Merrill mener, at de betydelige amerikanske stimuli for at håndtere coronakrisen giver en højere vækst i USA end Europa. En konsekvens af den aggressive finans- og centralbankpolitik er en svækkelse af dollaren. Svækkelsen vil vare ved, mens inflationen vokser til over 2 pct.

Capital Market Outlook

The coronavirus crisis has caused policymakers to engage in the biggest fiscal expansion

since World War II. While the latest stimulus package was deemed too small by some, it is

the second biggest since World War II, surpassed only by the first Coronavirus Aid, Relief,

and Economic Security (CARES) Act of March 2020.

Hence, the U.S. economy is experiencing its two biggest fiscal stimulus impulses within less than a year. Overall, the U.S. fiscal stimulus in 2020 and 2021 exceeds that of any other major economy in both absolute and per capita terms.

This is one reason why the U.S. has outperformed the economies of other major

developed markets like those in the European Union (EU), where debates over mutualizing

debt have delayed the implementation of fiscal stimulus.

One consequence of the more aggressive U.S. fiscal and monetary policy is a weaker greenback, which declined about 7% on a trade-weighted basis in 2020.

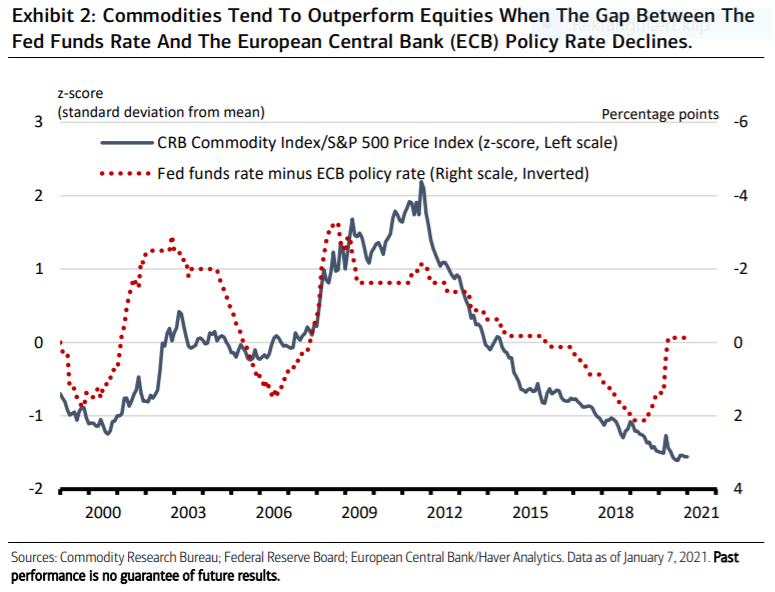

The appreciating dollar before 2020 was partly due to stronger U.S. growth and equity

market performance during the 2009-2020 expansion. Also, despite low inflation, the Fed

felt compelled to keep interest rates higher than those in Europe and Japan, which boosted

the dollar’s foreign exchange value (Exhibit 2).

As a result, as shown in Exhibit 2, the Fed had more scope to cut rates when the pandemic hit. The relatively bigger decline in U.S. interest rates helps explain the dollar’s weakness in 2020. Now that the Fed is committed to a more aggressive reflation policy, the likelihood that the dollar continues to depreciate and that inflation rises over 2% for a while has increased.