Fra Merril Lynch:

Disclosure Matters

Climate change is the single most important ESG issue considered by U.S. asset

managers, according to U.S. SIF3

, the Forum for Sustainable and Responsible Investment.

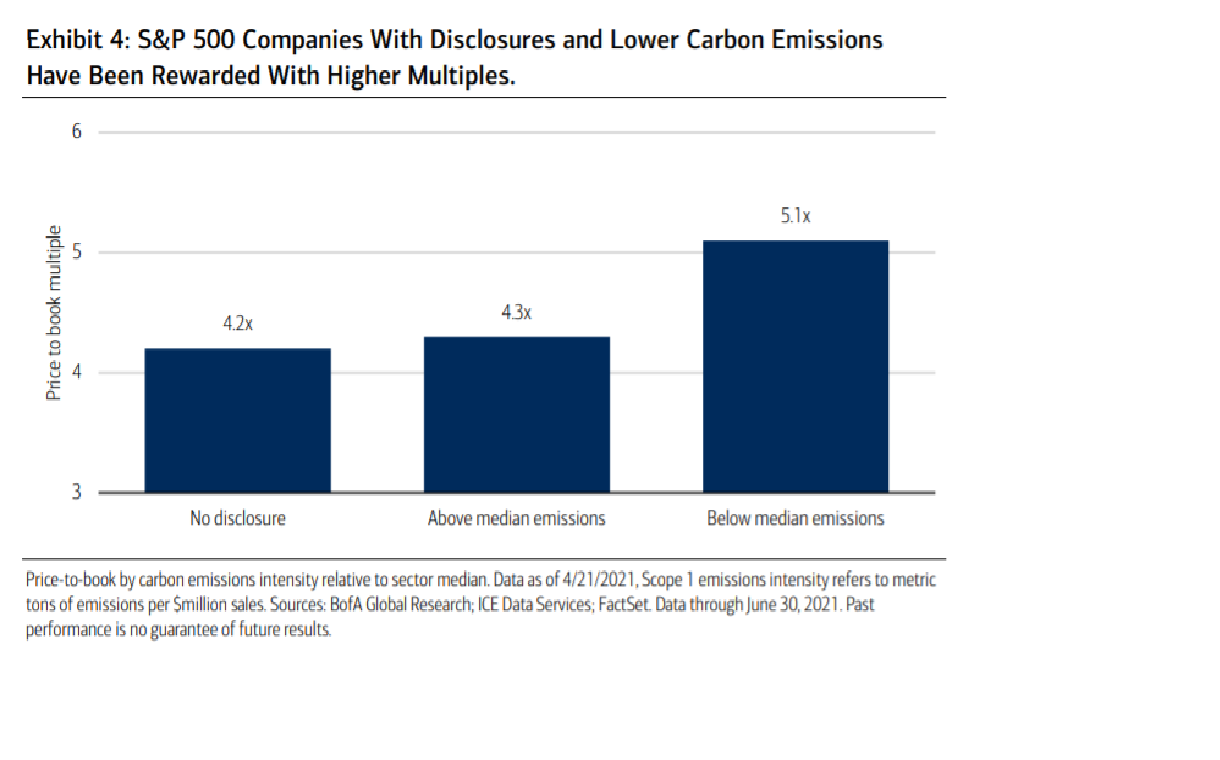

Assessing climate risks relies on good disclosure, and BofA Global Research suggests that

disclosing this information is positive for a company’s share price: U.S. companies that

disclose Scope 1 and 2 emissions and those with lower carbon emissions trade at a

premium on book value to those that do not disclose.4

The SEC has signaled that there may be tougher rules coming for corporate climate

disclosures, making a rapid move to request for comments: “It’s time to move from the

question of “if” to the more difficult question of how we obtain disclosure on climate,” noted

Allison Herren Lee, then acting chair for the regulator. Moreover, the Climate-Related

Financial Risk Executive Order issued in May will add climate risk to climate plans across

all government agencies.

An even greater accelerant may come from overseas, as the European Union’s (EU) new

Sustainable Finance Disclosure Regulation (SFDR) requires asset managers to disclose the

sustainability of their financial services or products, accelerating their interest in

standardized disclosures by their portfolio companies (and the EU Taxonomy provides a

common language for sustainable activities).

Regulation, such as that by the SEC et al., will continue to close the gaps in disclosure and

provide investors with material information for consideration. And investors also have an

important role to play. A recent survey commissioned by Robeco of more than 300

institutional investors, as well as wholesale and insurance investors (accounting for about

20% of global assets), indicated that half of all assets under management will be

committed to net-zero in the coming years.5 Of those surveyed, 86% acknowledged that

climate change will be seen as a significant factor in their investment policy over the next

two years, and 81% see renewable energy (solar, wind, hydrogen power) leading the

decarbonisation drive.

As fast-flowing capital have continued into sustainable investment strategies, the

environment is a key driver. Climate activism and green trends now extend into traditional

consumer practices; capital markets are getting behind viable solutions; and we are seeing

increasing assets flow into companies with climate adaptation or mitigation strategies.

Corporates and investors alike are paying attention to the “E” in ESG.