Merrill venter en kraftig fremgang i 2021, og det bliver Kina og USA, som vil trække læsset. Merrill forudser, at USA får den største vækst siden begyndelsen af 80’rne. Forbruget vil være en af de største faktorer. Der er udsigt til en kraftig stigning i virksomhedernes overskud, og en stor del vil blive placeres i investeringer. Den lave rente vil opsluge virkningen af forventede lønstigninger. Overskuddet nærmer sig rekord i de ikke-finansielle selskaber. Alt i alt peger det på fremgang på aktiemarkederne i både 2021 og 2022, mener Merrill.

Macro Views for 2021

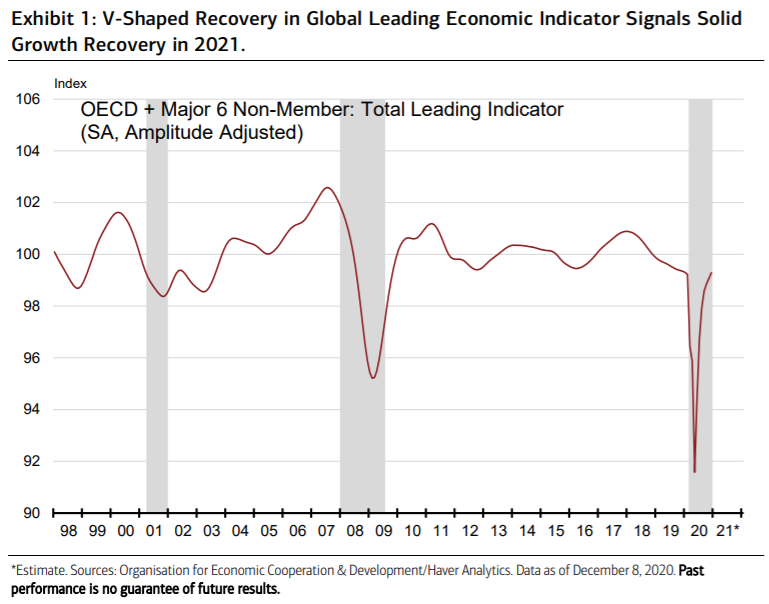

Global economic growth: Aggressive monetary and fiscal stimulus continue to support a

positive, self-reinforcing growth dynamic that is expected to receive an additional boost

from vaccinations, unleashing pent-up demand all over the world next year.

Global leading economic indicators reflect this confluence of factors (Exhibit 1). Strong growth in the U.S. and China, the two largest economies in the world, should lead the way, in our view. The

U.S. economy could be poised for its fastest rate of growth since the early 1980s.

U.S. Consumer Spending: The U.S. consumer will likely be a solid pillar of support in

2021. With the help of fiscal stimulus, the personal savings rate is relatively high, while at

the same time, wealth is rising (rising home and equity prices are helping), and financial

obligations are low, a powerful setup for consumer spending in 2021. Consumers have

room to lever up. Pent-up demand for high-contact leisure activities is expected to provide

a significant spark if vaccinations are effective in gradually reducing the associated risk.

Jobs are expected to also rebound rapidly in these industries. Like overall real gross

domestic product (GDP) growth, real consumer spending growth could set up for a multidecade record.

Profits: The profits rebound already underway will help to reinforce the broader economic

cycle in 2021. Companies would use profits to invest in productivity-enhancing technology

and people. Corporate profits at the economywide level reached a record high in the third

quarter. The profits cycle will be supported, in our view, by elevated margins, which also

surged in the third quarter with after-tax profit margins for nonfinancial companies near a

record high. Low interest costs should support margins even as labor costs pick up.

Importantly, a pickup in productivity will likely serve to ease these labor cost pressures and

support margins.

U.S. Equities: The economic growth and profits outlook for 2021 and 2022 is encouraging

for U.S. equity performance next year. The Organisation for Economic Co-operation and

Development (OECD) is forecasting faster economic growth in the U.S. in 2022 than in

2021 (3.5% versus 3.2%). The BofA Global Research Global Wave is showing a cyclical

upswing in the global manufacturing cycle and earnings revisions. While historical

valuations are a longer-term headwind, equity valuations relative to fixed income remain

attractive. Monetary and fiscal stimulus remains on standby next year in the event of a

coronavirus resurgence or an unexpected deflationary shock.

Risks: Election risk around the Georgia Senate runoffs are an early risk. Other risks include:

Premature monetary or fiscal tightening; disappointing vaccine results (in effectiveness or

uptake, for example); structural economic scarring; U.S.-China relations (Taiwan is a

notable flashpoint); the buildup of nonfinancial corporate leverage; and a bubble-watch

from massive global liquidity injections.