by Morgan Stanley

Alpha Over Beta

Equity markets got off to a fast start in 2021 as greed continued to overcome fear.

As usual during such strong bull runs, investors and traders added leverage to their bets. In fact, a few weeks ago we were at record levels of leverage for hedge funds and record-low cash balances for long-only institutions. Meanwhile, retail investors have been buying record amounts of call options and using margin debt aggressively. The prevailing view of better economic growth, more fiscal stimulus to come and continued money printing from the Fed has everyone “all in.” When such periods occur, it’s rarely been easy or wise to get in the way. Instead, these trends typically need to run their course until they are derailed or simply exhausted.

However, this kind of complacency also leads to greater risk in markets, even though it feels safer for the moment. It’s the mirror image of last March, when fear was rampant and the risk of investing was actually very low. Such irony leads to one of the cardinal rules of investing – buy low, sell high. While that seems simple enough, it’s a hard rule to live by for many investors, especially professional asset managers that have to mark to market frequently and explain their performance to clients.

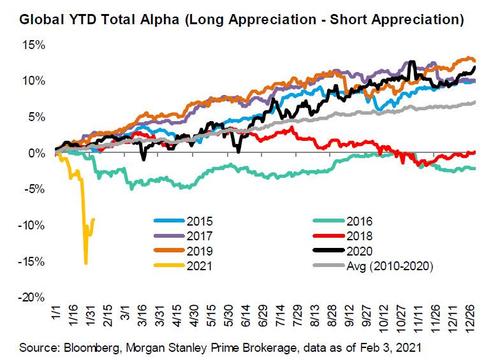

Retail investors, on the other hand, don’t have to answer to anyone but themselves. Furthermore, a new kind of retail investor has emerged. Emboldened by a combination of free money from the government, spare time on their hands, cheap and easy access to markets and a growing desire to take on the establishment, the “Joes” wreaked havoc on the “Pros” last month, who rediscovered that leverage can cut both ways. A series of retail-orchestrated short squeezes forced a significant de-leveraging by hedge funds, and major indices sold off 3-5%.

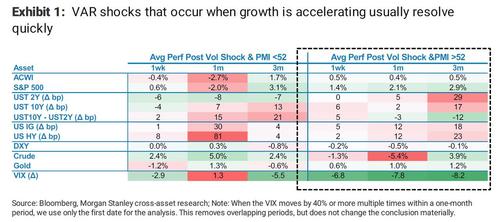

On the one hand, the fact that a few day traders with stimulus checks could cause such disruption in markets is a little scary because it’s emblematic of the excess leverage and lack of two-way risk embedded in financial markets. On the other hand, with equity markets roaring back last week, it appears that greed once again has the upper hand over fear and the bull market is ready to resume in earnest. Our cross-asset strategy team’s work suggests that when VAR shocks like the one two weeks ago happen during growth acceleration phases, they tend to dissipate quickly.

The growth acceleration phase is defined as a period when the ISM index is above 52. With the ISM near 60, a quick resolution of January’s drawdown makes sense, particularly with the larger version of the COVID relief bill looking more likely – i.e., it’s hard to imagine the ISM falling below 52 with so much stimulus and a reopening of the economy right around the corner.

This doesn’t mean there’s nothing to do. On the contrary, we are still very much in a bull market at the early stages of an economic recovery that’s gaining momentum. To us, this means the big returns remain below the surface rather than at the index level, and since early November that’s exactly what we’ve seen. Therefore, we continue to recommend stocks with the most upside to an improving economic backdrop as the vaccines are distributed and normal activities resume. These would include stocks in pro-cyclical sectors like banks, materials, industrials and consumer. Conversely, defensive stocks or ones that may be vulnerable to a shifting consumer wallet as the economy reopens likely don’t offer earnings upside to offset the expected multiple compression and should be avoided. We embrace the view that 2021 will be a year of alpha, not beta.