Merrill har analyseret value-aktiernes udvikling og ser en tendens til, at de halter efter vækstaktier i slutfasen af en cyklus, hvor indtjeningen i erhvervslivet falder, og hvor investorerne søger hen i færre og spekulative aktier, og high-tech har netop drevet aktieopsvinget de seneste år, især under coronakrisen. Men når en ny cyklus indtræffer med voksende indtjening, der spredes bredt i erhvervslivet, kommer value-aktier typisk igen, og det sker også nu, målt i indekset Russell 1000 Value.

Value’s Comeback Story

Value is currently staging a comeback—again. This time, however, the recent rotation into

Value has bested earlier attempts with Value returning its strongest outperformance in

February relative to Growth since March 2001, and amid more Value-oriented sector

leaders so far this year with Energy and Financials up 30% and 16%, respectively.

This shift comes on the heels of a strong year for Growth stocks. The Russell 1000

Growth Index returned 84% from the market bottom to the close of 2020, trouncing the

Russell 1000 Value Index by a large margin with the index gaining 61%. The performance

gap between the two factors widened in large part as result of a strong Technology

sector, which accounts for roughly 45% of the Growth index. Still, rotations into more

cyclical areas of the market ebbed and flowed in the latter half of 2020, with Value

outperforming Growth by over two percentage points each month from September to

November 2020. These rotations ultimately never fully solidified with investors favoring

more secular growth areas during periods of uncertainty surrounding the elections and the

coronavirus. Recent moves favoring Value beg the question if this broadening out of

leadership will stick.

The dynamics between Growth and Value are closely tied to the economic cycle and

profits. Growth generally sees stronger performance during the later stage of a cycle when

economic growth starts to slow and when uncertainty may be higher, driving investors to

favor companies that do not strictly depend on a strong economy to maintain growth in

earnings. Stronger Value performance tends to happen at the early-to-middle stage of the

cycle when the profit cycle accelerates and improving earnings growth is shared across

the board. That period tends to be characterized by rising interest rates amid improving

prospects for economic growth and inflation.

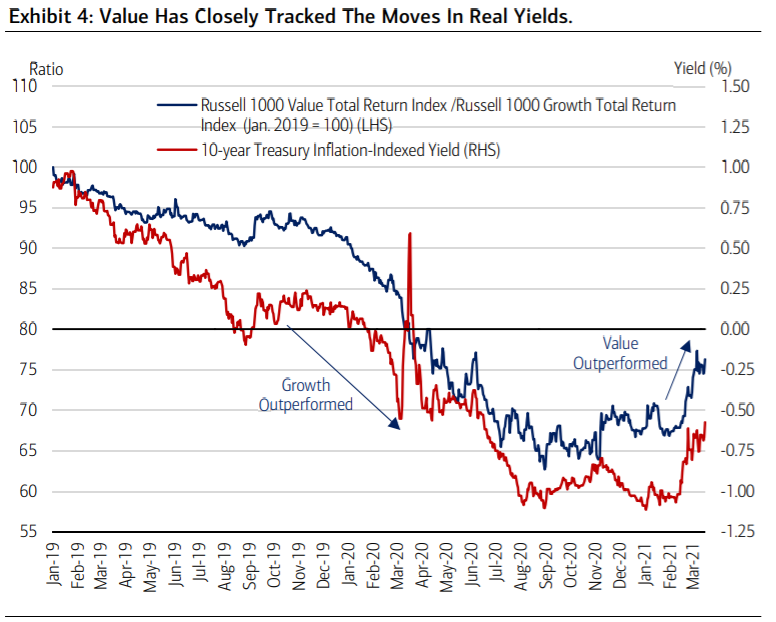

At this point, the recent move higher in interest rates proved to be the catalyst for the

Value rotation to try once more after the low rates environment of the last year

underpinned Growth’s performance. The 10-year Treasury yield has moved up roughly 80

basis points from the end of 2020, sitting now at 1.7%. And while the main driver of the

move higher in rates has been rising expectations for inflation given the massive stimulus

filtering through the economy, real yields, or inflation-adjusted yields, have also started to

move higher. Value has recently closely tracked the moves in real yields, as measured by

the 10-year Treasury inflation-indexed yield (Exhibit 4), which could mean this catch-up in

Value has more staying power given that real yields are still very negative.