Nordea beskriver en række argumenter for, hvorfor dollaren ventes at stige sommeren over.

Nothing else matters (than the USD)

Getting the USD outlook right will likely prove to be the cornerstone of all good position-taking over the summer, which will leave stakes high. We remain USD positive, and find more reasons to start removing reflationary bets than vice versa currently.

The past week has seen the S&P500 future, Nasdaq and Brent oil prices primarily ranging sideways amidst choppy price-action. Aside from higher yields worrying investors – which has been the case on and off for the past few months, investors now also have to think about the direction of the dollar…

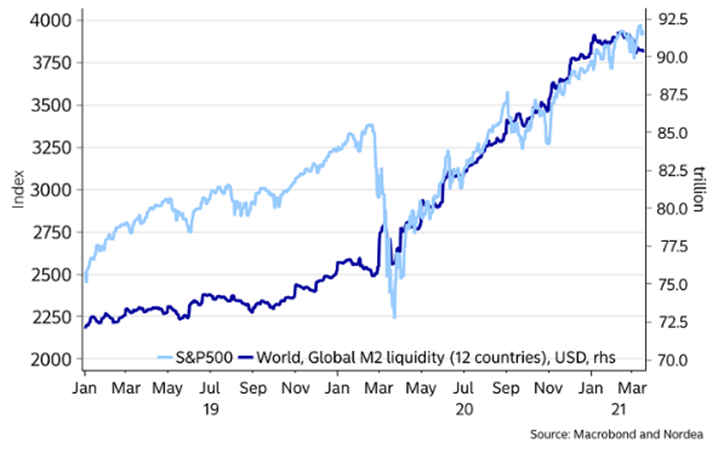

While we remain strategic reflationistas and inflationistas (for now), we fully understand these choppier markets. For instance, should the dollar break free (higher) in a more significant way, it would likely spell trouble for broader risk appetite. For instance as it would weigh on global liquidity (in USD).

Chart 1. A stronger dollar weights on global liquidity (in USD)

Another thing to ponder is that stimmie checks sent out as a part of Biden’s bombing budget has not (yet?) had much of a positive effect on risky assets, at least insofar we can tell.

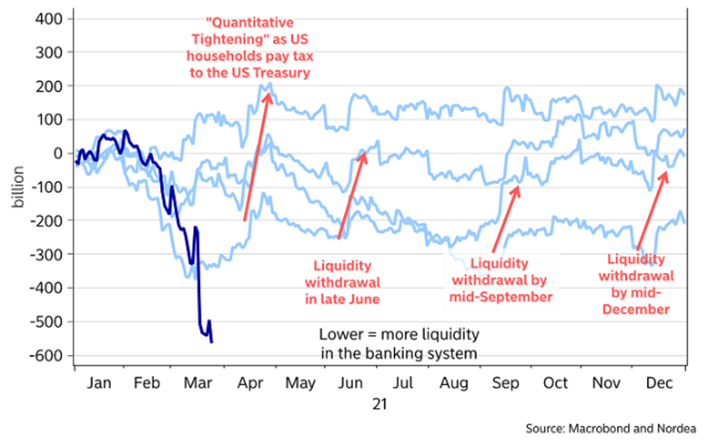

While the outlook for US excess liquidity remains highly benign at least until August (as the TGA will be drawn down according to the US Treasury’s plan with an added bonus of a further drawdown in July due to to the debt ceiling), tax payments may make the near-term outlook less benign. Indeed, tax payments from US households typically boosts the Treasury’s TGA by some ~200bn during the first half of April, which reduces liquidity in the banking sector by the same amount.

Chart 2. YTD changes to the US Treasury’s General Account

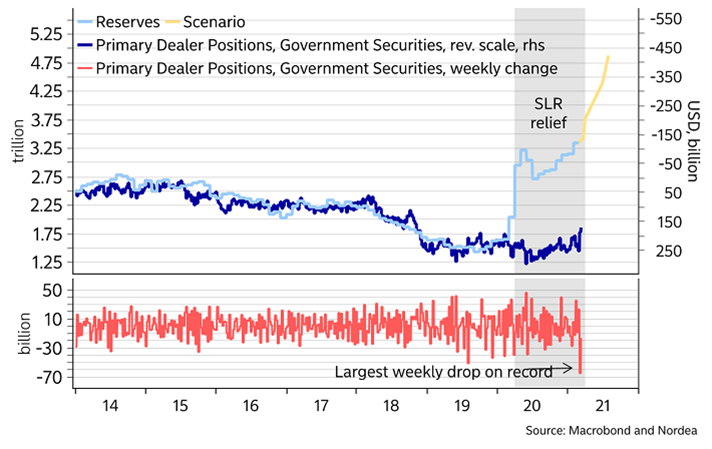

These two aforementioned reasons could cause headwinds for risky assets, but there’s also some potential tailwinds. For instance, the narrative around the end of Fed’s SLR causing primary dealers to dump Treasuries en masse may already be – or at least should be – fully priced in by early April (when last year’s SLR relief ends). Perhaps this will ease investors fears and prompt greater purchases of US Treasuries?

