Fra Zerohedge/BofA

At the end of January, when looking at the plunge in covid cases, deaths and hospitalizations we asked a question: “Is it almost over?”

We got the answer today, when BofA published its latest Fund Manager Survey (which as is the tradition every month, polled some 220 panelists with $630bn in AUM). The title said it all.

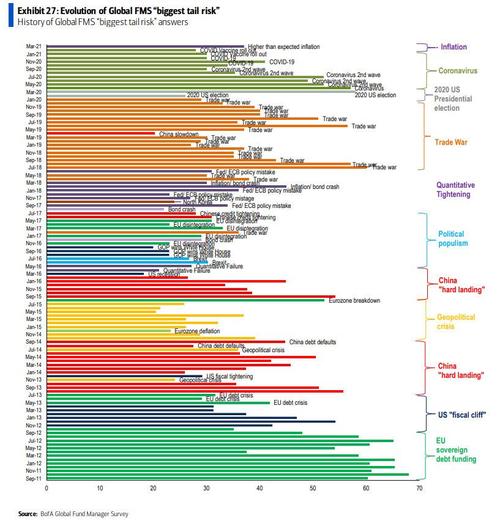

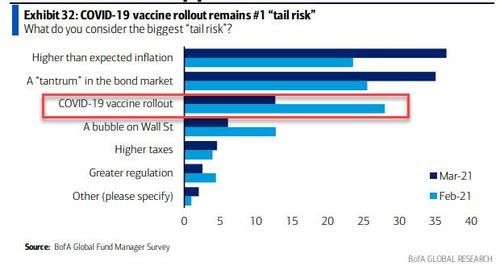

Indeed, as the March BofA fund manager survey (which was taken between March 5 and 11) reveals, COVID-19 is no longer the #1 “tail risk” for the first time since Feb’20…

… with finance pros now saying inflation & taper tantrums are bigger risks.

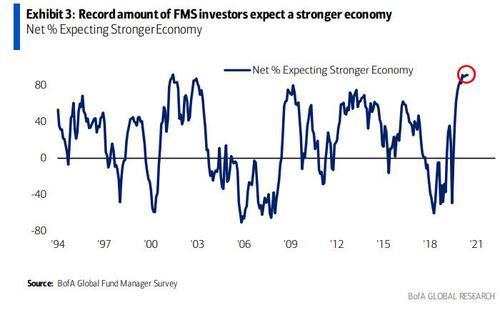

While the biggest tail risk on Wall Street was a notable change, where there was no change was that for yet another month, investor sentiment remained unambiguously bullish, with a record amount of investors (91%) expecting a stronger economy on what is the “best economic outlook ever”…

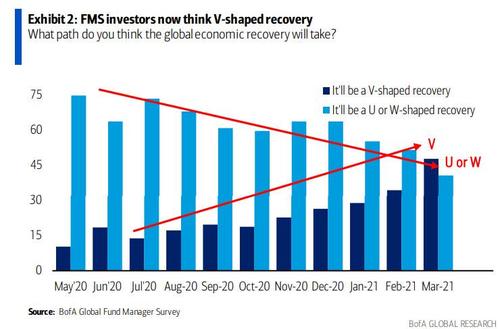

… leading to BofA finding that as the majority of respondents now see a V-shaped (over a U or W-shaped) recovery.

As expected, the FMS views on macro and policy are euphoric, with the former “bust” view having first shifted to a “Goldilocks” macro view and now to a V-shape boom (see chart above) with record expectations for GDP, EPS (record 89%), inflation (record 93%) and profits which are now expected to be the highest ever…

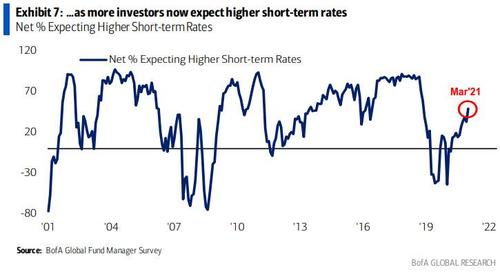

… which in turn has led to a surge in rate expectations, with a net 49% of investors now expecting higher short-term rates (up 16% M/M):

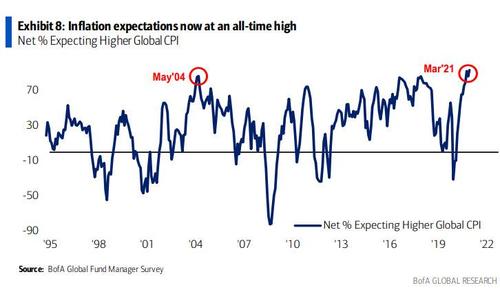

… a number which probably should be higher as inflation expectations are now at an all time high (net 93% of FMS investors expect higher inflation in the next 12 months, up 7% MoM, now an all-time high)…

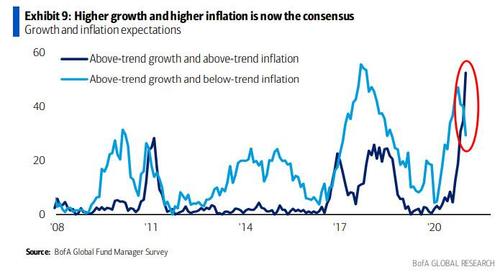

… which also led to soaring growth expectations, with the March FMS indicating that higher growth-higher inflation (53%) has now surpassed “peak Goldilocks” of higher growth-lower inflation (29%) – this has happened on only 2 other occasions in Mar’11 and Dec’16.

