JPMorgan har analyseret forholdet mellem value og growth og konstaterer, at value-aktierne er billige. De ligger under trenden i forhold til vækstaktierne. Men det er naturligt, da value-selskaber blev hårdt ramt af pandemien, der gav dem en lav indtjening i forhold til vækst-aktierne. De samme aktier vil dog få et opsving, når økonomien vokser, for det slår igennem på indtjeningen. Derfor venter JPM, at value-aktier vil stige gennem hele året.

Thought of the week

As we head into summer, one of the most frequently asked questions is whether the value vs. growth trade still has room to run.

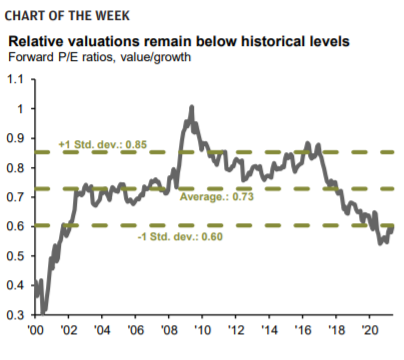

To answer this, one should start by looking at relative valuations. As seen in this week’s chart, relative valuations continue to signal that value looks cheap relative to growth, with the ratio only just recently rising to one standard deviation below its long-run average.

One might have expected that the outperformance of value since late last year would have done more to close this valuation gap, but the story has been heavily influenced by earnings.

Breaking down the total returns of the Russell 3000 growth and value indices from March 2020 to the present shows that growth’s outperformance was primarily driven by stronger profit growth, which accounted for 23.8% of returns compared to 14.4% for value.

This comes as no surprise given that the industries most acutely affected by the pandemic (banks, airlines and oil) are some of the largest components in the value investment style and saw earnings crumble last year.

However, value-oriented sector earnings tend to be more correlated to GDP growth than their growth-oriented counterparts, which suggests that a solid year of economic growth should support robust profit growth among the value-oriented sectors. This, combined with higher interest rates in the second half, suggests that value stocks can further extend their outperformance relative to growth into the end of 2021.