Inflationen viser rødt i USA, skriver Nordea og mener, at centralbankerne ikke kan blive ved med at sige, at en højere inflation kun er temporær. Den er vedvarende på vej op, og det vil føre til stigende renter, og de vil komme på et tidligere tidspunkt, end centralbankerne forventer. ECB vil formentlig optrappe sit opkøbsprogram i forsøget på at holde renterne i ro. De tyske renter har nået niveauet fra før pandemien.

Major forecasts: Rise and shine

The improving macro environment and stronger inflation signals are likely to convince at least the Fed to change course. Bond yields have more climbing to do, while the EUR/USD is set to resume falling before long.

Highlights:

- The macro environment continues to improve, and inflation pressures are mounting, especially in the US.

- Central banks have mostly dismissed the idea of policy changes being in store any time soon, but those views may change later this year.

- Despite the recent pause in rising US bonds yields, there is much more upside left

- The ECB’s accelerated purchase pace has not prevented bonds yields from striving higher

Inflation is going to be the HOTTEST topic of Q2 and Q3

The economic situation is brightening by the day. The pace of vaccinations has picked up even in the Euro area, while also seasonal variation is aiding in pushing new Covid-19 infections lower. Restrictions are being eased, and the economy is gathering more steam.

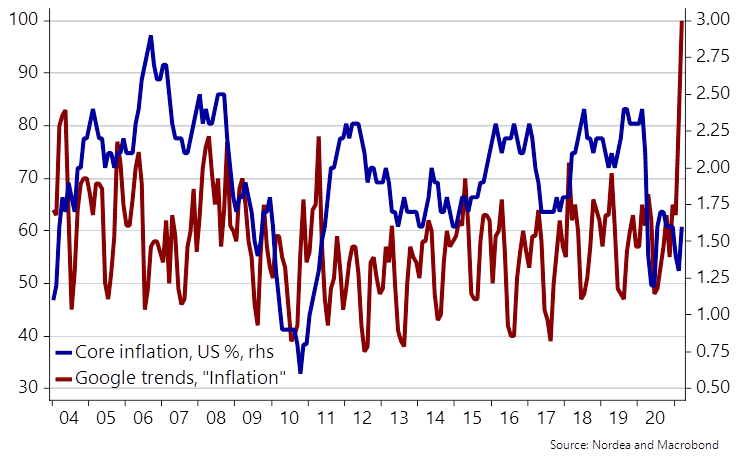

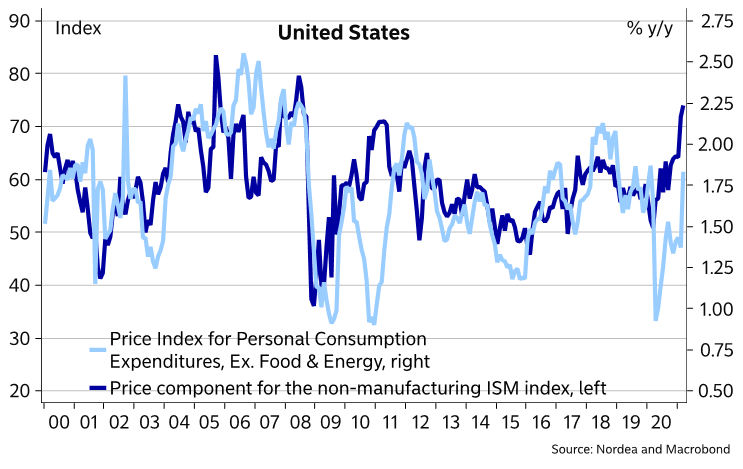

Supply constraints on the back of shortages in commodities, intermediate inputs and components are already visible in many parts of the industry. Global commodity prices continue to surge. The share of small US companies not able to fill their open job positions is at a record high. Inflation signals are flashing red even in the US services sector.

Central banks have taken the stance that all this will be temporary. But what if it is not? The rise in long bonds yields in the US has paused in the past month, likely illustrating at least partly the fast increases seen earlier this year, which drove short positioning to high levels. The current levels continue to look very modest compared to the macro-economic outlook, and we continue to see plenty more upside left for global bond yields.

