuation gap between Growth and Value stocks is likely to continue to close in the year ahead.

As shown in Exhibit 1, ERP data shows that the valuation gap tends to be greatest during recessions and normalize over expansions when it fluctuates around zero.

We suspect this expansion will follow that pattern. The pandemic was

especially hard on many cyclical sectors and especially beneficial for many high-tech,

WFH growth stocks. This sets up a big move back to normal as the pandemic hopefully dissipates over 2021.

ERP estimates that value stocks outperformed by six percentage points on November

9, “the biggest one-day relative return in seven decades.” Relative returns of three

percentage points or more in a day are extremely rare according to ERP.

“Value stocks outperformed in the next six months in all the episodes save one, that at the end of April this year.” The extended pandemic effect likely accounts for that exception, and the end of the pandemic is thus likely to amplify this typical cyclical rotation.