Fra Zerohedge

The Greece impasse set to culminate on Sunday continues to have a massive impact on at least one stock market, unfortunately it is the wrong one, located on a continent which is mostly irrelevant to the future of the Greek people (unless that whole AIIB bailout does take place of course).

We are, of course, talking about China which as noted earlier, started off horribly, plunging over 7% with over 1000 stocks hitting 10% limit down, then in the afternoon session mysteriously recovering all losses and even trading slightly higher on the day, before the late selling returned once more, and the Shanghai Composite plunged to close down 5.8%: a ridiculous 20% total roundtrip move!

This brings the total drop since the highs less then three weeks ago to just over 28% (and 33% for the Nasdaq-equivalent Shenzhen) the biggest 3-week plunge in 23 years.

What is most troubling is that, as we noted last night, this clear bubble bursting is not done with the government’s blessings – as should have been the case since a crash was clear to anyone – but despite the government constant attempts to intervene and prop up the bubble.

It all started with appeals to buy and hold because, well, it’s patriotic: “Fan Shaoxuan, a senior executive at Weibo TV who has more than 12,000 followers on Sina Weibo, posted a photograph showing the slogans: “Hold stocks with confidence. Win glory for the country even if you lose the last penny.”

Then overnight Bloomberg reported that in one sign of utter desperation, China is telling underwater investors to literally “bet the house on stocks” because under new rules announced Wednesday real estate is now an acceptable form of collateral for Chinese margin traders, who borrow money from securities firms to amplify their wagers on equities. Clearly this also means if share prices fall enough, individual investors who pledge their homes could be at risk of losing them to a broker.

While the rule change was intended to help revive confidence in China’s $7.3 trillion stock market, down almost 30 percent in less than three weeks, analysts say securities firms may be reluctant to follow through. Accepting real estate as collateral would tether brokerages to another troubled sector of the economy, adding to risk-management challenges as they try to navigate the world’s most-volatile stock market.

“It does come across as relatively desperate,” said Wei Hou, an analyst at Sanford C. Bernstein & Co. in Hong Kong. “Globally, illiquid assets such as real estate are not accepted as collateral as they are very hard to liquidate.”

“Brokers are not stupid,” said Hao Hong, a China strategist at Bocom International Holdings Co. in Hong Kong. “I don’t think they would be willing to take this kind of collateral.”

For more on China’s margin debt and Umbrella Trust problem read our article from earlier in the week:

But the real desperation was revealed overnight when China effectively hinted anyone caught shorting would be put in front of a firing squad (metaphorically, we hope)

It wasn’t just the shorts: a crackdown on “manipulators”, which really means sellers, has also been launched:

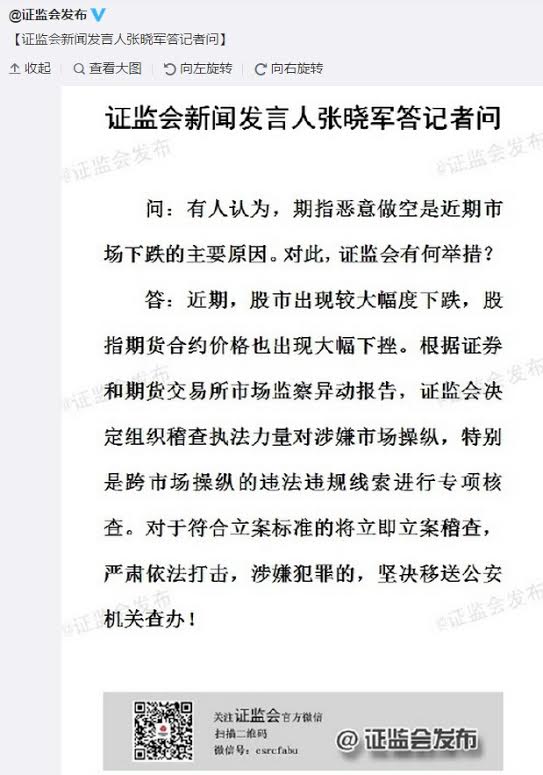

China’s securities watchdog announced Thursday it will investigate suspected manipulation of the stock market following weeks of plummeting stocks and future markets. Zhang Xiaojun, spokesman of the China Securities Regulatory Commission (CSRC), said they will investigate possible illegal activities occurring in multiple markets. He said they have tracked irregularities between securities and futures trading.

Even Morgan Stanley was mysteriously dragged into the blame game:

And if indeed the Chinese government is now helpless to halt the all out rout which, as we have warned countless times over the past 6 months, will leave millions of Chinese “traders” with nothing and thus desperate and angry, then the next step is also very clear and was laid out last week in a note by Nomura which warned that “A Market Crash “Poses Great Danger To Social Stability.”

Because a civil war over a market crash is all this worlds needs right now.

Hopefully there will be no civil war in Greece after this weekend’s referendum which those who are not watching their paper “profits” vaporize in China, will be watching closely as tthe fate of the Eurozone may well depend on the outcome of the vote.

For now, however, unlike in China European trading is muted perhaps because unlike in China, the European Central Bank long ago became the primary marginal source of risk demand.