Præsident Joe Biden har lanceret en hurtig og omfattende klima- og energipolitik, og det vil reducere forbruget af olie, gas og kul. Men er det nok, og er forandringerne for hurtige på nogle områder, spørger ABN Amro, der påpeger både økonomiske og politiske risici ved Bidens stærke satsning på at ændre Trumps politik. Biden står over for en vanskelig balancegang mellem det klimamæssigt “rigtige” og markedskræfterne og forbrugernes krav.

Biden’s flying start on climate and energy policy

- Up to USD 40 billion in fossil fuel subsidy to be drawn in

- From a climate change perspective it is good news and only the start, while from an energy markets perspective it may be too sudden

- Addition measures related to the pricing of carbon emissions, the form of which is not clear, are likely to follow

- Strong investments in renewable energy will lower the usage of fossil fuels in the energy mix

- Lower oil production could come with new local economic risks as well as geopolitical risks

- Less associated natural gas production could trigger a re-emerge of coal usage in power generation in a worst case scenario

A new tone of voice

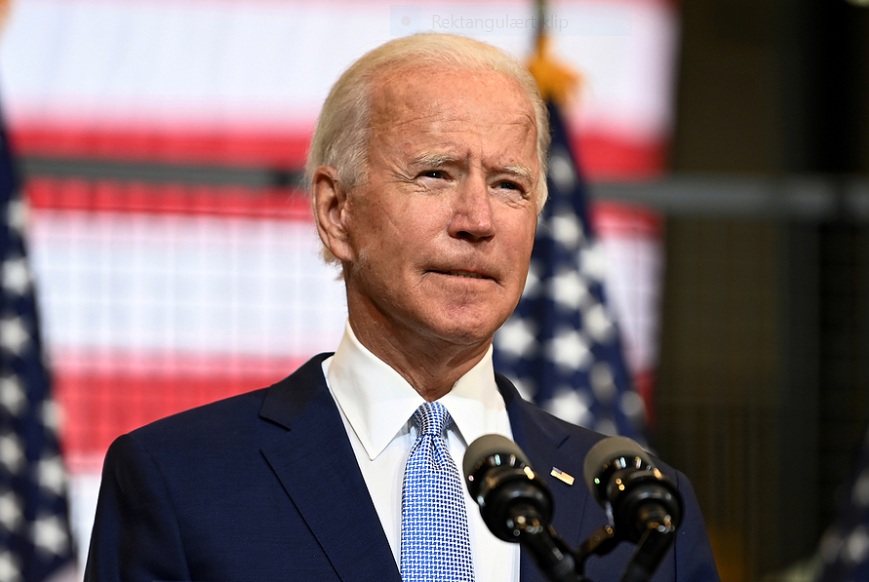

US President Joe Biden is wasting no time in keeping his climate promises. Within his first week the new tone of voice was clear. The Biden administration seems determined to change the climate and energy policy – if there was one – of his predecessor and replace it with ambitious plans to lower the US carbon emission substantially.

We anticipated the return to the Paris Climate Agreement, stronger legislation for oil and gas exploration and the pause of leases for oil and gas production on federal land. In addition, Biden announced cutting fossil fuel subsidies, the purchase of thousands of electric vehicles by federal agencies, and the immediate block of the Keystone XL pipeline from Canada to the US. Measures to price carbon emissions are likely to follow.

From a climate perspective, this is a necessary course. As the second largest global emitter and historically the largest emitter, Carbon Action Tracker estimates a 70% reduction in US emissions by 2030 is needed to limit warming to 1.5°C by the end of this century.

During the Trump presidency, the US took a completely different approach which hindered the local energy transition (at least from a federal perspective), and hardly contributed to the global climate policy actions.

The new Biden administration shows that the US is back on climate policy. Moreover, they want to lead the world to a carbon neutral economy during the coming decades. From an energy perspective, some of the decisions seem bold and come with new risks. The effects of the heavy investments in renewable energy and decarbonisation of the transport sector may not materialise quickly enough to make up for the announced measures to fight the use of fossil fuels.

Therefore, these measures may come with economic side effects in the short term, and could increase import dependency, unwanted shifts in the electricity mix, as well as new geopolitical risks. In this update, we will shed some light on both perspectives: the climate externality and the energy market impact.

Conclusion

‘Festina Lente’ is Greek for hurry slowly. The US needs to speed up the energy transition and invest heavily in its climate policy. However, it should not outpace itself by risking the energy security of supply by adding too much geopolitical risks and unacceptable consumer costs due to shortages in energy.

While the reduction in subsidies for fossil fuel seems bold, we expect additional measures related to carbon pricing, further pressuring market dynamic between fossil fuel and renewable energy sources. It’s like a tight rope walk between two sky-scrapers. The pole makes it look harder, but it is in fact crucial for balancing.