Trods optimismen på aktiemarkedet over corona-vaccinerne, ser den amerikanske centralbank inen vækst i meget af USA. I 4 af centralbankens 12 distrikter ses kun lidt eller ingen vækst, og i resten er der kun en beskeden vækst – set gennem de seneste uger – fremgår det af centralbankens seneste rapport, Beige Book. Centralbankchefen Powell har på det seneste advaret mod en hård vinter og har anmodet Kongressen om betydelig finanshjælp til virksomheder og forbrugere. Der er 10 millioner færre jobs end før krisen.

Fed sees little to no growth in much of U.S. as stress mounts

Federal Reserve officials saw “little or no growth” in four of their 12 regional districts and only modest growth in the others in recent weeks as a rapidly spreading health crisis and ongoing recession continued to devastate some U.S. businesses and families even as many others thrive.

In the U.S. central bank’s latest “Beige Book” compendium of anecdotes from businesses across the country, Fed officials seemed to signal that the winter slowdown they’ve feared would follow a new coronavirus outbreak is taking root.

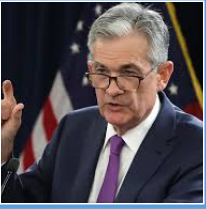

Earlier on Wednesday, Fed Chair Jerome Powell repeated his plea for Congress to provide more aid to “get us through the winter” and support businesses and households until a vaccine allows for a broader resumption of commerce. Initial inoculations may begin in the United States this month.

Members of Congress and the Trump administration have resumed discussions over a possible aid package, but with no guarantee that a longstanding impasse will be broken during President Donald Trump’s final weeks in office.

Meanwhile, the pandemic is spreading at a rate of a million new cases a week and around 1,500 deaths a day.

In some places that has led officials to impose new restrictions on businesses and social gatherings. In others, households have pulled back on their own.

“This is one of the most troubling Beige Books we have seen in a long time,” Jefferies LLC economist Thomas Simon said.

The possibility of growing loan bank stress added a newly worrisome note: The comparative lack of loan defaults so far has prevented the recession from spawning a separate financial crisis.

But “banking contacts in numerous Districts reported some deterioration of loan portfolios, particularly for commercial lending into the retail and leisure and hospitality sectors,” Fed officials reported. “An increase in delinquencies in 2021 is more widely anticipated.”

Similarly, firms had become tentative about hiring because of the uncertain path of the pandemic.

LABOR MARKET WORRIES

Nearly all districts reported that employment was growing more slowly and that the recovery “remained incomplete.”

Businesses said it was harder to retain workers, especially women, because of challenges finding child care and dealing with school closures caused by the virus. Firms in several districts said they feared “employment levels would fall over the winter” before improving.

In Boston, “a supplier to commercial aviation announced major layoffs over the summer and has not had any reason to revise those plans either up or down,” local Fed officials noted.

Still the latest collection of Fed field reports, compiled on or before Nov. 20, included stories of other firms where managers struggled to find workers to help meet a boom in goods sales.

That divide, among regions and sectors that are doing well and those that are not, has become a hallmark of the current recession and presents the Fed with a difficult decision as it debates whether to provide more support for the economy at its Dec. 15-16 policy meeting.

In the meantime, the country is 10 million jobs short of where it was in February. Job numbers for November will be released on Friday and are expected to show the pace of improvement is slowing, with some analysts now predicting an outright job loss.