Nordea venter en øget spænding om gasledningen fra Rusland til Tyskland, Nord-Stream 2, fordi USA vil hindre gennemførelsen af projektet, og det kan føre til en stigning i dollaren. I det hele taget kan geopolitiske spændinger verden over, også omkring Kina, føre til en stærkere dollar.

Uddrag fra Nordea:

Will Nord-Stream 2 lead gas north but risk assets south?

Tensions are rising and we judge that the Biden administration is sounding increasingly Russia-hawkish, which could lead to a final attempt to derail the Nord-Stream 2 project. Meanwhile, April will deliver a plethora of positive data surprises.

If you want to receive a copy of FX weekly directly in your inbox, you can sign up via this link.

This week in geopolitics

Geopolitical tensions seem to be rising, and in this week’s weekly we won’t go into the incentive structure seen in different players. We surely hope some of the following is just for domestic posturing, and that a new war between Oceania and Eurasia is not in the offing. There’s at least three hotspots of sorts:

i) Eastern Europe: Putin has accused Ukraine for provocations, Merkel has told Putin to withdraw troops, US is reportedly (if CNN is to be trusted…) moving naval assets into the Black Sea, and Russia is slowing down Twitter until mid-May, ii) East Asia: China has sent more jets into Taiwan’s airspace, Taiwan is consequently fuming, US has added Chinese supercomputing entities to a blacklist while US senators have reportedly (if Al Jazeera is to be trusted…) introduced a new bill known as the Strategic Competition Act of 2021 (to counter China),

iii) finally there’s the Middle East where Israel has attacked an Iranian naval asset; the Saviz.

Whatever the driving forces, geopolitical tensions seem to be on the rise – any escalation of which would likely be good news for haven assets such as the USD (still), CHF, JPY as well as US Treasuries.

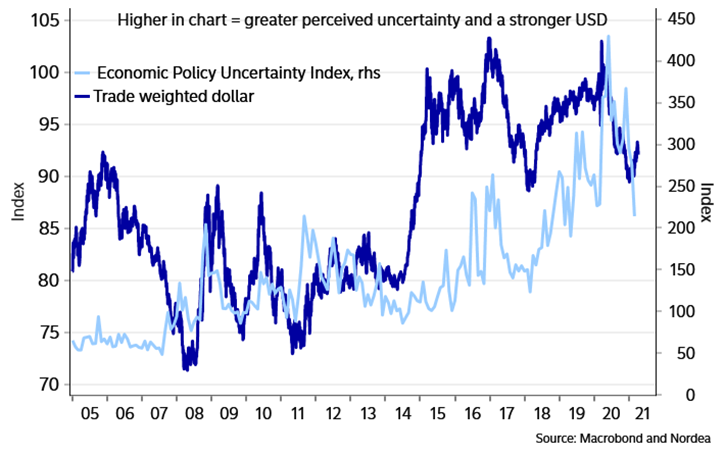

Chart 1. A rise in uncertainty would likely be good news for the greenback

Nord-Stream 2 is potentially the underlying trigger behind the renewed turmoil in Eastern Ukraine. The US has been against the project since the outset and Ukraine has traditionally been Russia’s main entry point to the European gas markets and annual transit revenues corresponds to roughly 3% of Ukraine’s GDP. So without talking too much about incentives, we at least wouldn’t rule out that both US and Ukraine holds an interest in an escalation, in a final attempt to derail the Nord-Stream 2 project.

The Trump-administration enacted the Protecting Europe’s Energy Security (PEESA) in December, that requires the government to impose sanctions on foreign vessels pipe-laying of Nord-Stream 2 and TurkStream 2. In October 2020, the The Department of State declared that they were fully committed to implementing sanctions authorities in the PEESA. The US Treasury Department announced on January 19 2021 that the US had imposed sanctions on the Russian vessel, Fortuna, in line with the Countering America’s Adversaries Through Sanctions Act (CAATSA) legislation.

