Merrill analyserer den enorme købekraft, som forbrugerne har verden over, efter opsparingsoverskuddet under pandemien. 5400 milliarder dollar er til rådighed. Det bliver til et globalt fænomen, som kan blive den helt store drivkraft for investorerne. Især amerikanske selskaber vil udnytte de globale muligheder, ikke mindst fordi de vil få gavn af det europæiske opsving efter pandemien. Andet halvår vil give aktionærerne en stor chance, hvis de ser på forbrugssektoren i en global sammenhæng.

“Cashing In” On the Global Consumer Recovery

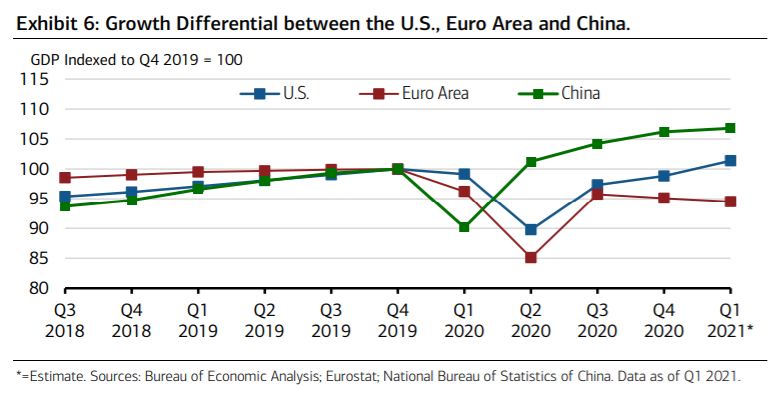

With so much said about pent-up consumer demand as the next leg of the U.S. recovery, it’s worth tracking the U.S. consumer to its global peers.

Why? Because the consumption boom, while U.S.-led, is about to go global, positioning likely future earnings upside for such sectors as Consumer Discretionary, Technology and various cyclical plays.

The three largest consumer markets in the world—the U.S., China and the Euro Area— experienced a varied (ranging from 11% to 26%) drop in consumption and a rise in consumer savings (ranging from 4 to 20 percentage points) during the pandemic. For this reason, the outlook for the global economy has never been more closely tied to the

consumer.

In part thanks to government stimulus measures, disposable incomes remained elevated during the pandemic, and excess savings lined consumers’ pockets.

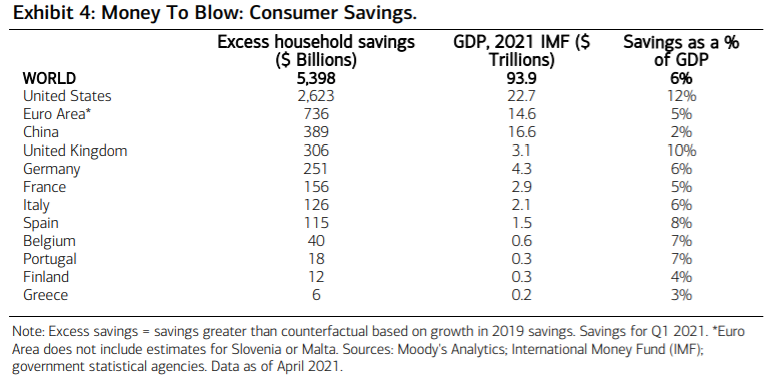

At the global level, Moody’s Analytics estimates households had accrued $5.4 trillion in pandemic related savings by the end of the first quarter of this year, as shown in Exhibit 4. Over the course of the crisis, U.S. households saved a very sizable $2.6 trillion, while the Euro Area and China amassed $736 billion and $389 billion, respectively. Excess savings account for 12% of gross domestic product (GDP) in the U.S. and more than 6% of output globally.

Portfolio Considerations for a Pent-up Demand Cycle

A reason for our overweight to the Consumer Discretionary sector and tilt toward more cyclical exposure is a pent-up consumer cycle that we expect to gain global momentum in the second half of 2021.

Upside surprises to the level of consumer spending will add support for Equities even into 2022, especially in those sectors that are more levered to the business cycle and consumer recovery.

Investors should consider positioning for a stronger-than-expected consumer recovery in the year ahead, when spending may run above normal levels, financed by elevated savings, and emanating first from the U.S.

This coincides with our preference for U.S. Equities relative to the rest of the world, with neutral weights to both the developing and international developed markets. We continue to monitor investment opportunities abroad, notably the recoveries taking place in Europe based on an acceleration in vaccine programs or progress on the Recovery and Resilience Facility.

Emblematic of how levered the U.S., China and European Union (EU) markets are to the others, 43% of world trade in goods happens between the three.

Against this backdrop, Europe’s nascent consumer recovery is welcome news to Corporate America and may, along with a weaker dollar, translate to better-than-anticipated global earnings for multinationals levered to Europe’s consumer end-market, with the EU accounting for roughly 55% of U.S. foreign affiliate income (a proxy for global earnings).

Bottom line: It may be time, from a portfolio perspective, to “cash in” by positioning for

the consumer rebound that’ll go global in the months ahead.