Chart 3. Pent-up sales of 400bn-700bn of Treasuries? We’ll find out soon

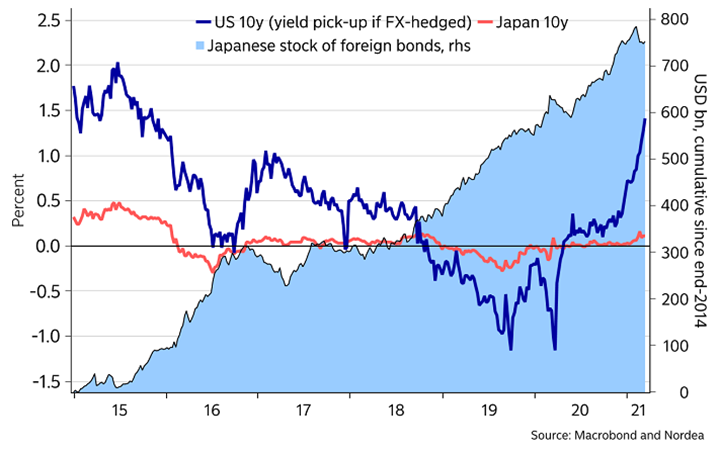

The first day of April also marks the start of a new fiscal year in Japan, and Japanese investors are thought to have sold a lot of US Treasuries so far this year. Perhaps this new fiscal year will mean greater risk-taking (purchases of US Treasuries), now with BOJ’s YCC change out of the way – and the SLR situation soon-to-be fully discounted?

Chart 4. US 10y bonds offer the greatest return since 2015 when adjusted for the cost of a 3m FX hedge

If the SLR hysteria is overdone and Japanese investors return in force to the US fixed income market, an associated stabilisation in US rates would be good news for risk appetite, but probably less so for the USD.

We would argue that Japanese investors probably won’t become aggressive purchasers of US Treasuries, since yields and term premium remain depressed vs “normal” levels, and the global narrative of reflation, inflation and growth should strengthen further in coming months with non-farm payrolls growth perhaps of a million, US inflation perhaps rising to 3-4%, ISM manufacturing above 60 and Euro-area GDP growth of 10% yoy in the second quarter. But we are open to being wrong.

We went short EUR/USD earlier this year with a target of 1.1750. We almost got there this past week (1.1762). We keep our fingers crossed for a final move below this level in the coming week or two.

Chart 5. EUR/USD should have more to give, gauging by relative growth

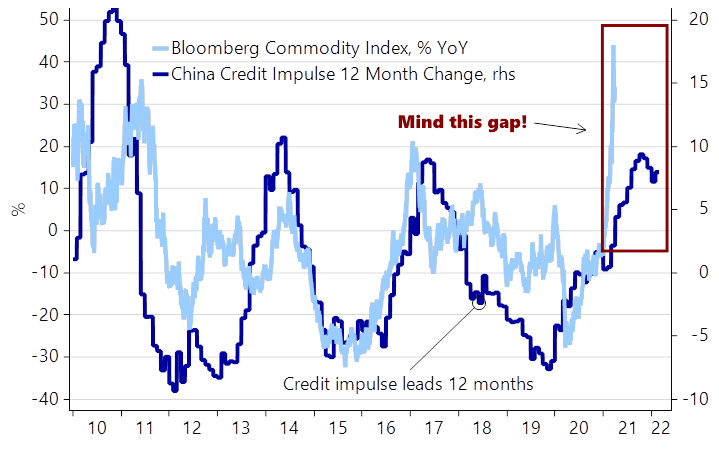

Speaking of trends that are running of fumes, we opted to label our Weekly “Bye Bye Reflation” a couple of weeks back in response to increasing signals of a fading Chinese credit impulse. The so-called commodity super cycle already looks shaky among other things due to i) Chinese authorities stepping slightly on the brake, ii) supply positive oil-news due to the Chinese-Iranian deal and iii) the stronger USD development in recent weeks. Let’s see whether the reinforced Chinese-Iranian brotherhood spurs renewed interventionism from Bombing Biden.

We are generally more tempted to remove reflationary bets from the table than adding new ones, why we stick to being short EUR/USD, EUR/GBP and AUD/NZD and opt to add USD/SEK longs to the mix ahead of the Swedish dividend season (USD/SEK – target 8.96, S/L 8.42)