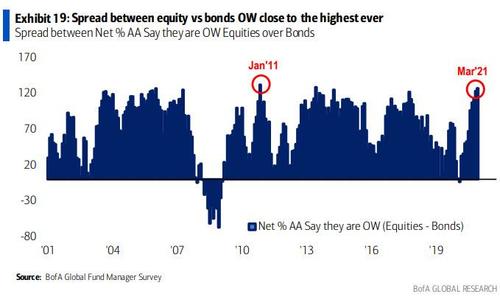

It is the soaring inflation expectations that sparked a puke of duration, with the spread between the net investors OW equities and the net investors OW bonds close to the highest levels ever (as investors continued to get more cyclical in terms of asset allocation)…

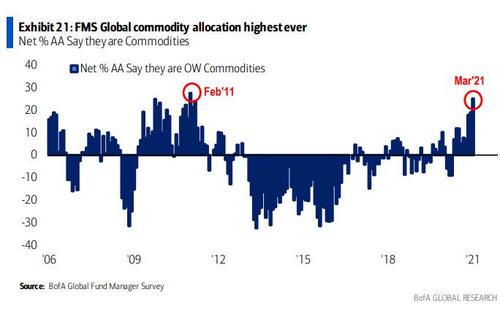

… resulting also in the highest commodity allocation ever…

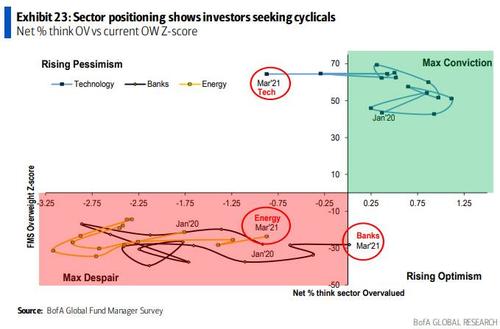

… and a capitulation into cyclicals (for the first time in over a year, banks have now risen into the “rising optimism” quadrant while tech has fallen into the “rising pessimism” quadrant. Similarly, energy is the only cyclical sector that has not seen a drastic rise in allocation.)

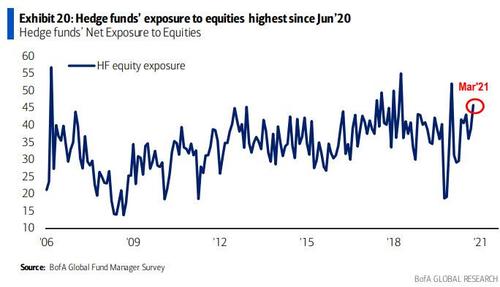

And even though hedge funds’ net exposure to equities also rose in March to 46% (+7% MoM), to the highest level since Jun’20, up from 29% in Aug’20…

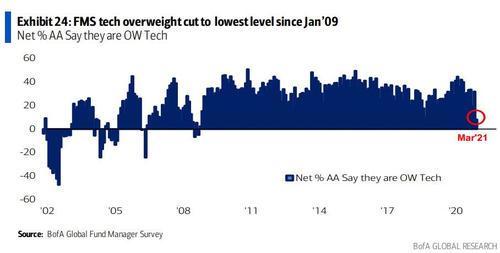

… it wasn’t to buy tech: in fact, tech saw the biggest drop in investor exposure in 15 years as asset allocators cut their tech weighting to the lowest OW since Jan’09 to net 8%. (for context, the last time tech was underweight was Nov’08).

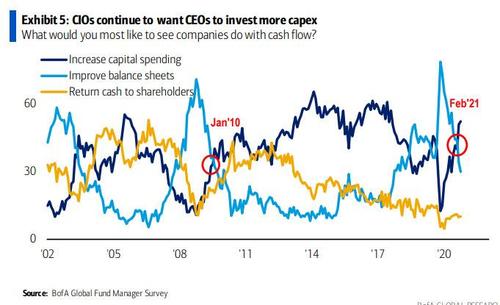

Meanwhile, since nobody needs buybacks to push stocks higher thanks to a sea of liquidity, investors now want capex not buybacks or debt reduction;

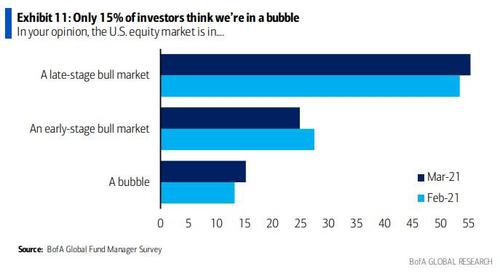

What we find most laughable is that while everyone is clearly euphoric and once again rushing to buy stocks, if not so much tech, only 15% think we are in a bubble, with another 25% saying it’s an early-stage bull market, and 55% late-stage bull market. An “early-stage bull market” where the Fed injects $120BN in liquidity every month… it’s truly amazing how people are willing to lie to themselves.