The Biden-administration has threatened to impose further sanctions and we find such increasingly likely. Blinken (the US Secretary of State) seems to be clearly more of a Russia hawk than a China hawk. We accordingly lean short in RUB, e.g. against PLN (we remain short EUR/PLN due to an expected high beta performance in PLN when Euro area data jumps).

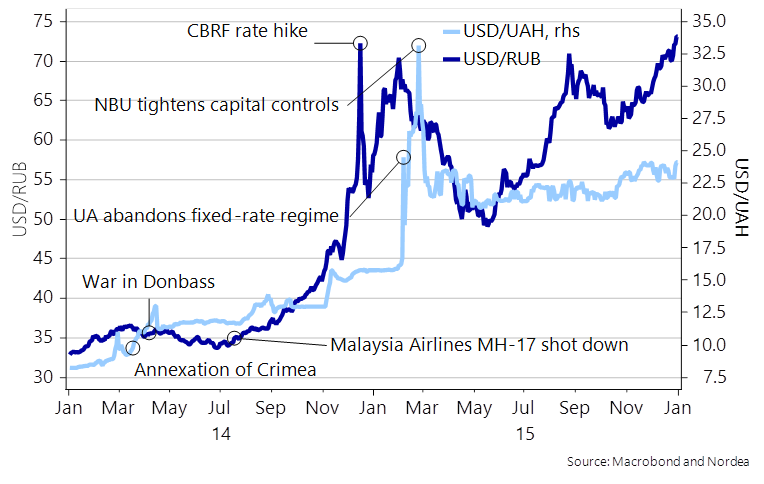

Chart 2. Both UAH and RUB sold off big time during round 1 of the Eastern Ukrainian conflict

Dollar dip – about profit taking or something more fundamental?

In the smaller(?) picture, we have become less certain with regards to the direction of the dollar. We have seen US yields stabilize and the dollar lose some steam, despite stellar ISM and payrolls figures so far in April.

Does this merely reflect some brief profit-taking, or perhaps something deeper? For sure, a lot of positive US developments ought to now have been priced-in, such as the positive fiscal, vaccination and currency impulses we outlined earlier this year in the dollar-o-meter. Biden’s infrastructure push should also be well known, and if US yields have become more rudderless, then perhaps the USD won’t be bid as aggressively?

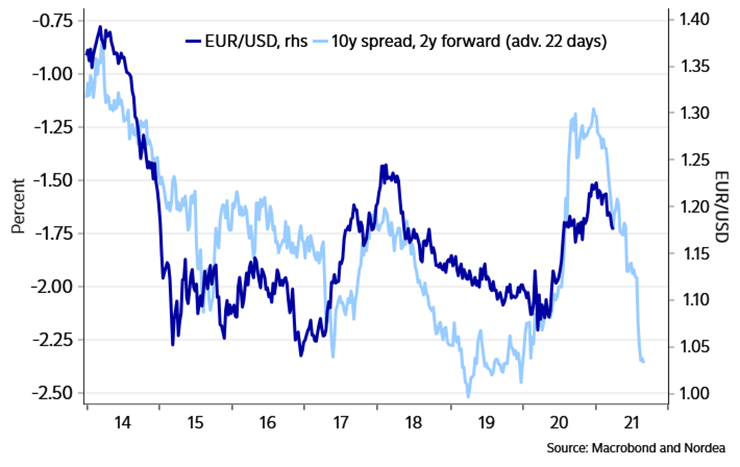

Chart 3. Will EUR/USD follow the 10y (forward) spread south?

At the same time, we can’t help but notice that fixed income markets at times lead developments in the FX space, as the aforementioned chart shows. The EUR-USD 2y10y swap rate spread has generally led EUR/USD developments by some 22 trading days over the past eight years. Perhaps this is just a fluke, or perhaps something we should pay attention to? It does suggest that we might see more USD upside in the coming couple of weeks – even if US yields remain somewhat stable for now. One big test will be how much the core PCE deflator rise in April and May, with an even bigger test in Q3 (does it cool, or not?)