Fra Merril Lynch:

Scenarios for the S&P 500 through 2022

Since the lows of the year on March 23, the S&P 500 has rallied 65%. Its forward price-toearnings (P/E) ratio, (next 12-month basis) has risen to 22x from 14x. Meanwhile, consensus earnings estimates have risen to $177 for 2021 and $200 for 2022. There is some level of optimism being discounted in current equity prices for the economic normalization and earnings recovery expected broadly by investors, and, as such, a

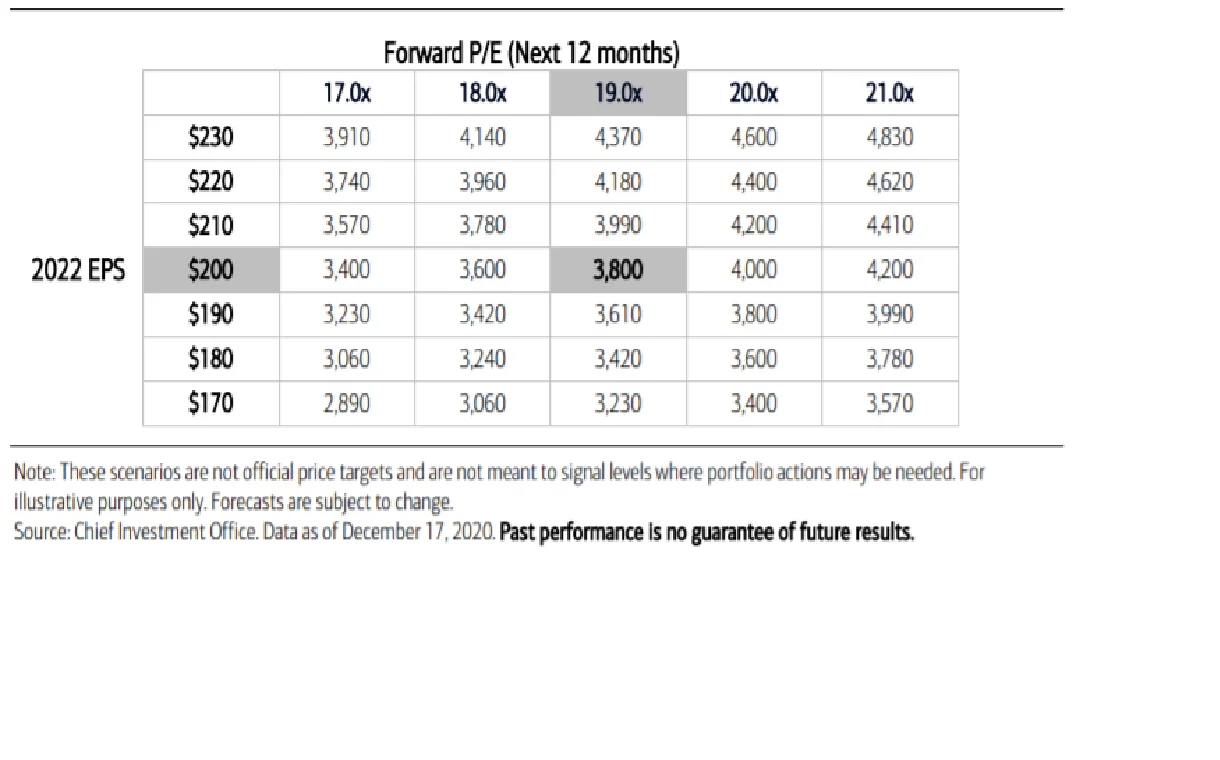

consolidation is likely in the near term. The table below provides a rough indication of where the S&P 500 index’s central tendency could be, given various scenarios for earnings per share (EPS) in 2022 and P/E multiples.

These scenarios are not official price targets and are not meant to signal levels where portfolio actions may always be needed. However, during times of market volatility, it’s useful to keep this basic framework in mind when deciding whether to incrementally add to or trim risk from portfolios while staying invested in one’s strategic asset allocation framework.

Exhibit 3: S&P 500 Scenarios Based on Forward P/E and 2022 EPS.

Forward P/E (Next 12 months)

Base case: The central tendency of the S&P 500 is currently around the 3,800 levels. This assumes current consensus 2022 EPS estimate of $200 and a forward multiple of 19x. We assume a rise in global growth as we move through 2021, vaccine deployment leads to the pandemic becoming less relevant in the second half of 2021, and interest rates likely moving higher moderately.

Upside scenario: It is likely that earnings estimates will move further higher for 2021 and 2022 as profit margins move back up toward pre-pandemic levels, nominal growth improves, and the dollar weakens. This could push the central tendency for the S&P toward the 4,000 range as earnings estimates move higher. In a more optimistic scenario, if multiples also expand (fund flows pick up more sustainably into equities, scarcity premium for stocks rises due to lack of yield and growth in other asset classes, sentiment moves higher into more optimistic levels) then a range of 4,200 – 4,400 is likely achievable.

Downside scenario: If bond yields rise meaningfully, then valuation multiples may face headwinds. A slight decline in P/E puts the central case for the S&P at 3,600 levels, assuming earnings rise to levels expected currently. A lower probability scenario would be if earnings estimates for 2021/2022 also falter due to weaker-than-expected pent-up demand pull-through and an unexpected strength in the dollar. Then the central case for the S&P 500 could move lower to the 3,400 levels