ABN Amro har analyseret opsparingen i USA og Europa, der er steget dramatisk under coronakrisen. Den er blevet fordoblet. Når økonomien er åbnet op, vil en stor del af opsparing ryge ud i øget forbrug, men meget vil også ende på aktie- og boligmarkedet. Derfor vil opsparingen stimulere aktierne og boligpriserne. Serviceindustrien vil få et stort løft, men også mange producenter af varige forbrugsgoder, især biler.

Just how much pent-up demand is there?

Consumption rebound to continue, but overheating fears look unfounded

This month, a doubling in vaccine supply drove a jump in the pace of inoculations in eurozone economies, while the UK – which had been ahead in its vaccination drive – took the first steps to significantly reopening its economy.

Although the Netherlands is also taking some steps to reopen at the end of the month, for the eurozone overall we continue to expect the main reopening to happen later in Q2. At the same time, the industrial sector has continued to do better than the lockdownhampered services sector, helped by strong global trade, and recoveries in the US and China that are much more advanced,

as the service sector in these economies has already opened up.

This month, we raised our Q1 GDP forecast for the US following exceptionally strong retail sales, and raised our 2021 growth forecast for China. With uncertainty about vaccine rollouts largely behind us, and given the massive accumulation of savings over the past year, the focus for the outlook is

shifting to how much pent-up demand there might be on the part of consumers, as lockdowns are eased and economies reopen.

Savings rates have soared…

Across the developed world, savings rates have jumped to levels well above historical trends. The rise was particularly sharp during the initial lockdown phase; in the eurozone, the savings rate rose from a long-term average value of c.13% in 2019, to as high as 25% in Q2 2020.

It reached similar levels in the US – 26% – although this was coming from a much lower base of

around 7% pre-pandemic. A rise in savings is normal in downturns. However, much of the current elevated savings is involuntary – due to restrictions on consumption imposed by lockdowns – rather than deliberate.

Research by the ECB suggests that during the first wave of the pandemic, just 10% of the total rise in the savings rate was driven by precautionary motives (eg. lower job security and fear for job losses), while the rest was forced savings due to lockdowns. Indeed, since peaking early last year, savings rates have fluctuated in line with the easing and tightening of lockdown measures.

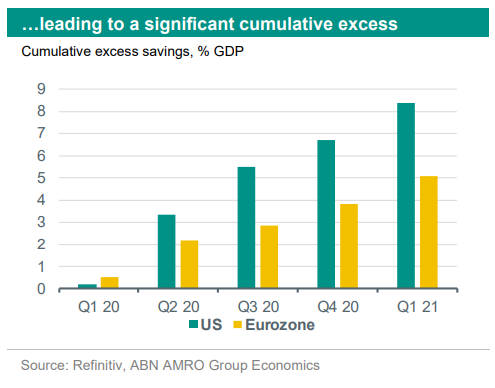

All told, we estimate that around €650bn in excess savings (i.e. above and beyond ‘normal’ savings) have since accumulated in the eurozone – equivalent to 5.1% of GDP – while in the US some $1.8tn has built up (8.4% of GDP).

Conclusion: Significant room for recovery, but no overheating

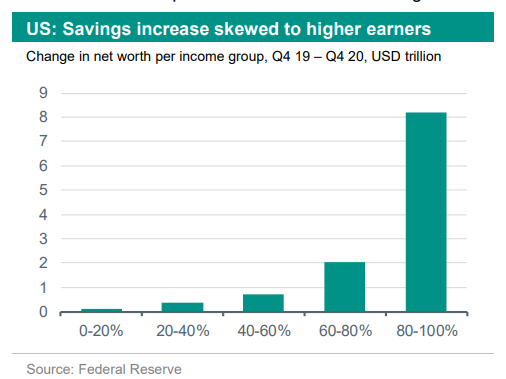

An analysis of both savings accumulations as well as shortfalls in consumption points to significant further gains to come in both the eurozone and the US. With that said, the skew in savings towards upper income groups will temper the degree to which these savings make their way into the economy.

More likely is that excess savings continue to fuel asset prices – both in financial markets, but also house prices, which have surged across the developed world over the past year (in the US, the

aggregate value of housing increased by $2.5trn last year alone).

Meanwhile, the patterns of growth are likely to differ – with further growth in the US now likely to be almost exclusively in services, while in the eurozone there is ample room for growth in both goods and services.

All told, we continue to expect US output gap to close by early 2022, while in the eurozone we

do not expect this to happen before 2023. For both, consumption is unlikely to rebound to the degree that it leads to a sustained inflationary upturn, in our view.