Merrill har analyseret Emerging Markets i forhold til industrilandenes markeder. Selv om der er store forskelle i EM, så er EM-landene som helhed blevet økonomisk mere stabile de seneste år, og de er blevet mere solide som investeringsmål, især i lyset af, at markederne i USA og Europa kan blive påvirket negativt af stigende inflation og rentestigninger. Der er altså et alternativ.

A Two-Tiered Trend in Emerging Markets

The recent equity market selloff has fallen unevenly across the emerging world, but EM as

a group have so far been relatively resilient.

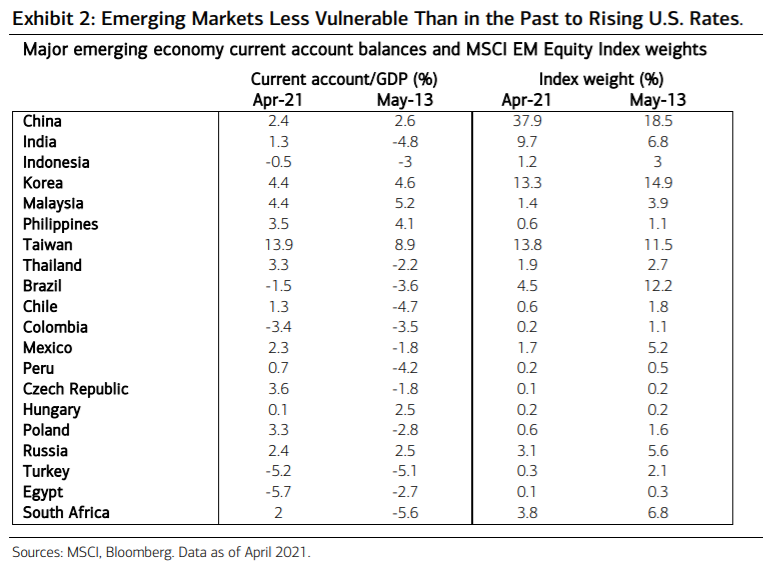

As a measure of reliance on external funding and vulnerability to higher yields, the current account positions for 13 of 20 major EM were in deficit at the time of the taper tantrum (in 2013), representing 44% of EM market capitalization at the time. But today only five of the same 20 EM have negative current account balances, representing just 6% of total EM market cap (Exhibit 2).

Rather than a broad-based flight from EM risk, the inflation scare has produced a similar

rotation across EM sectors and regions as that seen in the rest of the world. Weakness in

high-growth areas with higher-duration cashflows, such as information technology,

internet retail and communications services, has contributed to the significant

underperformance in the tech-driven north Asian markets of China, Korea and Taiwan.

By contrast, outperformance in cyclical sectors tied more closely to the near-term economic

recovery and steepening yield curve has been a tailwind for the other major regions of

Latin America and EMEA (Europe, Middle East and Africa), both of which have climbed this

month in absolute terms despite the pickup in volatility.

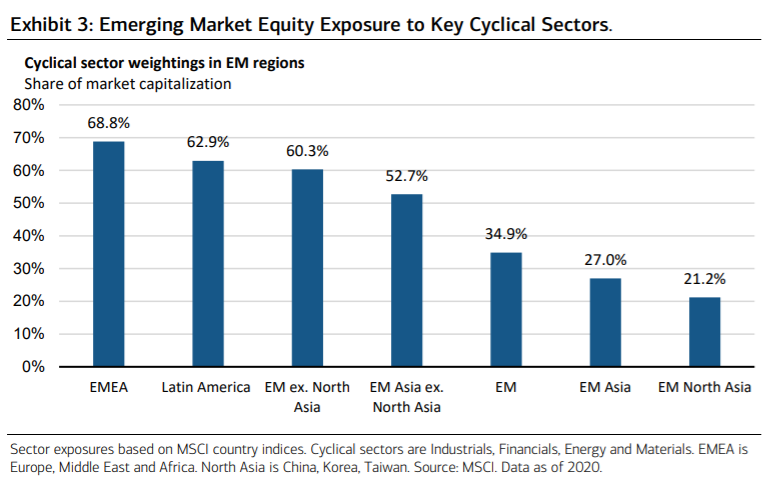

This divergence highlights the two-tiered style composition of the aggregate EM equity market, in which a few heavyweight countries in north Asia have limited exposure (21%) to the cyclically oriented sectors of Energy, Materials, Industrials and Financials, while the remainder of the index in

the EMEA and Latin America regions has a much higher concentration in these four

sectors of 60% to 70% (Exhibit 3).

But looking ahead to the rest of 2021 and into next year, we still expect EM to remain

relatively resilient with a narrower divergence between these two tiers of a growth oriented Asia and other more cyclically driven regions. Goods exporters in Asia should

ultimately benefit from stronger growth in most developed economies on the back of the

boost from government stimulus, economic reopening and strong household finances.

High asset prices, rising employment levels and double-digit growth in household bank

deposits across the U.S., Europe and Japan should provide fuel for developed market

consumption in the coming quarters, with the IMF projecting stronger real gross domestic

product (GDP) growth in 2021 for developed economies in aggregate (5.1%) than for all

EM regions outside Asia (8.6%), including Latin America (4.6%), emerging Europe (4.4%),

the Middle East (3.7%) and Africa (3.4%).