Den danske inflation krøb en smule op i november, til 0,5 pct. mod 0,4 pct i oktober. Det er det højeste niveau i næsten to år, og inflationen er væsentlig højere end i eurozonen, hvor inflationen faldt til 0,3 pct. Det er en ny tendens, for den dansk inflationen har siden 2016 ligget under eurozonens – indtil begyndelsen af i år.

Uddrag fra Nordea:

Danish inflation stays elevated compared to the Euro area

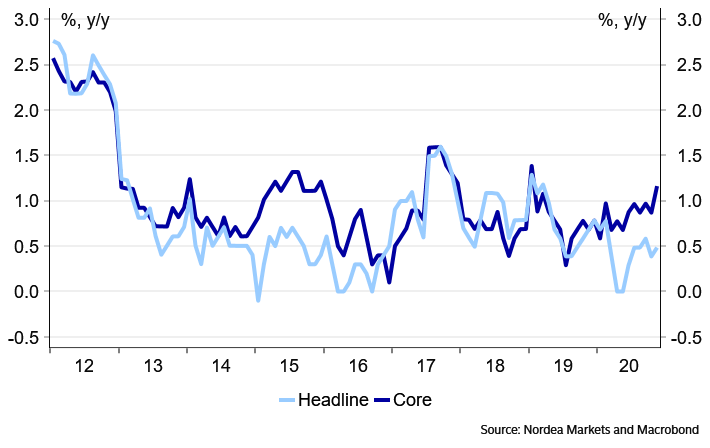

In November Danish inflation inched slightly higher to 0.5%y/y, up from 0.4% the previous month. Core inflation increased to 1.2% – the highest level since January 2019 and markedly higher compared to the Euro area

Chart 1: Both headline and core inflation tick higher

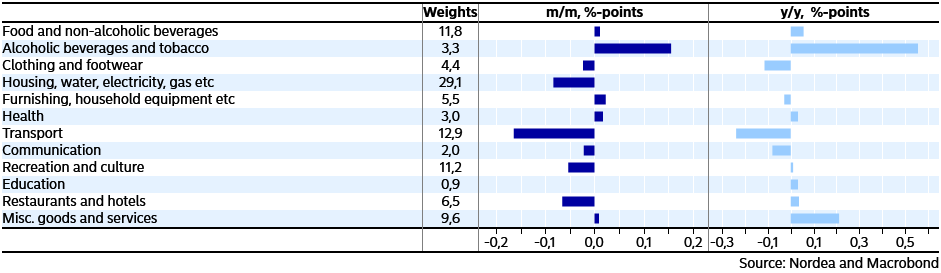

Higher prices of tobacco

The Danish consumer price index fell by 0.1% m/m in November while core inflation was unchanged. As usual in November, lower prices of travel made the most negative contribution to the monthly change. However, it should be noted that due to the coronavirus most of these prices of travel were estimated by Statistics Denmark.

On the other hand, it finally seems like the full effect of the large tariff increase on cigarettes that was officially implemented on 1 April has now been adapted. In November, higher prices of tobacco added 0.19% point to the monthly change.

Table 1: Contribution to inflation in November

Compared to November last year, the Danish consumer price index was up by 0.5% while core inflation increased by 1.2%. The main contribution to the annual increase came from the large cigarette price hike, which in total added 0.57% point to the annual increase. Also, higher prices of insurance pushed inflation higher in November.

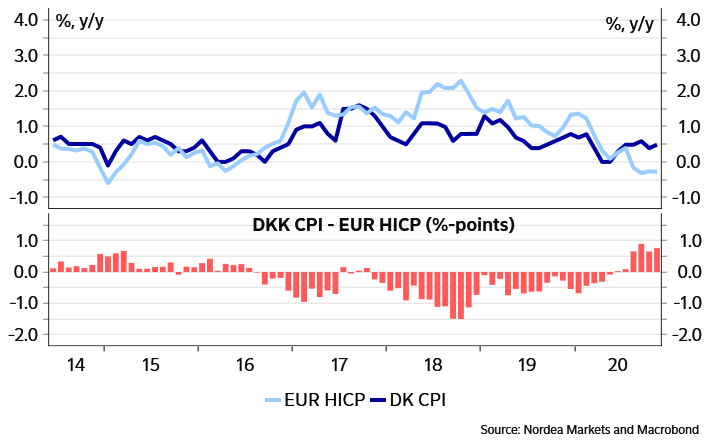

Danish inflation stays elevated compared to the Euro area

According to the flash estimate, the Euro-area HICP dropped by 0.3% y/y in November. This implies that the difference in annual inflation is currently 0.8% point. This marks the sixth consecutive month with higher inflation in Denmark compared to the Euro area.

Chart 2: Higher Danish inflation compared to the Euro area

Around two thirds of this gap can be explained by the increase in prices of cigarettes in Denmark, and it is most likely also partly due to some unusual seasonal patterns in the Euro area. Despite this, we expect Danish inflation to stay elevated compared to the Euro area in 2021.

This expected difference is both due to the base effects from the increase in cigarette prices in Denmark and to the fact that the higher activity level in the Danish economy is expected to pave the way for small price increases especially within domestic services.

On average we expect Danish inflation to reach 0.8% in 2021 compared to 0.3% in the Euro area.