Price pressures evident even in the service sector

Current yield levels continue to look moderate compared to the macro situation

The ECB’s tone to see clearer changes only towards the autumn

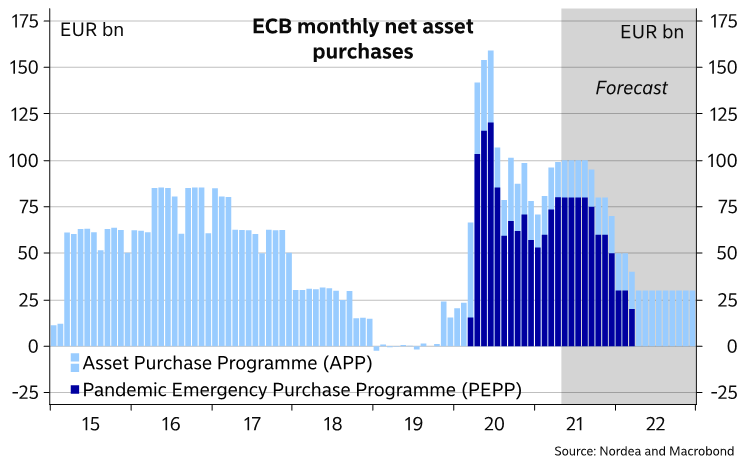

Recent data has confirmed that the ECB’s considerable higher bond purchase pace has in fact meant net weekly purchases in the Pandemic Emergency Purchase Programme (PEPP) of around 20bn. The April meeting did not provide much new information, and the future purchase pace of the PEPP will be debated only in June.

Given that the Euro-area economy has not reached full speed at point and bond yields are likely to continue to creep higher in the coming months, we expect the ECB to maintain the current pace of purchases over the summer. We doubt there will be appetite to accelerate the purchases further. The ECB is then likely to start tapering the PEPP in the autumn, as the recovery strengthens, and end net purchases under the programme in March 2022.

As the Euro-area inflation outlook likely remains modest still in March 2022, we expect the ECB to raise the monthly buying volume of the Asset Purchase Programme (APP) from EUR 20bn to 30bn, when net purchases under the PEPP end, and then continue buying at that pace at least until the end of our current forecast horizon, i.e. the end of 2022.

Current buying pace likely to be maintained during the summer months

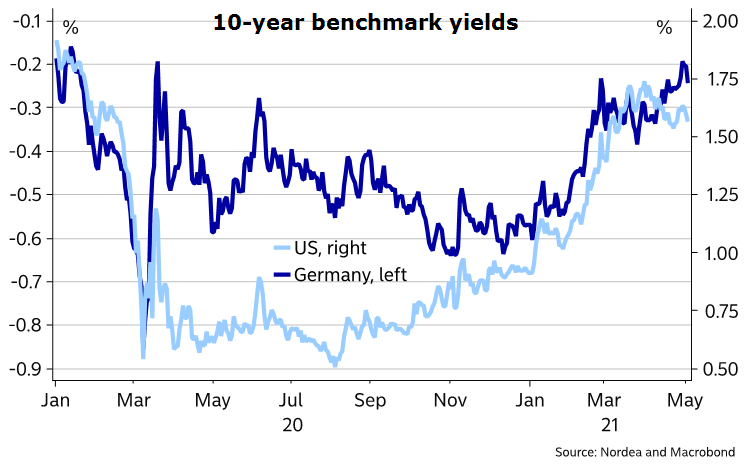

German yields reached pre-corona levels

Euro-area bond yields have resumed their rise in the past weeks despite the ECB buying at what it considers a considerably higher pace compared to earlier this year. The German 10-year yield has risen to around levels where it was before Covid-19 worries surfaced. Intra-Euro-area bond spreads have widened moderately at the same time.

That German yields have risen despite US yields correcting lower at the same time makes the moves even more significant, even though the magnitude is not that large yet, and supports our view that also Euro-area bond yields can climb, and the curve steepen, despite further sizeable ECB bond purchases.

Despite the recent diverging paths, we see much more upside potential for US yields than Euro-area ones. The booming US economy we expect to see, and growing inflation pressures are not reflected in the current still low levels of bond yields. The Fed outlook is also likely to be repriced later this year when the central bank starts to change its rhetoric. Almost no matter which macro-related bond yield model one uses, the conclusion is the same: long rates remain much lower than the macro-outlook suggests. Naturally, that alone does not guarantee yields would converge to such model-implied levels any time soon, but the rapid upward moves in yields seen earlier this year strongly suggest the era of bond yields only falling may be over.

While our baseline is for even US yields to remain at historically rather low levels throughout the forecast horizon, risks are tilted to the upside, as the inflation risks in the US economy are genuine and violent economic growth could easily drive yields higher at a faster rate than we assume in our baseline forecasts.

German yields risen despite falling US yields

The Fed is still stuck behind the curve and even though they are upbeat on economic projections (again), they also keep referring to the fact that they want to see actual progress and not forecasted progress before changing anything in the policy framework. They also need to see substantial further progress before moving towards tapering, but we are kept clearly in the dark on what that means. Our view is that tapering will be debated in June, launched in September and followed up by a subsequent hike from the Fed already around summer 2022. This forecast hinges on our bullish inflation view.