Nordea filosoferer over inflationen og lønudviklingen.

Oprahnomics works until it no longer does

Increasing the income for regular people during a crisis works until it no longer does. Jobs are hard to fill and wage inflation is up, but the Fed will see through the side-effects of Oprahnomics. But is it possible to remove the stimulus again?

Global: finally some vol…

Finally, there was a pick-up in volatiliy. At least in the equity market. Bond and currency markets didn’t react much at all to the surprise surge in the US CPI “inflation” index. By the close of the week, the latter two markets (2y/5y/10y yields and the DXY index) had retraced most of the already limited turbulence on Wednesday.

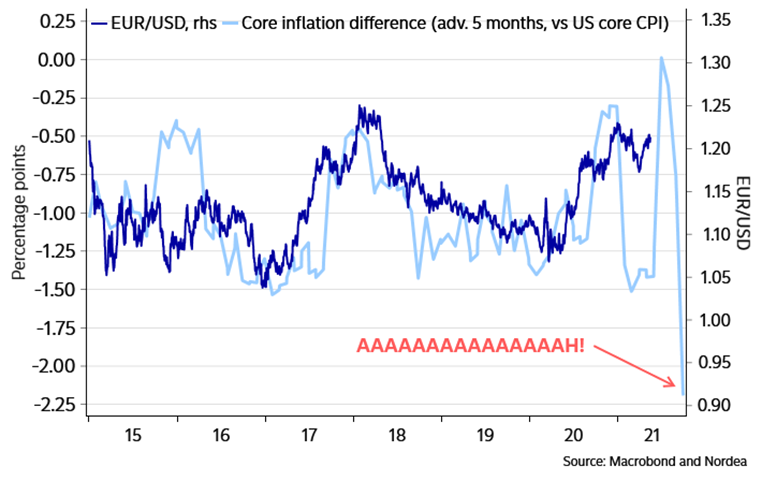

The April surge in US core inflation suggests EUR/USD should start to plummet in Q3, as the Fed might need to be repriced more hawkishly. The inflation spread will however bounce eventually, when for instance base effects from last year’s VAT cut drive up Germany’s core inflation. And some central banks have even warned us not to pay too much attention to inflation in 2021 as the figures will remain volatile owing to various pandemic effects. Still, we want to show this chart as thinking can be very harmful if it becomes “overthinking”, which will, alas, only be evident ex post.

Chart 1. US core inflation jump suggests downside pressure to EUR/USD

Tensions are nonetheless high between the overheat’istas and the transitory crowd as portrayed by the quote of the week from Carl Quintanilla who calls an end to the overheating debate based on 4-5 days of price action. We lean towards the former as long as #Oprahnomics remain in place, but we also recognize that parts of the current rise in prices will prove transitory. When e.g. Lumber is up 350% over the year, then it is almost impossible for the purely commodity based inflationary impulse not to fade during H2-2021.

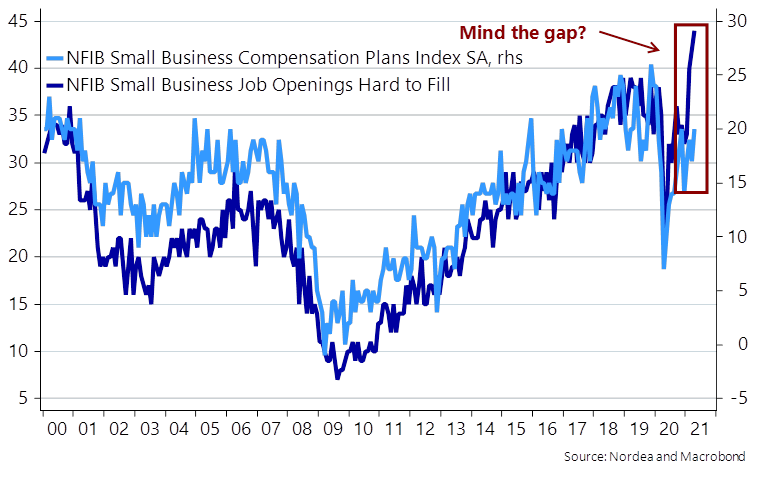

When the effects from commodity-inflation and the reopening impulse start to fade from the CPI figures, we will need wage growth to start carry the inflationary baton. It’s too early to conclude that the recent pick-up in wage growth is enough, as it is likely driven by a negative (but temporary) shock to the labour supply owing to the same #Oprahnomics. (We do expect wage growth to be able to carry this inflationary baton down the road.)

