Merrill ser tegn på, at investorernes stemning er steget i november. Stemningen er blevet mere bullish, og det skyldes de nye vacciner. Det illustreret i, at fund managernes kontantbeholdning er faldet i november, og nu er beholdningen lavere end i januar før coronakrisen. Desuden er der sket kursstigninger i de almindelige aktier, mens det var high-tech, der havde massiv fremgang under krisen. Den nye stemning ses i AAII-indekset for investor-stemning. Den blev på 55,8 i november – det højeste siden januar. Men der er ikke tegn på eufori, mener Merrill. Der er stadig 4300 milliarder dollar, der ligger som kontanter i fondene. Det er mere end i slutningen af 2019.

Uddrag fra Merrill:

Merrier Investor Sentiment but No Euphoria

Since the start of the economic recovery, investors have not fully embraced the market

rally, with sentiment remaining relatively bearish.

But on the back of positive vaccine developments and greater clarity around the outcome of the elections, investor sentiment has turned more bullish in November.

Investors who maintained elevated levels of cash throughout the pandemic have

redeployed some of this capital. Fund manager cash holdings fell in November to 4.1%,

down from 5.9% in April, and now sit lower than the pre-coronavirus level in January at

4.2%, according to BofA Global Research.

More cyclically oriented areas of the market have benefited, with all sectors positive for the month led by Energy, Financials and Industrials, and market breadth improving with roughly 93% of S&P 500 stocks trading above their 200-day moving average.

The Chicago Board Options Exchange (CBOE) Volatility Index (VIX), used as a gauge for

investor uncertainty, has shown volatility moving lower and levels receding during market

down days.

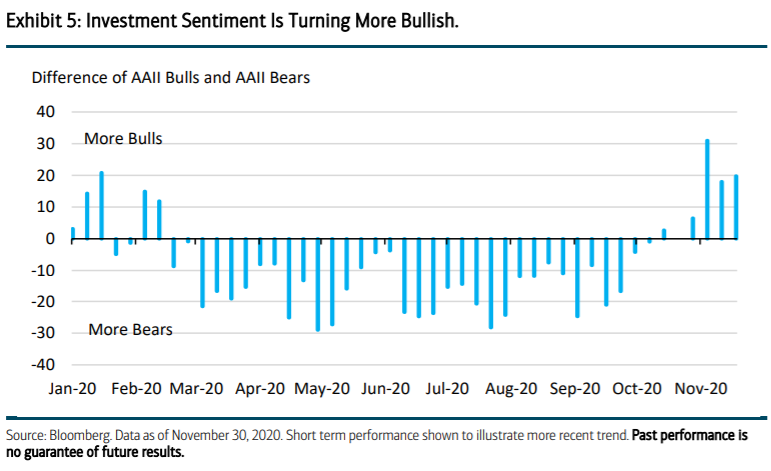

The American Association of Individual Investors® (AAII) sentiment survey

confirms the rise in bullishness with the second week of November bull reading at 55.8, a

level only last seen in January 2018 (Exhibit 5).

But could these more elevated sentiment indicators be a sign that optimism is turning overly exuberant?

The bullish breakaway pulled back some with the AAII bull reading in the subsequent week

roughly 12 points lower at 44.3, likely in the wake of rising coronavirus cases, and the ratio

of AAII bulls to bears currently in the 73rd percentile is still not at a statistically worrisome

level. Despite more cash reentering the market, money market assets under management

still sits at $4.3 trillion, roughly $700 billion higher than the level at the end of 2019.

For now, investor sentiment remains closer to neutral, in our view, given that cash levels still remain elevated and near-term sentiment continues to fluctuate. We believe some consolidation could be healthy for the market but see the current backdrop of an accommodative Fed and continued progress in the economic recovery as supportive for higher equities into 2021.