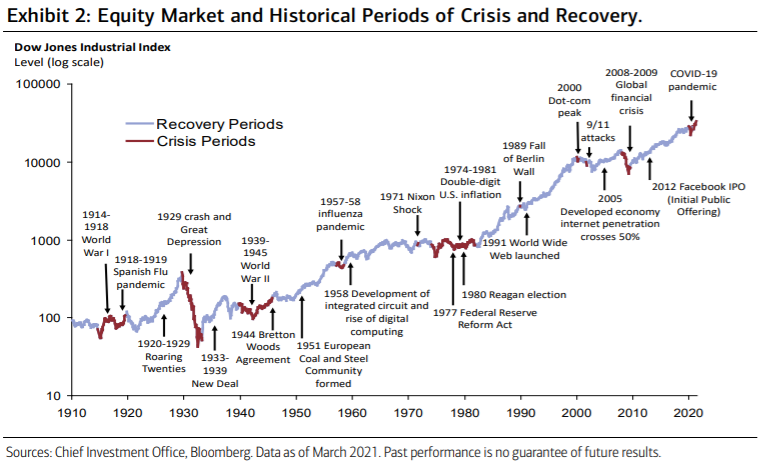

Merrill har forventning om, at markedets fremgang vil fortsætte, som det illustreres i Dow Jones-grafen (nederst). Men banken anbefaler investorerne at lægge mærke til tre store risici: Inflationen kan stige mere end ventet, også på grund af lønstigninger. Pandemien er ikke ovre, og slet ikke i de nyindustrialiserede lande, der har betydning for virksomhedernes indtjening. Der kan blive voksende geopolitiske spændinger, især mellem USA og Kina, der er de vigtigste markeder for halvdelen af Jordens lande, og hvor Kina er vitalt for amerikanske virksomheders indtjening. Trods dette vurderer Merrill, at markedet vil fortsætte opad i kraft af finanspakkerne, og Merrill ser positivt på: financial, industrials and energy, and long-term bullish on technology and health care. Our favored themes: cybersecurity, automation/robotics, and water and waste management. U.S. equities in our opinion remain a long-term source of wealth creation.

Don’t Forget About the Three Bears

A narrative is emerging that likens the current economic environment to a backdrop that is

“not too hot, not too cold, but just right.” In market speak, this means strong real U.S.

economic growth with tame inflation expectations.

The upshot: “just right” conditions for equities, with U.S. and many global indexes at or near record highs.

But playing off this theme, investors should not lose sight of the three bears.

Bear number one: The risk of stickier and sustained inflationary pressures as opposed

to the Fed’s expectations of transitory price increases. As the St. Louis Fed advised in

December 2020, Americans may have to “prepare themselves for a temporary burst of

inflation.”

Many economists like to note a slack labor market as a harbinger of

muted inflation readings; however, when a fast food retailer was paying people $50 to just

show up for a job interview and still struggles to fill positions, then maybe the labor market

is a great deal tighter than consensus expectations, and wage inflation is poised to surprise

on the upside.

Bear number two: The pandemic is not over, and the scar tissue from coronavirus will

be deep and long-lasting. Well into the second year of the pandemic, the battle with

coronavirus continues. Not only has the disease killed over three million people worldwide,

but the pace and speed of coronavirus-related deaths is accelerating. Coronavirus claimed a

million lives in the first nine months of the pandemic, but it took only four months to claim

another million lives and just three months to claim a million more. This undermines the nascent global economic recovery and market expectations of upside global earnings growth.

The renewed surge in coronavirus is likely to create a two-speed global economy—one led

by just a handful of nations like China, the United States, the United Kingdom, and Israel,

with relatively effective immunization programs, versus the rest of the world struggling to

contain the virus.

Bear number three: A messy geopolitical backdrop. It’s not all quiet on the geopolitical

front.

There has been no geopolitical reprieve under the Biden administration thus far.

U.S.-Russia relations are plumbing new lows.

Then there is China, with the U.S.-China strategic rivalry only hardening since January, a

development the markets have generally ignored.

That’s hardly a propitious indicator given that the more the U.S. and China spar over

technology, trade and human rights, the greater the risk to global growth and trade. Per the

latter, roughly half the world counts either China or the U.S. as their No. 1 export market.

Meanwhile, as we have noted in the past, China is a significant source of earnings for many

U.S. firms, with U.S. foreign affiliate income, a proxy for global earnings, totaling over $13

billion in 2020, well above what affiliates earned in 2000 ($1.2 billion). In the end, simmering

geopolitical tensions could increase near-term market volatility and emerge as a stiff

headwind to our expectations of a market grinding higher this year.

Investment implications: Are investors in for a mauling?

The short answer is “no.” We expect the major U.S. indexes to grind higher over the near

term, supported by unprecedented fiscal and monetary support, stronger-than-expected real

GDP growth, above-consensus earnings growth and the gradual push toward global

immunization of coronavirus.

We remain constructive toward financial, industrials and energy, and long-term bullish on technology and health care. Our favored themes: cybersecurity, automation/robotics, and water and waste management. U.S. equities in our opinion remain a long-term source of wealth creation (Exhibit 2).