Chart 2. Oprahnomics leads to a record amount of job opening being hard to fill

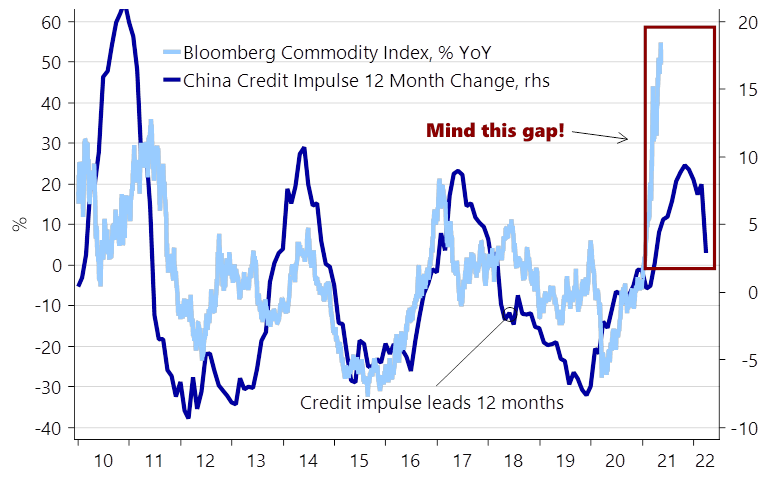

If we opt to look through the obvious cherry-picking of Mr. Quintanilla, then he has a point. There are signs that growth will start slowing already in the second half of the year and even if a cocktail of increasing inflation momentum and slowing growth momentum sounds stagflationary, we would argue that it is not. The recent commodity doom loop price action (with commodity longs being used as a hedge against rising inflation) will not last forever, and the clear roll-over in the Chinese credit data could be a canary to watch.

Chart 3. China has rolled over. Will commodities follow south?

Biden/Oprah-nomics will also fade during Q3. For instance, the jobless claims bonus payments are due to end in September (unless prolonged by Congress). The recent mix of low payrolls growth but high wage growth can probably be explained by people staying home to Netflix & chill. If you get more money by sitting home than commuting to wash dishes, wouldn’t you do so? This is why we think it’ll be interesting to watch payrolls and wage growth in the states where Biden’s bonus payments ends earlier, in June, such as South Carolina and Tennessee.

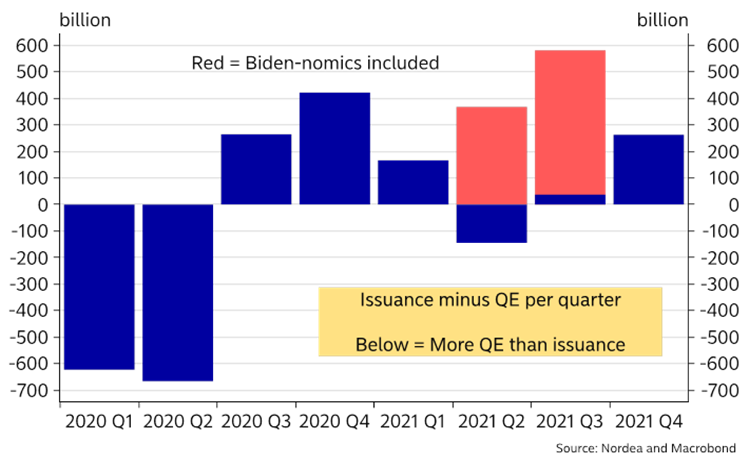

The worst issuance-to-QE ratio also lies ahead in Q3, which usually doesn’t bode too well for risk assets. The recently updated quarterly issuance plan included a large upwards revision to the Q3 issuance outlook (544bn) and a potential zap of USD liquidity via a renewed build-up of the US Treasurys account at the Fed. We are accordingly a bit worried ahead of Q3 from a risk positioning perspective.

A big question is then if politicians will ever be able to end higher benefits and direct transfers. Some may argue that such measures are destined to become permanent instruments in the fiscal tool-box. Both “temporary” taxes and “temporary “handouts have a tendency to become permanent, just look at Scandinavia if you have any doubt.

Chart 4. Biden/Oprahomics will peak in Q3 unless direct transfers are prolonged

The Fed will be tested in its average inflation targeting regime as a summer of >2% inflation prints will force them to clarify when enough is enough. Meanwhile, the ECB could launch an AIT-regime at the Sintra conference in September, which may carry potential inflationary spill-overs should it come into fruition.

The Fed launched AIT on a much better platform than the ECB will be able to as the Fed only needed to overshoot by 0.3-0.4%-points over a five-year period to make up for former undershooting. The ECB will need to overshoot by 0.75-1%-points over a 5-10 year period if an AIT-regime is supposed to become fully credible. If the ECB manages to launch such a regime with integrity, then we should expect a complete melt-up in 5y5y EUR inflation expectations by late Q3. Probably for good at first, but then comes the head-ache.

Chart 5. Euro area AIT will have to lead inflation expectations WAY above 2% to become credible

The market has already chased an early tapering from the ECB and repriced 2y1y EUR rates accordingly, which we find premature. Should the ECB move closer to an AIT decision by the Sintra conference in September, we would rather argue that steepeners should continue work, while the very front of the EUR curve is an outright receive. The EUR has also gained some tailwind versus USD alongside the 2y1y relative repricing between EUR and USD, but we consider it temporary as the Fed is simply miles ahead of the ECB when it comes to barely “thinking about thinking about discussing thinking about interest rates.”