Merrill konkluderer i en analyse over energikilderne, at der begynder at være en voksende interesse fra investorernes side for atomkraft. Uden atomkraft vil det blive svært at leve op til de politiske mål om klimaforbedringer. Problemet er, at der er betydelig folkelig modstand mod atomkraft.

Nuclear Energy: The Ultimate Green Energy Play

More and more regions in the U.S. and countries around the world are setting goals to

eliminate fossil-fuel-powered vehicles over the next 10 or 15 years. As a result, electric

vehicles (EV) are expected to become the primary mode of transportation after the 2020s.

Perhaps Norway is the most advanced in this regard. Electric vehicles there already comprise 60% of monthly sales, and the ultimate goal is to ban the sales of new fossil-fuel-based cars starting in 2025.

One consequence of transitioning the transportation system from fossil-fuel to electric

vehicles will be a massive shift away from petrol demand to electricity demand. This means

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment bproducts sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”).

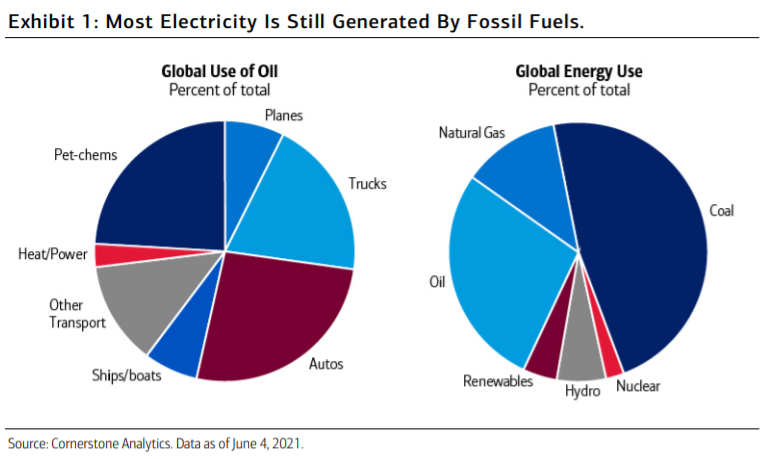

Exhibit 1 shows the current sources of global energy use, which are

overwhelmingly comprised of fossil fuels. If most electricity remains generated by fossil

fuels, then shifting the transportation fleet to electricity-based vehicles would do little to

reduce carbon emissions. The electricity generation system will also need to transition to

increasingly renewable green-energy sources.

This is where nuclear energy excels. When all factors are considered, nuclear energy

matches wind energy as the all-in lowest emitter of CO2, with less than half the

emissions rate of the most efficient solar sources and a slim fraction of the emissions

rate of various fossil-fuel sources of electricity. The other major advantage of nuclear

energy is its reliability compared to wind and solar power, which are subject to the

vicissitudes of the weather.

According to the U.S. Energy Department, “nuclear has the highest capacity factor of any energy source, producing reliable, carbon-free power more than 92% of the time in 2016. That’s nearly twice as reliable as coal (48%) or natural-gas (57%) plants and almost three times more than wind (35%) and solar (25%) plants.”

Because of its much higher reliability factor, nuclear power plants produced 20%

of the country’s electricity even though they accounted for only 9% of generation capacity

in 2019, for example. This is important since problems with unreliable wind and solar

power generation have played a role in multiple serious blackout incidences in recent years

all around the world, with notable examples in Texas, California and Germany in the past

few years.

The stark contrast between the performance of popular green-energy stocks, like those of

solar and wind companies, and that of unpopular nuclear-related stocks also illustrates the

growth-to-value rotation driving 2021 equity-market performance. Solar stocks, for

example, were favored by green investors in 2021, with the last gasp to record valuations

after the new green-friendly administration was elected in November 2020.

In retrospect, thanks to analysis by Empirical Research Partners, we now know that about a third of the big multiple expansion in long-duration growth stocks, such as those of traditional green energy technology companies, reflected the big drop in long-term interest rates between

March and December 2020. The sharp 2021 underperformance of these stocks, with lots

of innovation promise but scant cash flows, reflects in part the revaluation of their long duration cash flows to a doubling of long-term Treasury rates.

In the meantime, in our view, uranium and other nuclear-related stocks are riding a cyclical and secular wave on the renewed promise of nuclear energy after four decades in the desert.