Fra Citigroup, udgivet den 21. december:

The week in review

- Industrial production +0.4% m/m

- Retail sales -1.1% m/m

The week ahead

- Personal income/spending

- PCE inflation

- Durable goods orders

Thought of the week

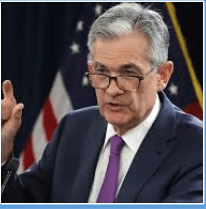

Last week the Federal Open Market Committee (FOMC) held its final meeting of 2020, and maintained the federal funds target rate in a range of 0.00%–0.25%. It also explicitly committed to purchasing U.S. Treasuries and agency mortgage-backed securities of at least $80bn and $40bn (net) per month, respectively, until the committee feels “substantial further progress” has been made toward its inflation and employment goals.

Although its “dot plot” of fed funds rate estimates still implies no rate adjustment through 2023, the Fed is likely to taper its asset purchases before making rate adjustments as the economy improves. In its quarterly economic projections, its growth forecasts were revised up for 2020-2022, reflecting prospects for a robust recovery.

With upward revisions to its PCE inflation forecasts in 2021 and 2022, and the unemployment rate projected to reach 4.2% in 2022, conditions to taper could come much sooner than 2023. As the expectation for tapering increases, the yield curve will likely steepen further in 2021. As shown in this week’s chart, the yield curve has steepened meaningfully this year as a result of lower short-term rates. Next year, it will likely steepen as a result of higher long-term rates. In that environment, investors will want to manage their duration carefully in fixed income, and for equity investors, these conditions could propel value stocks that benefit from a steeper yield curve and an improving growth and inflation outlook.