Fra Zerohedge:

Following GMO’s co-founder Jeremy Grantham’s renewed warning about extreme overvaluations, RIA Advisors Chief Investment Strategist Lance Roberts chimed in on the conversation Thursday morning.

In “Three Minutes on Markets & Money,” Roberts agress with Grantham, saying, “the stock market is in a bubble.”

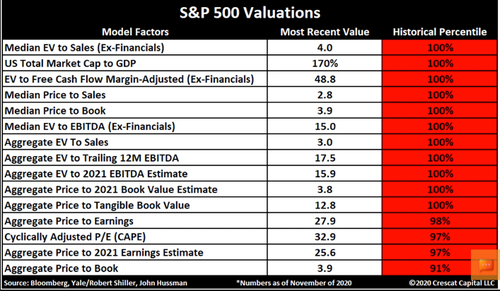

To refresh readers on Grantham’s Tuesday note titled “Waiting for the Last Dance,” Grantham wrote, “today, the P/E ratio of the market is in the top few percent of the historical range, and the economy is in the worst few percent. This is completely without precedent and may even be a better measure of speculative intensity than any SPAC.”

He wrote while he doesn’t know when the bubble will burst, the bust cycle is inevitable, and not even the Federal Reserve can prevent it.

“Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives,” Grantham said.

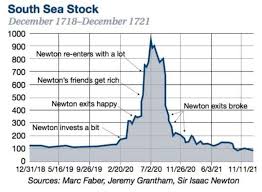

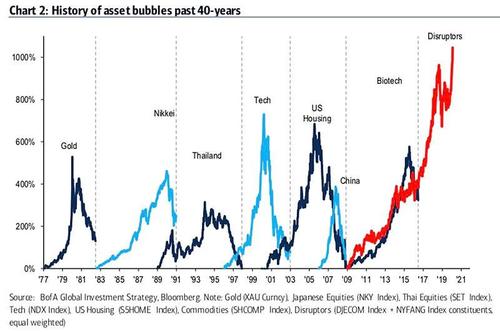

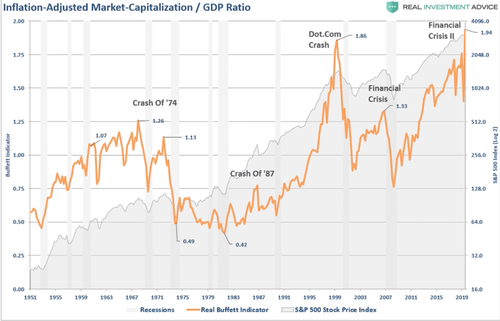

So back to Roberts, he says bubbles are a function of the market and repeat throughout time. Clearly, that is true in the figure below, showing bubbles over the past four decades.

Today is “clearly a bubble,” he said, adding that S&P500 valuations are overly stretched.

Roberts went on to say, “valuations are simply a representation of the psychology of the markets, and it’s the psychology that actually drives the bubble.”

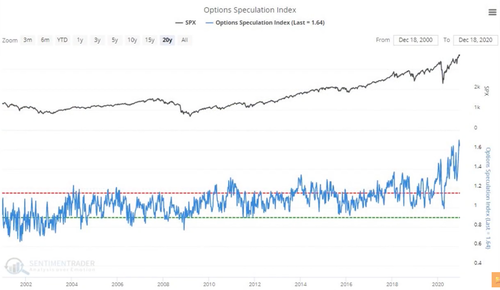

He said investors’ psychology is euphoric as they take on more equity exposure than ever before, adding that most speculative risks are being transacted in the options market.

In a series of charts, Roberts shows extreme optimism and/or high valuations that are not sustainable.

Market Cap Of Stocks / GDP Ratio

S&P500 Price To Sales Ratio

Roberts believes “the stock market is in a bubble, and it’s just a matter of time before it pops.”

One bubble in particular to watch is Tesla.

While there is still potential upside for many of the stocks as central banks inject a record $1.4 billion in liquidity into capital markets every hour, there could be an adjustment in valuations as interest rates begin to rise.

The risk-reward for stocks has deteriorated materially, and the market is ripe for a drawdown.

Watch: Three Minutes on Markets & Money