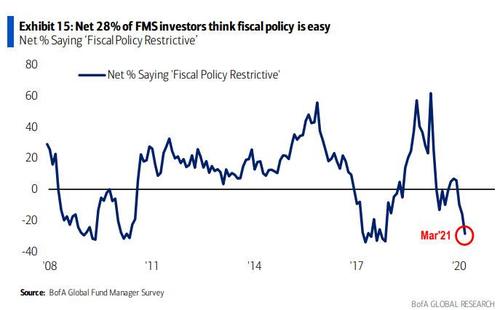

Another remarkable observation: 28% think policy is easy…

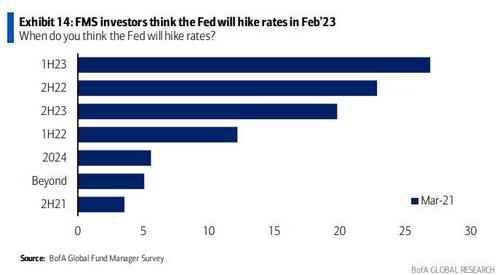

… and yet the majority of FMS investors believe that the Fed will start hiking rates in Feb 2023.

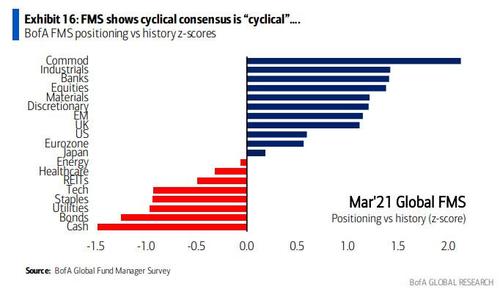

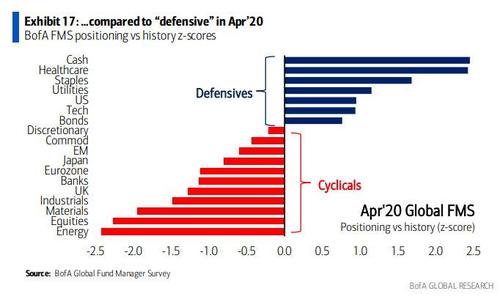

Puttig it all together, the March FMS survey shows consensus is “cyclical” with high exposure to commodities, industrials, banks, discretionary, EM relativeto the past 10 years….

… which is a drastic 180 from a year ago when investors were heavily invested in “defensives” like cash, healthcare, staples and utilities.

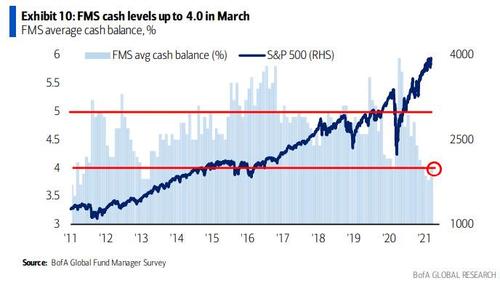

Elsewhere, the survey found that cash levels rose from 3.8% to a still-low 4.0% (1st rise since Jul’20)…

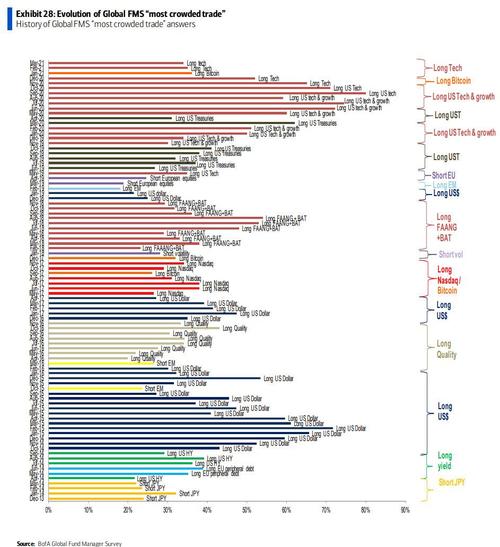

… with “long tech” still deemed most crowded trade (then long Bitcoin & long ESG)…

… and the proposed contrarian trades are long cash-short commodities, long utilities-short industrials if GT10 heading to 2%; long tech-short banks, long EM-short Europe if Fed YCC coming.